Anyone following cryptocurrencies lately has noticed that the Bitcoin (BTC) price in U.S. dollars has fallen by more than 47% from its peak above US$64,100 in April to trade below US$33,000 by the time of writing on Tuesday morning. The leading cryptocurrency is seemingly tangled up in its usual boom-and-bust cycles, which follow every fourth year “halving” event.

Bitcoin usually soars to new all-time highs after rewards to miners are cut in half after every 210,000 coins are mined. This usually happens every four years.

It can be noted that in the first cycle, which ended in November 2012, BTC’s price reached a high of about US$30. In the second cycle ending July 2016, the coin’s all-time high was US$1,200; and in the third and most recent cycle that ended in May 2020, US$20,000 was the magic number.

We are already in the fourth cycle, and BTC has topped US$64,000. One can only speculate what fortunes the next cycle beginning in 2024 will bring to investors in the cryptocurrency, especially to some of the world’s largest cryptocurrency miners, like Hut 8 Mining (TSX:HUT)(NASDAQ:HUT).

Hut 8’s stock price rose 278% between January 1 and February 22 this year to an all-time high of $15,98. Mining profitability and the value of its cryptocurrency assets soared as Bitcoin soared to the moon. Well, natural gravity, aided by an ongoing crackdown on cryptocurrency mining operations in China, has brought the cryptocurrency’s price back to near Earth levels for now.

One can only imagine how high the company’s shares could soar in the next cycle — 200%; 300%; or even more? It’s hard to tell when will Bitcoin rise again, but speculating from previous trends, the capital gains from buying the miner’s stock at today’s low $6 levels could prove substantial over the next five years.

Five reasons to buy Hut 8 Mining stock today

As history has proven since BTC’s inception, the cryptocurrency’s value has rallied after each halving event. The next halving, which is expected in 2024 could give BTC more firepower to lift towards the moon again, or to at least make another emphatic attempt.

It could benefit to buy the big-name crypto mining growth stocks during their current dips today. This is one potential reason to buy Hut 8 Mining stock right now.

Secondly, the company is expanding its productivity significantly right now, while mining operations remain profitable at current crypto prices.

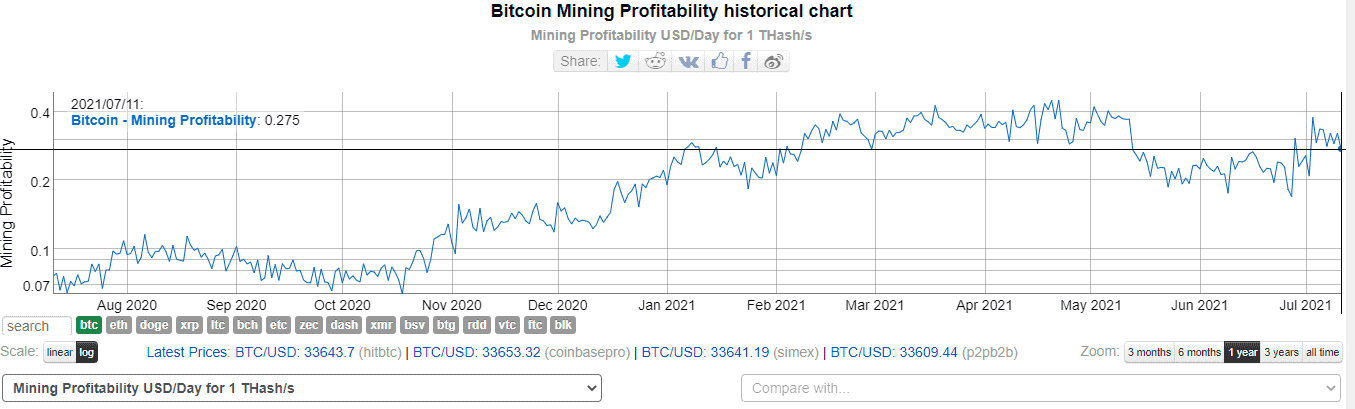

Even after the recent significant fall in cryptocurrencies, mining operations generally remain viable, with better economics than 2020 settings. Miners who increase their productivity now will reap more benefits. Operational profitability is still present, even if BTC prices remain subdued near current levels for years to come.

Third, the company and its North American cryptocurrency mining peers are picking up the spoils from a China crackdown. Competition for blocks has come down as Chinese rigs go offline, and BTC mining difficulty has eased as a result. The company is a major cryptocurrency miner in North America, and management may be smiling, as operations become more profitable in the short term.

Reason number four is company specific. The company anticipates expanding its mining capacity from 1.2 Exahash (EH) to about 2.5-3.0 EH within the next few weeks. Productivity could increase from current lows of 6.2 Bitcoin a day to about 10 coins per day by August this year. Higher productivity will be good for the business — more so, given current profitability and lower mining difficulty.

Moreover, the company boasts of a big wallet. Its coin inventory had accumulated over 3,800 self-mined Bitcoin by the end of June 2021. Current productivity gains could increase portfolio size to 5,000 coins by December this year. Buying Hut 8 stock is like buying into a Bitcoin ETF that has mining operations on the side. The gains on invested capital will be substantial — more so if BTC ever reaches billionaire investor Tim Draper’s US$250,000 prediction at any time this decade. This is the fifth reason why I would recommend a BUY on HUT stock today.