Gold stock have not been popular in 2021. Stock markets continue to perform exceptionally well, as vaccinations make their way into people’s arms. Clearly, many investors are looking ahead to a time when things reopen. In fact, most investors are pricing this in. But have we thought about the potential problems that might arise? And have we thought of how to position ourselves for it?

Rising inflation could be the consequence of the massive coronavirus stimulus

It’s no secret that governments have pumped out massive amounts of stimulus. The goal of this was to basically combat the negative economic effects of shutdowns. And this has worked. It has saved many from economic ruin. And it has supported the economy in this crisis.

But what are the longer-terms effects of this? Higher inflation is certainly a risk here. This is to be expected and is not a bad thing. The question is, will inflation get out of hand and hit the economy hard in the coming year or two?

As you know, gold is a hedge against inflation. If you think that inflation is a real risk here, consider buying gold stocks to diversify and protect your money. Here are the two gold stocks to buy in May, as we prepare for an inflationary environment.

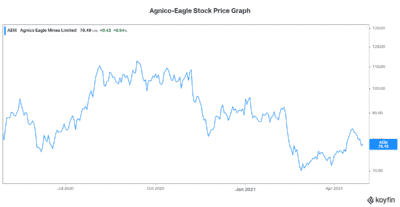

Agnico Eagle Mines stock: A low-risk Canadian gold stock to buy

Agnico-Eagle Mines (TSX:AEM)(NYSE:AEM) is a top-tier Canadian gold stock. The company has established a competitive advantage in low-political-risk, pro-mining jurisdictions. This means places like Canada and Europe.

Momentum at Agnico-Eagle is continuing to build. For example, the company is posting record production. In the latest quarter, production increased over 25%. With this, EPS and cash flows skyrocketed. I’ll highlight cash flow from operations here, which increased 120%. These numbers are really numbers to get excited about. Yet, Agnico-Eagle Mines stock has not performed well in 2021. The stock is down 13%.

Going forward, we can expect continued momentum for Agnico-Eagle. Continued exploration success and optimization should continue to drive results. In turn, this can be expected to drive Agnico’s dividend higher yet. Agnico has paid out a dividend since 1983. Since 2015, Agnico has grown its annual dividend per share from $0.32 to the current $1.40. That’s a very impressive compound annual growth rate of 34%.

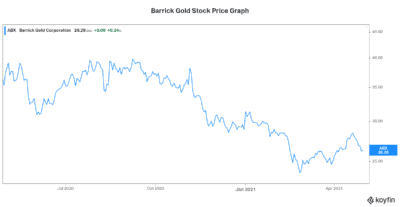

Barrick Gold stock: The Canadian gold stock that investors turn to for gold exposure

Barrick Gold (TSX:ABX)(NYSE:GOLD) is another top gold stock. Actually, Barrick is the most well-known gold stock. It’s the one that investors flock to first when looking for gold exposure. This makes sense, as Barrick is the $47 billion gold behemoth.

This top-of-mind status has not sheltered Barrick Gold from weakness in 2021. Investors have become increasingly optimistic about the end of the virus, and this means a recovering economy. But now that this has really been priced into stocks, what happens when everything reopens? Stocks trades on expectations. They reflect expectations for the future. If they’re focusing on the recovery, they’re not focusing on the risk of inflation. Gold stocks will shelter you from that storm. Barrick Gold’s stock price has declined 10% in 2021. It’s the other top gold stock to buy in May 2021.

Motley Fool: The bottom line

If you’re worried about inflation, buy Agnico-Eagle stock and Barrick Gold stock. These gold stocks have come a long way in recent years. They’re currently extremely profitable, and financially sound. Also, they provide a hedge against the inflation that may happen in the near future.