Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM) and ATS Automation Tooling Systems (TSX:ATA) are two of the best Canadian stocks to buy in June. Both companies reported strong results in their latest quarter, and their outlooks for the year are excellent.

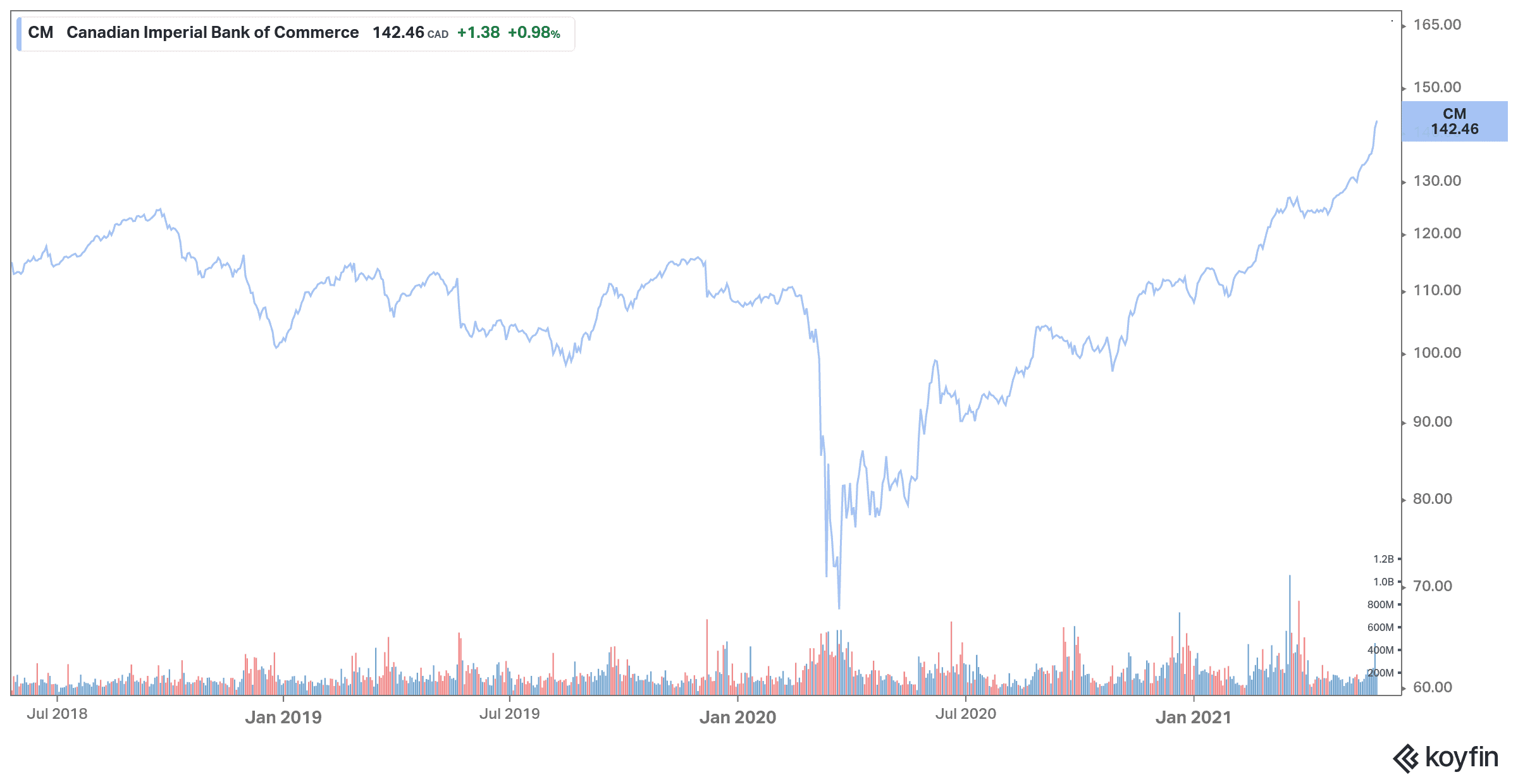

CIBC

I could have cited any big Canadian stocks in my best Canadian stocks to buy in June. I chose CIBC, as it’s the bank that reported the best quarterly results, in my opinion. Indeed, Canada’s fifth-largest bank profit more than tripled in its second quarter, driven by lower loan-loss provisions and strong financial market results.

Total revenue increased 7.6% to $4.93 billion and topped estimates of $4.76 billion. Profit was $1.65 billion ($3.55 per share) in the second quarter of 2021 compared to $392 million ($0.83 per share) in the same quarter a year ago. CIBC earned $3.59 per share on an adjusted basis, which was much higher than the consensus estimate of $3.01 per share.

The most significant change for CIBC during the quarter relates to provisions for credit losses. Indeed, the Canadian bank allocated only $32 million to new provisions in the second quarter compared to $1.4 billion a year ago.

Profits at CIBC’s core retail banking unit returned to pre-pandemic levels at $603 million, up 270% from the previous year.

The bank’s commercial banking and wealth management business unit profit increased 94% year over year to $399 million as provisions for credit losses decline.

Profits for commercial banking and wealth management in the United States reached $216 million from $15 million a year earlier due to a sharp reversal in bad debt provisions.

Capital market profits climbed to $495 million from $177 million in the same quarter last year.

