The best stocks to buy right now have to be in the right industry. They also have to be solid operational performers. Finally, they must have a competitive advantage. This is an important point, and it’s something I’ve written many Motley Fool articles about. Peyto Exploration and Development (TSX:PEY) is such a stock. It’s a Canadian gem that has been left in the dust for far too long considering its quality and its importance.

Providing the natural gas to power our economic recovery

Natural gas is a relatively low-carbon, low-emitting fuel. It is the easiest replacement to higher-carbon fuels such as coal. And it will certainly be a key transition fuel as we fight to reduce our carbon footprint. Gas powers an estimated 44% of America’s electricity. It will continue to power our lives for the foreseeable future.

According to some estimates, natural gas demand is expected to increase by as much as 45% by 2040. This will be driven to a large extent by Asian economies. They will be making the switch from coal to natural gas, as their economies continue to grow. The natural gas industry is experiencing very bullish fundamentals right now. So, it makes sense that this best stock to buy right now is in this industry.

Natural gas is still the cheapest and most abundant fuel source. It has a solid foundation in the transition to clean energy. Canadian natural gas is among the cheapest and cleanest, and it’s finding its way abroad. Canada has a comparatively easy path to the fast-growing Asian countries. As such, it has a huge market as LNG export capacity expands.

Peyto stock: One of the best stocks to buy right now

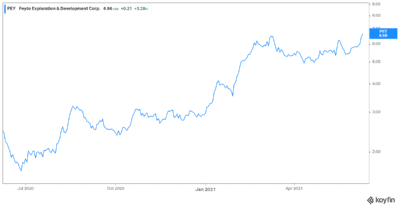

Peyto Exploration & Development is one of Canada’s lowest-cost natural gas producers. It operates in a very prolific resource basin. This basin has a predictable production profile. It also gives access to low-risk exploration. Finally, this basin has a long reserve life. This translates into a very strong and lucrative cash flow generation profile. In fact, in Peyto’s latest quarter, operating cash flow increased 115%. This was mostly attributed to soaring natural gas prices. Increased production and lower operating costs also boosted Peyto’s first quarter. Peyto is up 120% so far in 2021.

Peyto has been one of the best stocks to buy in the energy sector for a long time. It’s no stranger to strong cash flows. In fact, the company has a history of strong cash flow generation. Its low-cost operations ensure that Peyto generates cash flow, even in low natural gas pricing environments. This is Peyto’s competitive advantage.

Peyto stock is the Canadian natural gas stock to buy

If you’re not sold yet on the positive outlook for natural gas, read on. Natural gas prices have rallied more than 70% in the last year. Attractive supply and demand fundamentals have driven this increase. There are many useful and relevant Motley Fool articles that talk about this, but let’s go over it here.

On the supply side, years of record low natural gas prices have hit production. There has been less investment in natural gas resources. Simply put, capital investment was low, as companies were simply struggling to survive. On the demand side, we’re seeing another bullish trend for natural gas prices. As North America emerges from lockdowns, economic activity is slowly picking up. Natural gas demand will rise as this fuel will power this post-pandemic economic recovery. In addition to this, LNG exports to Asia will pick up as natural gas demand from that region skyrockets.

The supply and demand fundamentals should continue to improve over the next while. This leaves Peyto sitting pretty as one of Canada’s lowest-cost natural gas producers.

Motley Fool: The bottom line

Peyto stock is one of the best Canadian stocks to buy for a few reasons. First of all, the oil and gas industry is currently in recovery mode. We are possibly entering cyclical highs. Second, Peyto is and always has been a shining example of operational and financial excellence. Consider adding Peyto to you portfolio for solid returns.