Canadian dividend stocks provide investors with monthly income and stability. In fact, they are a cornerstone of a successful investing strategy. At the Motley Fool, we try to help single out the best opportunities for income-seeking investors.

In this Motley Fool article, I present three of the best Canadian dividend stocks to buy now. They are known for their stability and resilience. And today, they’re yielding very attractive dividend yields. Without further ado, here they are.

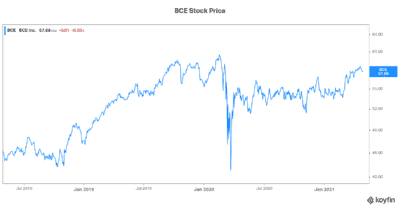

BCE stock: Canada’s telecom giant and one of the best Canadian dividend stocks

BCE (TSX:BCE)(NYSE:BCE) stock is currently yielding a remarkable 6%. This is a company that has a multitude of defensive characteristics. For example, BCE is one of the most cash flow-rich companies. It’s also an essential business, because telecom companies are a necessity. Their earnings and cash flows are steady and predictable. Also, they’re pretty economically insensitive. Yet BCE stock is yielding over 6%. It’s really quite remarkable.

What else makes BCE stock a top Canadian dividend stock to buy today? Well, in its latest quarterly result, BCE once again delivered growth. In fact, the quarter marked the return of top-line growth. BCE is laying the foundation for continued 5G growth. It’s also speeding the rollout of its fibre optic network. This will deliver the fastest speeds and best performance for its customers. It’s no surprise that BCE continues to take market share with its fibre network offering.

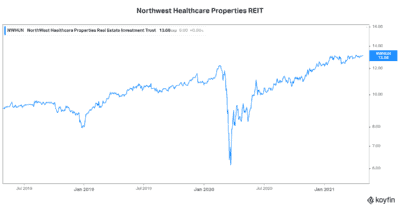

Northwest Healthcare Properties REIT: A Canadian dividend stock to buy yielding over 6%

Another +6%-yielding stock is Northwest Healthcare Properties REIT (TSX:NWH.UN). Northwest is in the medical properties business. It has a growing global presence and a long history of providing dividend income.

While its stock price has been pretty steady over the last five years, it has consistently provided a generous dividend yield. And these days, it seems to be breaking out. Northwest is a play on the aging population. We will need increasingly more medical buildings to meet the healthcare demands of the future.

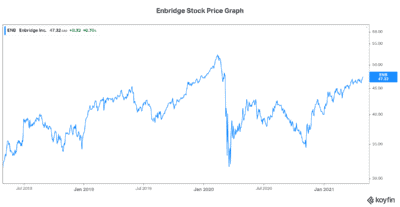

Enbridge stock: A dividend stock with a 7% yield and strong business fundamentals

Enbridge (TSX:ENB)(NYSE:ENB) has been haunted by negative sentiment for some time now. This has hampered pipeline approvals. It has also dampened investor sentiment toward the stock. But it has not hit the company’s bottom line. In fact, Enbridge is doing better than ever these days. But we wouldn’t know it by looking at Enbridge’s stock price.

But Enbridge remains as essential today as it always was. It remains as profitable as well, if not more. This has resulted a truly undervalued stock. Finally, I would be remiss if I didn’t mention Enbridge’s long history of reliable and growing dividends. In the last five years, Enbridge’s dividend has grown at a compound annual growth rate of 8.85%. Let me remind you, this was a period when the price of oil was extremely volatile. But Enbridge continued to chug along, happily growing its cash flow and increasing its dividend.

Motley Fool: The bottom line

The best Canadian dividend stocks to buy today are all yielding above 6%. They’re all stable and reliable companies. And they all have good prospects for the future. Consider adding them to your portfolio to ramp up your monthly income.