Dodig expects Canada to experience an economic boost in the second half of the year, as more people are fully vaccinated against COVID-19. This will be a tailwind for CIBC and other Canadian banks.

“Our neighbours to the south … are enjoying an economic boost that we have yet to fully experience here in Canada,” Victor Dodig told analysts on a Thursday call.

For fiscal 2021, analysts expect CIBC to report revenue growth of 5% and EPS growth of 35.4%. CIBC pays a quarterly dividend that currently yields 4.1%.

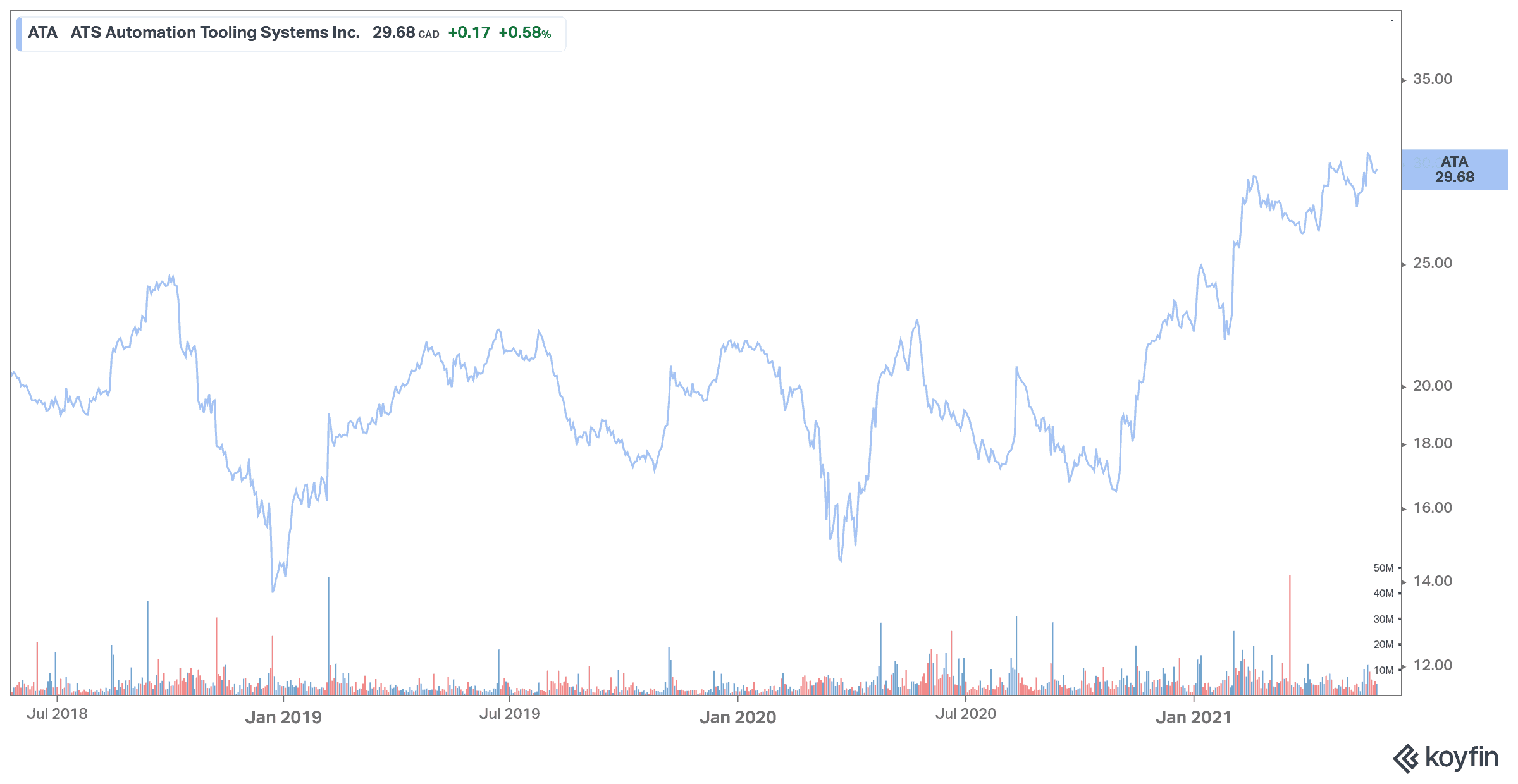

ATS Automation

ATS is a leading global provider of custom automation solutions for a range of markets including life sciences, food and beverage, transportation, consumer products, and energy.

The company set both top-line and bottom-line records in the fourth quarter. It posted revenue up 5% year over year to $399.9 million. Adjusted EPS was $0.34 per share compared to $0.26 per share for the fourth quarter of 2020. Analysts were forecasting Q4 EPS of $0.30 per share.

Of note is ATS’s orders and backlog, which grew 30% and 23% year over year, respectively, to $463 million for bookings and $1,160 million for order backlog as of March 31, 2021.

Looking ahead, ATS said it expects continued cash flow from operations as well as available cash and available credit, to be sufficient to provide liquidity if the economic impacts of COVID-19 continue for an extended period and to finance investments, including potential acquisitions.

ATS paved the way for further growth through M&A by acquiring global food and beverage equipment market provider CFT and laboratory automation and fluid distribution equipment supplier BioDot.

The provider of automation solutions is one of the best Canadian stocks to buy this month for its strong expected growth. For fiscal 2022, analysts expect ATS to post revenue growth of 33.7% and EPS growth of 37.5%.