Canadian stocks have been having an incredible year of gains. While cyclical stocks have dominated 2021, technology and growth stocks are also recovering. Just in June, Shopify (TSX:SHOP)(NYSE:SHOP), one of Canada’s most exciting growth stocks, has gained 22%!

Shopify has been on a run lately

Almost any investor will admit that Shopify is one of the best companies in Canada. Quarter after quarter and year after year this business meets or beats investors’ expectations.

Just a few days ago, Shopify announced that it will drop commissions on the first $1 million of revenue developers make through its platform. Consequently, barriers for developers to join Shopify and create marketplaces should drop. This should broaden its eco-system and create further opportunities for new merchants come to its platform.

Shopify is a great business but a very expensive Canadian stock

Shopify consistently innovates and outthinks its competitors. As a result, it is primed for outsized growth for years ahead. The only problem is, the stock market has already valued it for nearly infinite growth.

This Canadian stock trades with a sales multiple of 66 times and enterprise value-to-EBITDA ratio of 514 times. It is one of the best companies in Canada (and maybe the world). Yet, for more conservative growth investors, that provides a very small margin of safety should it stumble.

Consequently, in this elevated market, I am looking for Canadian stocks with strong growth but a cheap or fair valuation. Fortunately, here are two stocks that are worth a look today.

A beaten-down Canadian growth stock

Enghouse Systems (TSX:ENGH) is one of the best tech performers on the TSX over the past decade. Yet it has been knocked down by nearly 10% this year. This is largely due to growth somewhat slowing as we exit the pandemic.

When lockdowns hit in March 2020, businesses were running to Enghouse for its video conferencing platform and various omni-channel software services. It saw record sales and earnings last year. Now that things are re-opening, demand for those services is starting to normalize.

I am not too worried. This company is incredibly profitable. It consistently produces free cash flow margins that are over 30%. As a result, it has a great balance sheet with $165 million of net cash.

While the market is concerned about its growth going forward, management is being patient about acquiring new businesses at better valuations. While this may hinder short-term results, it sets this Canadian stock up for long-term gains.

A stock set to soar again

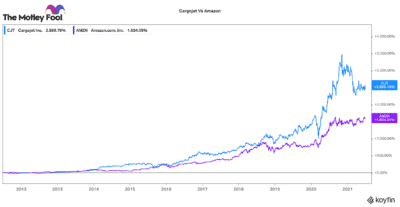

Many Canadian investors may not know it, but Cargojet (TSX:CJT) stock is also among the top performers on the TSX. It is incredible to imagine, but since 2012, it has nearly doubled the returns that even Amazon.com has delivered! It has earned early shareholders a 2,550% gain!

Yet, as of late, this Canadian stock has pulled back due to similar reasons as Enghouse. 2021 results may lag because 2020 was such a strong year. I am not really concerned.

It took strong free cash flows generated last year (nearly $200 million) and continued to reinvest in its fleet. Now that the company has a major competitive foothold in Canada (90% of the overnight air freight market), it is setting its targets internationally.

If the pandemic demonstrated anything, e-commerce is now entrenched in society. Given the expectation for same-day, next-day, or two-day delivery, Cargojet has the infrastructure, planes, and expertise to be a major long-term beneficiary of this trend.

Its stock is trading with an enterprise value-to-EBITDA of only 12.5 times. As it rolls out its new strategy and garners new contract wins, that could shift upwards and give this stock flight again.