Bitcoin has been controversial since the day it was launched over a decade ago. The coin has lots of potential, especially due to its revolutionary technology. Not to mention it is used by people all over the world.

Despite this, critics have called it a bubble and said it’s worthless since it’s not backed by anything. Essentially, Bitcoin has no real intrinsic value. Because of this, some people think the bubble will eventually burst, and Bitcoin could go to $0.

However, the Bitcoin and cryptocurrency bulls think a major revolution is underway, and it’s just getting started.

Many have called for much higher Bitcoin prices, with even some highly reputable companies, such as J.P Morgan, calling for a Bitcoin price of US$146,000. That is more than double its price today.

So, it can be difficult to know whether Bitcoin will more likely double or go to $0. It’s also difficult for some to make an investment in it, especially if they have a low risk tolerance, considering how volatile it is.

Where is the cryptocurrency going?

Nobody can say where the revolutionary cryptocurrency is going for sure. The coin and the entire industry, for that matter, do look promising. However, you never know what might happen, especially with some governments considering making their own and with the ability to ban these assets.

There is always some risk. Between going to $0 and doubling, though, Bitcoin has a far higher chance of doubling.

Bitcoin, even after its incredible rally since its creation, still has a tonne of long-term potential. This is important, because it gives even some investors with lower risk tolerances the chance to make an investment.

Putting a longer-term timeline on your investment helps reduce the risk. One of the biggest worries in the cryptocurrency sector is a crash like in 2018.

However, if you had invested in 2018 with a 10-year time horizon and bought at the worst possible time, the very top, within six months you would have been down, but by now, you would be positive on your investment.

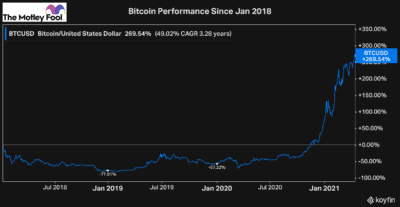

As you can see, a year into your investment, you would have been down 77%. Two years in, you would’ve been down 57%. But if you had continued to hold up until today, you would have seen a more than 265% return on your investment in those three years.

This is obviously an extreme example. However, it perfectly highlights how important it is and how much risk you eliminate when you decide to invest for the long term.

So, if you’re interested in Bitcoin, I’d consider a small position in your portfolio with money you can afford to have invested for years.

Best stocks for Bitcoin exposure

There are two main ways to gain exposure to Bitcoin today. The higher-risk, higher-reward method involves buying mining companies that are leveraged to the price of Bitcoin.

Today there are several Bitcoin mining stocks on the market. However, one of the very best has to be Hut 8 Mining (TSXV:HUT).

Hut 8 is one of the oldest and largest Bitcoin-mining stocks in the world. The company has impressive operations, making it highly competitive in the mining space, which is why it’s so attractive today.

Bitcoin mining is one of the most competitive businesses there is, and these companies have to continue to upgrade their computing power to ensure they’re staying competitive.

So, the fact that Hut 8 is already one of the best makes it a top stock to consider in the sector. However, you still have to monitor its operations and make sure that the company is staying competitive.

Another reason Hut 8 is so attractive is because of the vast amount of Bitcoin it’s holding on its balance sheet. So, if you believe in Bitcoin long term and want a high-risk, high-reward investment, Hut 8 is a top stock to consider.

The other most popular way of gaining exposure is by investing in the ETF. Purpose Bitcoin ETF exposes investors directly to the price of Bitcoin.

This is a lower-risk investment, because you only have to worry about Bitcoin’s price appreciating. It’s essentially just like buying the Bitcoin yourself. However, if you buy the ETF, you can own the Bitcoin in your TFSA.