Once again this week, the so-called “meme stocks” that first became popular on the internet site Reddit are pumping again. Along with stocks like Gamestop and AMC Entertainment, one of the Canadian stocks that has seen its share price rally considerably is BlackBerry (TSX:BB)(NYSE:BB).

When stocks rally rapidly as these have, it can be exciting and enticing for investors. However, if we learned anything from last time, while it’s not impossible to make money, it’s extremely difficult and purely speculation.

There is no telling when these stocks will rally and, more importantly, no telling when they will sell off.

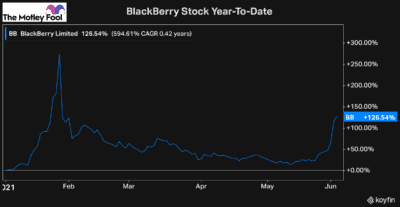

Looking at the chart, you can see that BlackBerry’s stock price sold off just as fast as it rallied last time.

With some stocks, like AMC, you may not want to own the business at all because it’s struggling or extremely overvalued. That’s not the case with BlackBerry, though.

Should you buy BlackBerry at this stock price?

BlackBerry is actually a decent company. However, it’s only worth an investment if you get it when the price is right. And so, after this rally, it’s definitely not worth an investment today.

The company has struggled in recent years, but it has a tonne of potential with its impressive security technology. Investors have been bullish on BlackBerry’s stock price for a while, as it’s expected to have crucial technology for self-driving cars. However, it’s still overpriced today by pretty much every metric.

Analysts have an average target price of just below $11. So if you really like the company as a business, you can consider buying it around or below that price. Above that, though, you’re purely speculating on the stock and taking a major risk in the process.

There are no fundamental reasons BlackBerry’s stock price should be trading at this valuation. So rather than speculate on BlackBerry today, here is a top Canadian tech stock to consider instead.

Forget speculating: Buy this stock instead

Rather than speculating on whether BlackBerry’s stock price can increase, a top Canadian tech stock to consider taking a long-term position in is Nextech AR Solutions (CSE:NTAR).

Nextech is a micro-cap, $200 million tech stock with a lot of promise. Augmented Reality (AR) is a technology that continues to be improved and has a tonne of potential uses in the future.

Whether its advertisers using augmented reality to help sell a project to investors, consumers playing video games, or even firefighters rushing into a burning building, AR is one of the most promising future technologies.

So the fact that Nextech is still only worth $200 million shows exactly the kind of potential the stock has over the next few years. The stock is still a high-risk, high-reward investment this early on, but it’s still nowhere near as speculative as betting on BlackBerry’s stock price.

In 2019 the AR market was estimated to be worth US$10 billion, and by 2024, that’s already expected to grow to more than US$70 billion. And with Nextech, the company’s vision is appealing. It’s focusing on driving a market-wide adoption to help the sector grow even faster.

So if you’re looking for a top tech stock with major growth potential today, Nextech AR is one of the best to consider.