The entire cryptocurrency has seen a massive increase in popularity over the last year thanks to the major coins like Bitcoin and Ethereum leading the way. However, some of the only stocks that outperformed these cryptocurrencies during their rally were crypto stocks, and one of the best performers over the last year has been HIVE Blockchain Technologies Ltd (TSXV:HIVE).

When you look at HIVE’s performance recently, it’s almost unbelievable. The Canadian growth stock has gained 1,032% over the last 12 months and a whopping 4,555% over the last 16 months since the start of 2020.

The main reason HIVE stock has performed so well is due to the cryptocurrency industry’s boom and the fact that it’s leveraged to the performance of the main coins it has exposure to, like Bitcoin. And over the last year, Bitcoin is up by 540%.

HIVE, however, is also exposed to Ethereum — one of the major reasons why it’s one of the top crypto stocks in Canada. And while Bitcoin is up 540% over the last year, Ethereum is up over 1,250%. Many still think Ethereum has more potential to grow too.

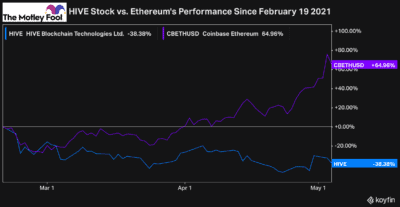

Even with HIVE’s performance the last year, more recently, the stock has struggled. What’s even more puzzling is that since February 19, it’s lost over a third of its value.

As you can see, HIVE stock declined with Ethereum in early March. However, Ethereum has since rallied significantly, while HIVE has continued to sell-off.

Throughout this period, Bitcoin has been flat too. So the recent discount in HIVE stock clearly shows a divergence. But does that mean it’s worth an investment?

Is HIVE stock worth an investment today?

An investment in HIVE stock offers a tonne of potential for investors. However, it comes with significant risks. Any time a stock gains over 1,000% in a year, it’s bound to be a speculative investment.

And often, when stocks rally that fast, they can fall that fast too. The stock certainly has leverage to the cryptocurrencies due to its mining operations. However, when the industry is rallying, investors also bid it up and award the stock with growth premiums.

These premiums start to erode as the rally loses steam. That’s a major reason why the stock has underperformed. Although Bitcoin has generally been flat over the last few months and Ethereum has been rallying, albeit a lot slower than in 2020, investors don’t see as much growth potential in the stock right now.

So while it may be gaining some intrinsic value as Ethereum’s price rises, it’s lost more market value from having its growth multiples rerated lower by the market.

The stock could be worth a buy today. However, it’s still a speculative investment. The company certainly offers investors potential over the long term, especially if you’re bullish on the cryptocurrency industry and HIVE’s operations.

There’s certainly no guarantee, though, that you see growth as we have in the past. So considering the significant risks that are present, you have to really be bullish and committed to the stock long-term for it to be worth an investment today.

Is HIVE the best stock to buy in the cryptocurrency industry?

Just because HIVE stock might be attractive doesn’t necessarily mean it’s the best stock for your portfolio. Investors may choose to invest in a stock with more direct exposure to the top cryptocurrencies rather than a miner.

This is something risk-averse investors would likely prefer or any investor who isn’t that bullish on cryptocurrency mining. If that’s the case, an investment in The Ether Fund (TSX:QETH.U) may be a better choice.

The Ether Fund offers investors direct exposure to Ethereum instead of buying a miner like HIVE stock. It’s a much more straightforward way of investing in what I think is the best cryptocurrency to buy.

You don’t have to worry about growth premiums or the operations of a company. You’re investing solely in the growth potential of Ethereum, which will lead to more demand and consequently higher prices of its native currency, Ether.

Bottom line

HIVE stock certainly has growth potential and is cheap. However, it isn’t the only way to play the incredible opportunities that the cryptocurrency industry is offering. It’s also not the only stock with massive growth potential to buy today.