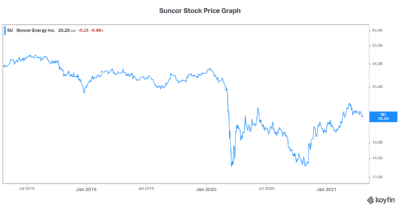

Bargain stocks are increasingly rare, but always desirable. So what can we do in a year that has pushed equity prices to new heights? Well, 2021 is the year of ESG – environmental, social, and governance issues have finally taken their rightful place in investing decisions. This has caused clean energy stocks to soar. It has also caused traditional oil and gas stocks to plummet. Suncor Energy Inc.’s (TSX:SU)(NYSE:SU) stock price, for example, has plummeted 34% since December 2019.

This is where our never-ending search for bargain stocks comes in handy.

The ESG movement makes oil and gas stocks like Suncor bargain stocks

I’m 100% for the ESG movement. I was actually for the movement before it was a movement. However, the fact remains, the world will need an abundance of energy to power the next few decades. And this demand will not be satisfied through clean energy alone. In fact, we will need to rely on fossil fuel energy for years to come.

So what does that mean? Well, it means that oil and gas stocks will be around for quite some time. It also means that oil and gas companies must clean up. Oil and gas stocks are trading at depressed levels as this uncertainty prevails. But if we look at the fundamentals, we get a completely different picture.

A top bargain stock being hit by investor rotation

For Suncor, the picture is one of solid cash flow generation. It’s also one of industry-leading results on the ESG front. Suncor is working hard to invest in a clean future. Its stated greenhouse gas emissions goal is to “harness technology and innovation to reduce our emission intensity by 30% by 2030.” This is to be achieved by using more co-generation facilities. This is a highly efficient technology that reduces waste. Suncor will also invest in other technologies to change the way the company extracts and processes the oil sands. Finally, Suncor is researching carbon capture and conversion technologies.

Finally, the company’s initiative also includes investing in lower carbon forms of energy. Suncor has even dipped its toes into renewable energy such as wind and biofuels — indicating the longevity of this $24.5 billion company.

The price of oil has been trading between US$50 and US$60 in 2021. This will fall to the bottom line at Suncor. If this continues, oil and gas companies will see a very profitable 2021. EPS estimates for Suncor’s Q1 2021 earnings are currently at $0.32. This compares to last year’s Q1 EPS of a loss of $0.20. Suncor’s stock price trades at a mere 17 times 2021 consensus expected EPS.

A best in-class bargain stock

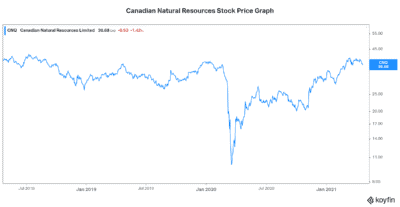

Canadian Natural Resources Ltd. (TSX:CNQ)(NYSE:CNQ) is also in the oil and gas industry. The company is also a top performer. But it is plagued by the same issues. How can we reconcile the need to save the environment with the need for energy to better our lives? Well, it’s a long road with no easy path. Companies like Canadian Natural must invest in it. And it, like Suncor, is investing in cleaning up its act.

The shifting tide toward clean energy is necessitating big changes in the oil and gas industry. It is already happening. Big oil and gas companies are cleaning up their act. Technology and desire are leading the way.

The fact is that Canadian Natural Resources is a high quality energy stock that excels operationally and financially. Canadian Natural Resources’ asset base is resilient. Its long-life, low-decline assets mean predictability. The company is diversified and flexible. Canadian Natural has a long-term target of net zero emissions in its oil sands operations. Investments and technology will be key to getting there.

The bottom line

Suncor stock and Canadian Natural Resources stock are both bargain stocks today. Suncor’s stock price, as well as that of Canadian Natural is being hit by the fact that the oil and gas industry is being shunned by investors. They will continue to clean up their operations. In time, I think this will change investor appetite. Today, these quality stocks are bargains!