Since the start of the pandemic, there have been a select few Canadian stocks that have been popular. Cineplex Inc (TSX:CGX) is one of those stocks. The business has been impacted severely by the pandemic causing the stock to fall by more than 60%. This has left many investors wondering if it’s one of the top stocks to buy now.

While value is important, and I think Cineplex is a better option than Air Canada if you had to choose between the two, several Canadian stocks are offering a better opportunity today.

Whether you’re looking for value or growth stocks, it’s all about weighing risk against reward. And while Cineplex and similar stocks like it look ultra-cheap, there is a tonne of risk with owning these businesses and little upside today.

That’s why I would forget Cineplex stock for now. Instead, especially if you’re looking for value, one of the top stocks to buy now is Corus Entertainment Inc (TSX:CJR.B).

Cineplex is not worth an investment today

Cineplex is cheap, but like Air Canada, it’s hard to tell when the company may recover.

Corus, on the other hand, has recovered well from the pandemic. It’s not completely out of the woods yet. However, its operations have been extremely robust, and its financial results extremely impressive.

You know what you’re getting with an investment in Corus — which still can’t be said for Cineplex.

Investors have seen time and time again throughout the pandemic that it’s impossible to predict what these stocks will do and how the economy will recover.

More than four months after the vaccines were announced, over a year after the pandemic began, and as temperatures are rising, Canada is in its third wave. And some provinces, such as Ontario, are back in a full stay-at-home order.

This shows how hard it is to predict when Cineplex may be able to open up fully. That’s why I wouldn’t include it among the top Canadian stocks to buy now.

Looking at analysts’ reports, they seem to have a consistent view on Cineplex as well. The consensus one-year target price is below $13, meaning according to analysts, at this point, there is no upside in the stock over the next year.

That will, of course, change as the economy opens up, but for now, with no catalysts and seemingly only negative events impacting the stock, it’s not worth an investment.

Why Corus is one of the top Canadian stocks to buy now

Corus is a Canadian media and entertainment stock like Cineplex. However, the two companies have completely different businesses.

Corus’ main business is in the TV industry. The company makes most of its money from advertising, subscription services, and selling the content it creates.

The industry was impacted slightly by the pandemic but has recovered rapidly. So not only is Corus in a much stronger position than Cineplex stock, but it’s also considerably undervalued, which is why it’s one of the top Canadian stocks to buy now.

With Corus trading around $6.30 a share at the time of writing, the stock is trading at a forward price to earnings ratio of just 7.1 times.

According to analyst estimates, the stock is worth closer to $8 a share, giving Corus more than 20% upside over the next year.

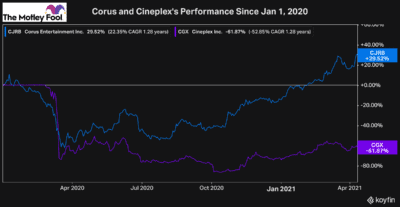

Looking at both companies’ performances since the start of 2020 shows exactly why you can’t just look at a stock’s price to determine its value.

As you can see by the chart, Corus and Cineplex have had completely different performances over the past six months. However, after analyzing each company’s operation and current position, it’s clear Corus has more value.

So although Cineplex may seem cheap, it’s not worth an investment today. Several top Canadian stocks, like Corus, offer much better potential for investors to buy now.