Launched as a joke in 2013, Dogecoin has traded below a cent for most of its history, before surging above US$0.05 earlier this year. It is now trading close to US$0.50. Its market capitalization puts it in sixth place among cryptocurrencies in importance, according to coinmarketcap.com site. The cryptocurrency, which refers to a popular photo of a Shiba Inu dog on the internet, even reached nearly US$0.70 in May.

It seems like a bubble, and it’s likely not sustainable. Like other cryptocurrencies, Dogecoin is only valuable if people value it. If they stop valuing it, be prepared for a big correction.

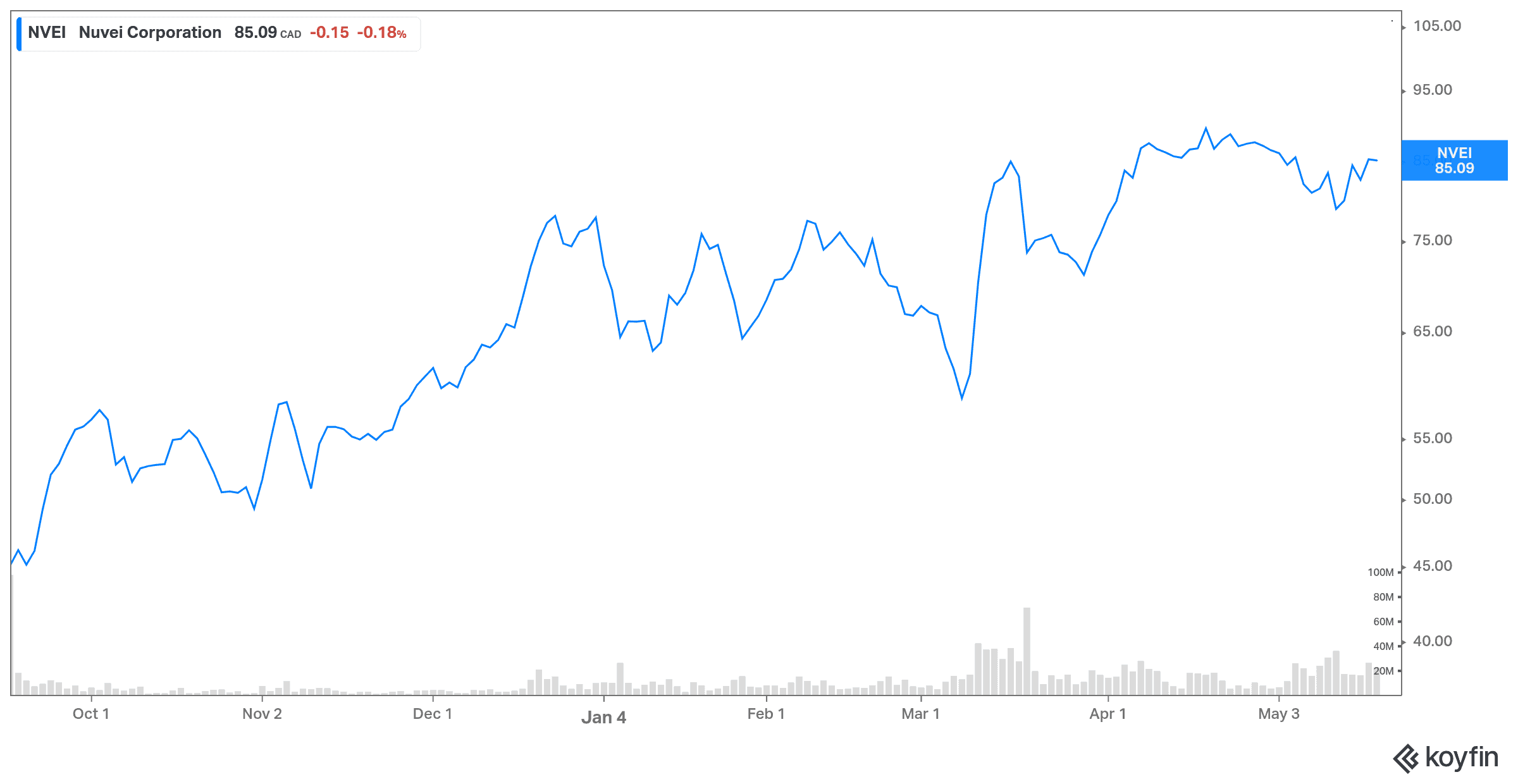

It’s much less risky to invest in a high-growth stock like Nuvei (TSX:NVEI), a global electronic payment-processing company based in Montreal. This high-growth stock is a top Canadian stock to buy now.

Nuvei acquires Simplex

The Nuvei digital payment platform is gaining ground in the cryptocurrency world. The company announced it will acquire crypto payment firm Simplex, which allows cryptocurrencies to be bought and sold using a credit card or directly from a bank account. Nuvei is also securing a licence for Simplex to open bank accounts and issue cryptocurrencies payment cards to both individuals and businesses.

With Simplex’s acquisition, Nuvei expands its range of financial services to the general public for the first time. It will now be able to issue payment cards whose balance will be calculated in a cryptocurrency like Bitcoin or in the currency of the country where the user resides. Simplex had just signed a partnership with Visa to issue such cards.

The leaders of the Montreal-based company have repeated on several occasions, since its listing on the Toronto Stock Exchange last September, their intention to establish Nuvei as the main supplier of transactional tools in the still-nascent cryptocurrency market.

In March, Nuvei added some 40 digital currencies to the more than 150 currencies that the transaction management tools it offers to merchants can handle.

The acquisition of Simplex will add a significant volume of transactions to the Nuvei platform. The Israeli company processed around 600 million transactions in 2020 and planned to quadruple that volume this year.

Simplex is the eighth transaction in three years for Nuvei and its second in two months. Nuvei is a top Canadian stock to buy now for its strong growth.

Strong quarterly results

Nuvei beat first-quarter earnings and revenue expectations. The performance of the global payment technology partner was driven by growth in the volume of existing merchant customers and an acceleration in the number of new customers.

Indeed, total volume increased by 132%, from $8.9 billion to $20.6 billion. E-commerce accounted for about 87% of total volume.

Nuvei revenue for Q1 2021 was $149.9 million, an 80% increase from Q1 2020 revenue of $83.2 million, and exceeding estimates of $9.37 million.

Meanwhile, the company reported Q1 2021 profit of $27.8 million ($0.19 per share) compared to a loss of $62.3 million (-$0.74 per share) in Q1 2020. Adjusted EBITDA increased 97% from $33.3 million to $65.5 million.

On an adjusted basis, Nuvei earned $0.35 per diluted share for its most recent quarter compared to adjusted earnings of $0.11 per diluted share in the prior-year period. Adjusted earnings were higher than analysts’ expectations by $0.32.