Bank stocks are some of the most popular investments among Canadian investors. The Big Five banks are some of the top long-term businesses to own, as they are stable and have incredible long-term growth rates.

Banking is always an industry where you can make a lot of money. And Canadian banks are always investor favourites, because, in addition to that growth, they are renowned around the world for their stability.

And while these companies can still be great investments today, there are other financial stocks that offer even more long-term potential. Here are two of the best to buy today.

A financial conglomerate larger than some of the Big Five bank stocks

One of the best financial stocks in Canada has to be Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM).

If Brookfield were a bank, the stock would be the third largest in Canada. At a market cap of $100 billion, it trails only TD and Royal Bank.

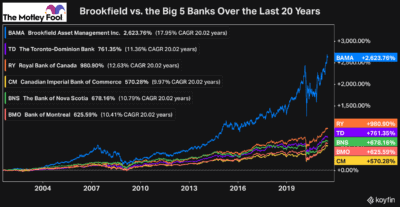

However, Brookfield has massively outshined the Big Five bank stocks over the last few decades when it comes to performance.

As you can see, Brookfield has put up an incredible performance, more than double its next-closest bank stock competitor. Even over the last 10 years, Brookfield is up more than 450% versus its next-closest competitor at just a 250% gain.

One of the reasons Brookfield has been so successful is that in addition to the asset management portion of its business, which is somewhat similar to banks, the company also has multiple businesses from renewable energy to some of the best infrastructure assets in the world.

Brookfield is well known as one of the best investment managers. It has a tonne of liquidity, which helps give it some of the best deal flow. And because it’s such a great money manager, it’s always recycling capital from older projects into new and exciting opportunities.

So, if you’re looking to add a financial stock to your portfolio, while you can’t go wrong buying bank stocks, Brookfield looks like it’s offering a lot more potential for growth.

A rapidly growing specialty finance stock

Another top growth stock to consider that’s had even more impressive success than Brookfield Asset Management is the specialty finance stock goeasy (TSX:GSY).

goeasy is one of the fastest-growing and most profitable stocks you can buy in the financial industry. While the Big Five bank stocks are up between 55% and 100% over the last five years, goeasy has gained a whopping 925% during the same period.

The majority of its business consists of loaning money to below prime borrowers. goeasy takes on higher-risk clients than what the bank stocks will typically take on. In exchange, though, it charges a higher interest rate to compensate for the increased risk.

However, because goeasy has such a strong and stable portfolio of loans, it keeps its loan losses and bad debt expenses low, which leads to an incredibly profitable business model.

As of the first quarter in 2021, goeasy was charging off just about 9% of its loans. At the same time, it had a total portfolio yield on its consumer loans north of 40%.

To give you an idea of how profitable it’s been, the company earned $64 million of operating income on just $170 million of revenue in the first quarter.

And on top of the incredible margins that the business has, it’s been rapidly expanding its loan portfolio, which is why the stock has rallied so rapidly.

goeasy has built an incredibly successful business and is still only worth just $2.5 billion — considerably less than any of the big bank stocks.

So, if you’re looking for a high-quality financial stock to add to your portfolio today, goeasy should definitely be a top consideration.