What would you think of making $35 per day for the rest of your life without having to lift a finger? Do you think it’s impossible? In fact, it’s possible and easier to earn this kind of passive income than you might think.

How can you earn $35 per day in passive income?

Buying a stock that has a high dividend yield is the way to go to earn an interesting amount of passive income every day. You could earn $35 per day with dividends by buying Enbridge (TSX:ENB)(NYSE:ENB) stock.

The pipeline company has increased its dividend in each of the past 25 years and has a compound annual dividend-growth rate (CAGR) of 10% during that period. Development projects will generate distributable cash flow (DCF) growth of 5-7% through 2023. Investors are expected to see distribution increase in line with the higher DCF.

Enbridge has a very high dividend yield of 6.5%. That means you need a capital of about $200,000 to get $35 per day in passive income with this stock. Reaching $200,000 in investments may seem hard, but it can be reached in a few years if you invest in the right stocks.

You should look for growth stocks to grow your money faster. Those stocks generally don’t pay a dividend or just a small one, but they tend to rise faster than dividend-paying stocks, as money earned is reinvested in the growth of the company.

Galaxy Digital is a growth stock with high potential

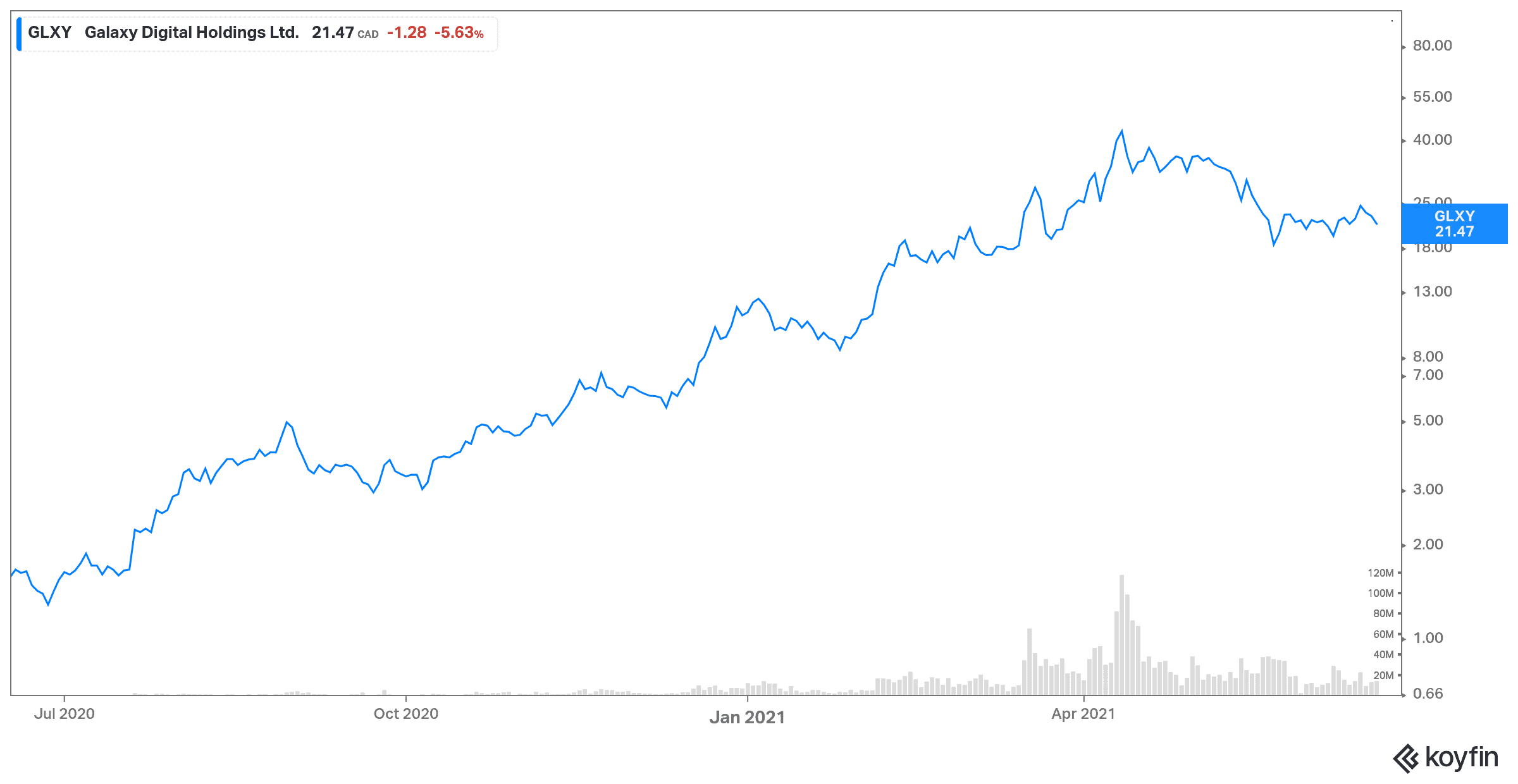

You might want to consider Galaxy Digital Holdings (TSX:GLXY) stock to make your money grow faster. This stock is rising very fast, with a one-year return of 1,225%.

Galaxy Digital provides investment management services to the digital asset, cryptocurrency, and blockchain technology industries. As crypto is booming, Galaxy Digital is growing fast. The company reported strong results in its latest quarter.

Comprehensive net income reached $860.2 million in the first quarter of 2021 compared to a loss of $26.9 million in the first quarter of 2020. The improvement is mainly due to the company’s holdings in assets digital and other investments in connection with its trading activities. Higher operating expenses partially offset the good performance.

The fair value of net asset holdings increased 128% to $1.85 billion from $813.5 million at the end of the previous year mainly due to gains on digital assets and other investments.

Galaxy Digital founder and CEO Michael Novogratz said, “Galaxy Digital had another record quarter in a row, with overall net income increasing to $860 million from $336 million in the previous quarter; assets under management increased to $860 million from $336 million in the previous quarter … counterpart loan origination increased by more than 510%. Beyond spectacular organic growth, we announced the acquisition of BitGo, which will make Galaxy Digital the premier full-service digital asset financial platform for institutions and ensure that our business is aligned with a wider institutional adoption.”

The BitGo acquisition has been approved by Galaxy Digital boards of directors and is expected to be finalized in the fourth quarter of 2021.

Galaxy has acquired Vision Hill

Galaxy announced in May the acquisition of Vision Hill Group, a company offering digital asset management and advisory services to institutional investors using data-driven solutions.

This acquisition expands the company’s Galaxy Fund Management platform, providing institutions with access to Vision Hill’s broad range of investment, analytics, data, and benchmarking products for the digital asset class.

Vision Hill CEO Scott Army said that the company is confident that Galaxy Fund Management will help bring its mission to life. Vision Hill has worked closely with Galaxy for the past two years.