Dogecoin has been boosted by the buying frenzy that surrounded the GameStop saga earlier this year and by Elon Musk’s multiple Twitter posts.

The price of Dogecoin has traded below US$0.01 for most of its history, before surging above US$0.05 early in the year and then soaring to its all-time high above US$0.60 on May 7. But the Dogecoin buying frenzy has calmed down in recent days. The cryptocurrency price is currently trading under US$0.40.

There is a safer alternative to buying Dogecoin

A sign of the volatility of Dogecoin, its price can gain or lose billions of dollars in valuation in a few hours.

Most financial analysts are therefore very wary of the high volatility of Dogecoin, which especially appeals to individual investors, unlike Bitcoin, which has regained its nobility with large groups on Wall Street.

A better and safer alternative to Dogecoin is HIVE Blockchain Technologies (TSXV:HIVE), a crypto miner that mines Bitcoin, Ethereum, and Ethereum Classic.

Why HIVE stock is a good buy

HIVE is one of the most interesting coins in the cryptocurrency industry. While you cannot trade Dogecoin and other cryptocurrencies in your RRSP, you can trade HIVE stock in it.

The company deals with renewable energy, which is currently a hot trend. In addition, the company has a decentralized finance (DeFi) angle that could improve its shareholder value.

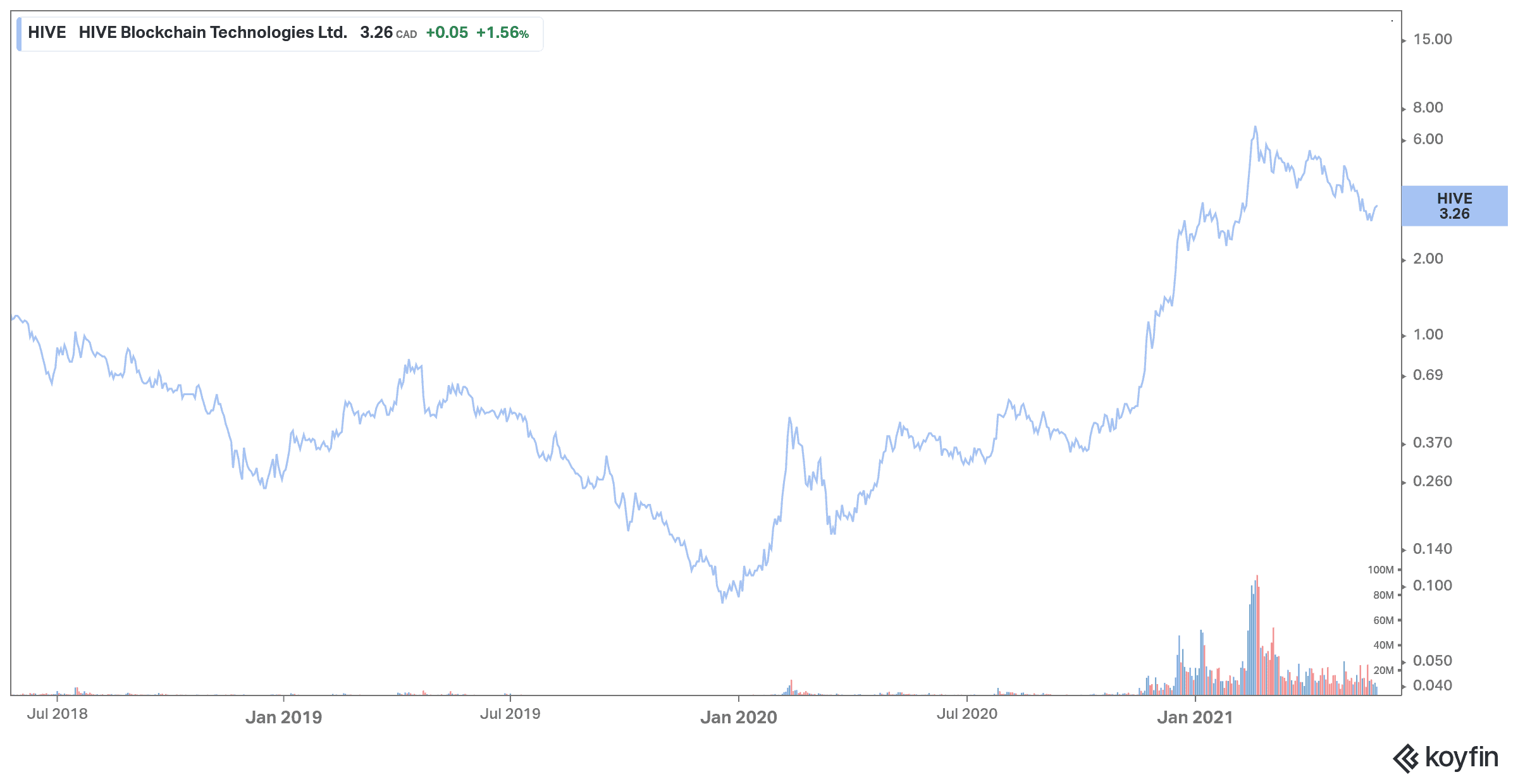

The stock has soared rapidly from just $0.11 in early 2020 to hit a 52-week high of $6.80 on February 19. The stock has since fallen and is currently trading around $3.

The green energy sector is subject to high volatility and investors should be vigilant. More importantly, a small stake in the stock can generate huge returns, but it could also backfire dramatically.

One of the important factors to keep in mind regarding HIVE stock is that the company is committed to conducting clean and sustainable cryptocurrency mining operations. Indeed, it takes ESG (environmental, social, and governance) factors into account.

At a time when Bitcoin has collapsed due to Elon Musk’s tweet regarding the environmental implications of the world’s largest cryptocurrency, this is a very important factor for future success.

HIVE conducts its mining activities in colder regions because it is not only cost efficient but also energy efficient, making it profitable. For investors interested in green energy plays, HIVE is a stock to watch.

A rebound in crypto could a positive catalyst for HIVE

It is important to note that just like the cryptocurrency industry as a whole, HIVE stock also suffers from periods of extreme volatility. So, it’s important to be careful when dealing with this stock.

Considering the type of gains generated earlier this year, it might be worthwhile to consider HIVE Blockchain stock at this point. Moreover, the possibility of a rebound in the crypto sector could also serve as a positive catalyst for a strong rebound in HIVE stock.

Cryptocurrency mining has been criticized for using large amounts of energy and the mining operations responsible for HIVE could make it stand out in a highly competitive industry. It might be a good idea to include HIVE stock on your watch list.