The month of May will go down in history as one of the most volatile months for cryptocurrency investors so far in 2021. Bitcoin, Ethereum, Dogecoin, and a host of other coins saw wild price swings in May and Ethereum falling as much as 60% from an all-time high reached during the month. Despite acute price swings, Ethereum miners, including Hive Blockchain (TSXV:HIVE) could have generated record monthly revenues in May 2021.

Total Ethereum mining revenue hits new records ever

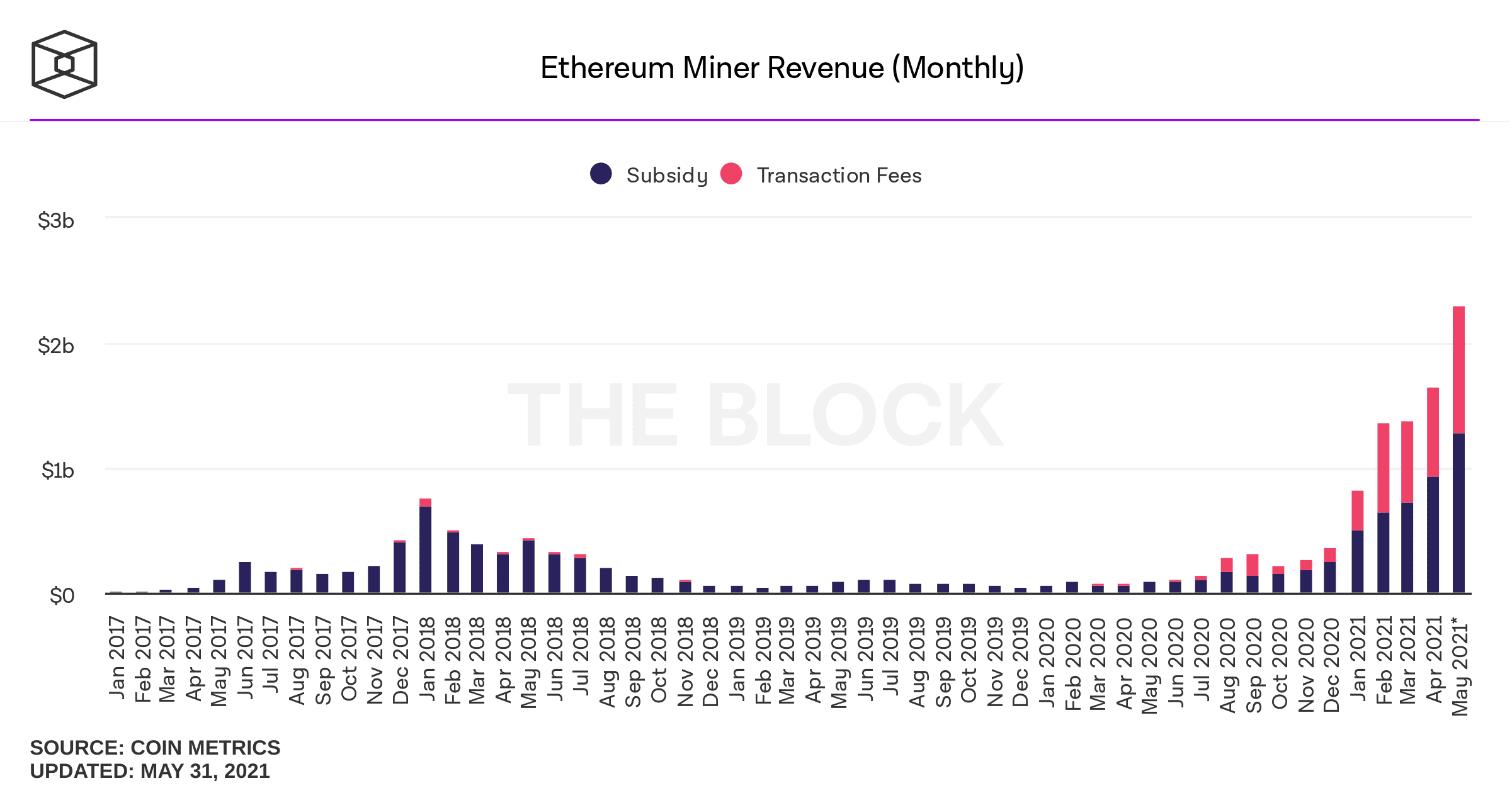

Total revenue generated by all Ethereum miners for May reached US$2.31 billion at the time of writing versus a record US$1.65 billion for April.

Two main drivers for record total miner revenue on Ethereum in May include record subsidies and record transaction fees.

Subsidies are the payments, in ETH coins, paid to miners for processing tasks and validating transactions on the blockchain. Transaction fees act more like inducements, as transactors compete for scarce computing resources.

Average transaction fees (seven-day moving average) spiked to a new record near US$44 per transaction by mid-May. Unfortunately, for miners, fees have since gone down under US$11 per transaction, which is consistent with rates seen during the first week of May. That said, it appears like Ethereum transaction, levels seen during the first week of May. It appears like fees usually spike mid-month and dip during month-end periods.

Why did Ethereum miner revenue spike in May?

ETH prices and total trading volumes spiked during the month. And the exponentially growing total computing power provided by miners (hash rate) hit new records, too.

Transaction volumes spiked, as traders caught up to the hysteria that pushed cryptocurrency prices to record highs during the second week of May. Trading volumes even spiked some more during market sell-offs. Market moving tweets from Elon Musk and a government crackdown on cryptocurrencies in China should be blamed for the acute volatility in the crypto market in May, but so should be the bouts of investor greed and fear triggered by those “market events.”

Most noteworthy, the surge in decentralized finance (DeFi) transactions (which are largely based on Ethereum) influenced chain transaction volumes, too. To add more, the rise of non-fungible tokens (NFTs) has been “complicit” in growing the ETH business ecosystem.

The trends could be recurring and likely permanent. Investors in dedicated Ethereum miners, including Hive Blockchain stock, should continue to watch the emerging DeFi applications wave; it could be what ETH needs to one day overtake Bitcoin as the cryptocurrency market’s most revered coin.

Time to Buy the dip on Hive stock?

Fundamentals have been improving for Ethereum miners so far this year, but Hive stock trades 55% off its all-time highs printed in February. ETH is also trading at 41% lower than its all-time high of US$4,362.35 seen on May 12 this year. Although mining profitability has declined to levels last seen in January, the business of mining ETH is still profitable.

Notably, Hive Blockchain diverted some significant computing power to Ethereum Classic, a related coin that had surged recently. The company may not have fully participated in the recent glory month for ETH miners. However, Hive still retains significant skin in the game.

Ethereum could be the blockchain that delivers more usability and functionality to humanity. Perhaps the rise in NFTs is one such functionality long-term investors could cherish someday. But such “innovations” are fueling transaction volumes and support the growing network fees on the blockchain. Hive stock is one of the best-placed miners to benefit.

That said, the extreme volatility in Hive’s stock price makes it most suitable for those willing and able to stay calm and ride the storm waves out.