BlackBerry (TSX:BB)(NYSE:BB) stock has experienced its fair share of ups and downs in 2021. Reddit investors have been turning this stock into a roller coaster! If you got in early, it has been a great stock. However, now I am not so certain. BlackBerry has exposure to some exciting thematic technological trends like electric vehicles, 5G, the internet of things, and cybersecurity. Yet there are fair reasons why this stock was highly shorted prior to the start of the year.

Pre-Reddit, BlackBerry stock has disappointed investors

Firstly, BlackBerry has a history of overpromising and underdelivering. Once again, in its recent quarter, it missed analysts’ revenue and earnings estimates. If you look back over the past five years, there is no consistency in revenue or earnings growth either.

Secondly, despite lacking operational performance, its management consistently get overtly rich compensation packages. I’d rather own stocks where management and shareholders are more aligned. Lastly, BlackBerry stock is just overvalued here. It trades with an enterprise value-to-EBITDA of 148 times and a price-to-sales ratio of 9.7 times.

I don’t mind paying for a rich stock if it is rapidly growing and consistently beating expectations. However, at least right here, BlackBerry stock just looks like one to watch from the sidelines. Instead, I would rather get wealthy by investing in stocks that are prudently and consistently growing earnings over time. Here are two top growth stocks that look great for July.

This TSX stock could be soaring for years ahead

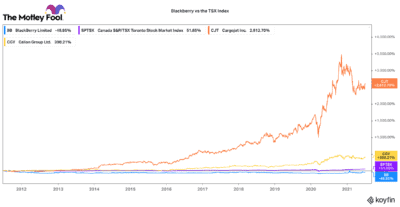

If you want a more consistent stock over BlackBerry, why not buy the railroad of the skies? I am talking about Cargojet (TSX:CJT). This stock isn’t talked about by Reddit traders. Yet, over the past nine years, Cargojet has earned a beautiful 2,100% return (not including dividends) for buy-and-hold investors. It has been averaging respective annual revenue and EBITDA growth of about 18% and 40% over the past five years.

It has built Canada’s best and most competitive overnight air-freight network. The company’s staff, planes, expertise, routes, and infrastructure give it a strong competitive moat. Unlike BlackBerry stock, Cargojet looks relatively cheap today. It trades with an enterprise value-to-EBITDA ratio of only 12 times. Certainly, that is based on very strong comparatives from last year. Yet I think this business could surprise to the upside.

Cargojet is expanding its fleet and setting its eyes towards international markets. E-commerce is quickly growing in Asia, Latin America, and Europe. All of these markets could present huge growth opportunities for years ahead.

This undervalued TSX stock wins from similar tailwinds as BlackBerry

Another “steady-as-it-goes” tech stock to buy over BlackBerry is Calian Group (TSX:CGY). Last year, this company grew revenue and adjusted EBITDA by 26% and 36%, respectively. For the first six months of 2021, it has grown revenues and adjusted EBITDA by 25% and 31% when compared to last year. Given a number of key acquisitions it made in IT and software services, the second half of the year should remain very strong.

Calian has four tiers to its business. Almost all are firing on all cylinders. Like BlackBerry, this stock plays into exciting technological themes, such as virtual education, 5G, cybersecurity, the internet of things, and low-earth orbit satellite communications. This stock is growing organically and through acquisition. Likewise, it is working fast to diversify operations by geography, customer, and product/solution mix. Today, it has $64 million of net cash that it can opportunistically deploy.

Despite the company’s strong positive outlook, its stock still only trades with a forward price-to-earnings ratio of 17 times and an enterprise value-to-EBITDA of 16 times. Calian and BlackBerry are focused on very similar technological trends. Nonetheless, I would much rather bet my money on a great value/growth stock like Calian today.