A little over a month ago, many Canadians had no idea what Dogecoin was, never mind what its price was. However, after this past weekend, it’s one of the top Google search trends in Canada.

Dogecoin has gained popularity over the last year as the crypto industry has exploded. The price for a single Dogecoin, of which 10,000 are minted every single minute, was worth less than a penny last year. However, this past weekend the cryptocurrency, which was created as a joke, hit a high of more than $0.70 per coin.

Dogecoin has been around for a while, but because it was created as a joke, it has very few use cases and far fewer technological benefits than a lot of other cryptocurrencies.

That’s why many think it’s not worth speculating on Dogecoin. With the price of the coin currently, it’s valued as the fifth most valuable cryptocurrency.

Serious cryptocurrency investors know that there are much better options than Dogecoin. And despite knowing that it’s highly speculative, many still buy Dogecoin hoping for quick gains.

This past weekend, though, was once again another lesson why speculating is so difficult, especially on assets that are so clearly overvalued.

Why speculating on Dogecoin’s price is so difficult

Speculating is never ideal. The statistics and percentages are always going to be stacked against you. Nevertheless, people continue to do it, and every now and then, when someone strikes it rich, it gives more motivation to everyone else.

As has been shown many times, though, speculating is a strategy that won’t pay off long term. And as difficult as speculating is at any point, it’s much harder to do ahead of an event that everyone’s waiting for.

Several investors seemed to think that despite Dogecoin’s insane rally the last six months, there was still plenty of potential for it to skyrocket after Elon Musk appeared on Saturday Night Live.

Many investors already knew that Dogecoin was trading well overvalued. However, these types of events rarely go well for investors.

A perfect example of why you shouldn’t speculate

If everybody is privy to the same information, it makes it extremely difficult to find someone willing to buy the Dogecoin from you for a higher price than you paid after the fact. Every investor would have been buying Dogecoin ahead of time.

This is a timeless lesson because it happens all the time. Most recently, it happened with cannabis stocks ahead of legalization.

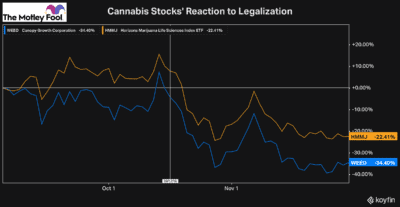

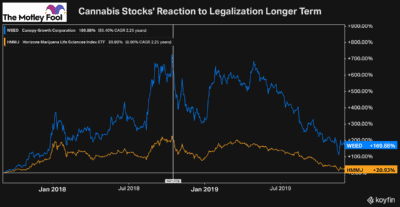

Below is a chart of Canopy Growth and the Horizons Medical Marijuana Life Sciences Index ETF, an ETF that tracks the cannabis industry. The vertical line shows the day of legalization in Canada.

Many investors who speculated thought prices would explode on the day of legalization. But given that everyone expected the same thing, it never materialized.

As you can see, the stocks sank on or around legalization day and never recovered. The top chart shows six weeks leading up to and six weeks after legalization. In the chart below, we see a year before and after legalization.

This chart and the situation with Dogecoin’s price the last week couldn’t be a better example of why investors shouldn’t speculate. Those investors who bought at the top never had a chance to sell the stock for more to someone else.

When you buy an asset for the sole purpose that you believe someone will come along and pay more for it down the road, you’re taking a big risk.

That’s why it’s much better to buy high-quality stocks that you can invest in for the long term. Buying a business with real value that can protect and grow your capital is a far better long-term strategy than gambling your money.

Dogecoin’s price has now fallen by roughly 40% since Saturday night. So I would forget Dogecoin and any other speculative investments and focus on finding the best stocks to own for the long term.