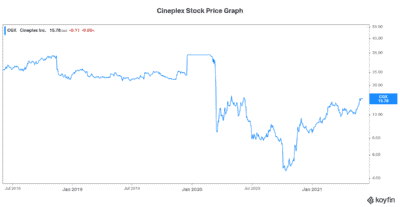

Cineplex TSX:CGX) stock has been a real nail-biter for us all here at Motley Fool. It fell from over $30 before the pandemic to below $5.00 in October 2020. But since this initial hit, Cineplex stock has been steadily regaining ground. In fact, the stock is currently trading above $15.00. It has certainly not been for the faint of heart. In the last month, however, the stock has soared 28%.

Why this sharp rally? Is it related to the meme stock mania that has taken over AMC Entertainment Holdings (NYSE:AMC)?

Cineplex stock is not part of the AMC meme stock mania

The whole mania and manipulation that is involved in the meme stock craze make me extremely uncomfortable. AMC stock has been subject to this mania. While some investors can make a nice profit, it’s generally a time of disconnect. Disconnect from fundamentals, confusion, and a lack of confidence in the rational functioning of the market.

I would rather watch a stock rise slowly on fundamentals any day. Because once the Reddit crowd gets their teeth into it, there’s no telling how high or how low it will go. It’s like the Wild West: chaotic, stressful, and yes, admittedly exhilarating when you’re on the right side of it.

But this is gambling. We at Motley Fool don’t pretend to be speculators. We are interested in long-term, fundamental trades. I’m happy to say that Cineplex stock has not fallen into the hands of the meme stock craze. I think it’s risen for solid fundamental reasons.

Even without the distraction of meme stock action, Cineplex stock has been hard to call in the last year. The business was effectively shut down at the start of the pandemic. It has only survived because of government help, landlord programs aimed at rent payment relief, and some solid crisis control.

Cineplex stock beginning to price in a real recovery in fundamentals

Today, a recovery is becoming palpable. We’re on the edge of a resurgence and re-emergence of all things entertainment. Movies, playrooms, dining and even theatre and sporting events are preparing to come to life once again. Indeed, 6% of the Canadian population is fully vaccinated against COVID-19, while 58% of the Canadian population has at least one dose. Furthermore, vaccinations are being accelerated, and second shots are being moved up for every age group.

Cineplex is therefore on the cusp of big things. You might have never been a believer in Cineplex stock. I understand that the movie exhibition business faces big threats in the form of Netflix, Crave, and a multitude of other streaming subscriptions available. But with Cineplex stock trading under $16.00, you might want to reconsider.

Cineplex stock offers the promise of strong cash flows

Just before the pandemic hit, Cineplex stock was trading above $33. In 2017, it was trading above $50. Since then, the streaming business has advanced markedly. But Cineplex has also continued to diversify to offset this pressure. Cineplex stock is valued at a mere fraction of what if value of a few years ago. Maybe some of this discount will remain. But with the re-opening of theatres, Cineplex stock stands to gain significant ground. In 2019, Cineplex generated EPS of $0.74 and cash from operations of over $300 million. The company also generated strong free cash flow of $167 million.

So as we can see, Cineplex is a real business with the ability to generate significant cash flows. Today, we can snatch up this stock at bargain prices. Some of us may wonder if movie theatres are a thing of the past. We can just watch our movies from home.

Well, I think we’ve had enough of being home and we’re aching to get out. The movie theatre is a low-risk way to start. And for those of you who doubt this, Cineplex is an increasingly diversified company that can help settle your doubts.

The bottom line

Cineplex stock has really surged in the last month off of expectations of a return to normalcy. This is very much justified. The end of lockdowns is almost here — and Cineplex could well reap the rewards. At under $16.00 at writing, Cineplex stock represents a solid buy opportunity.