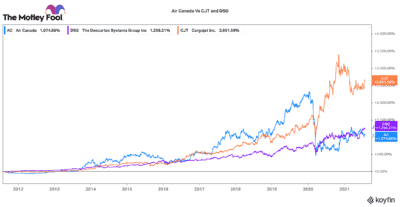

Year-over-year, Air Canada (TSX:AC) stock has made a pretty strong recovery. From this time last year, the stock is up 67%. Yet, since the start of the year it has been a rocky ride with the stock peaking and dipping on a number of occasions. Recently, it has pulled back, but is now a good time to buy in?

Air Canada stock is for traders, but investors be careful

Well, for a trade perhaps. In North America, the world is slowly re-opening and many people are eager to travel again. There is ample demand to see family, friends, and the world again. However, a resurgence in the Delta COVID-19 variant could hamper this recovery.

That brings me to a greater issue about this stock. Air Canada only has limited control over its destiny. It could have operated perfectly through this pandemic, but still struggle to hit profitability. It faces so many external controls like government regulations, border closures, variable cost increases (fuel, maintenance, staffing), and variable consumer demand. This is especially true for its challenged international business, which was one of its largest growth engines prior to the pandemic.

Air Canada stock is still in survival mode

To simply survive the pandemic, Air Canada has taken on a ton of debt. It also issued a significant amount of dilutive equity to maintain its balance sheet. As it goes forward, earnings per share growth will be harder to come by. Airlines were already a tough businesses to operate prior to the pandemic, but their challenged capital structures make them even more difficult.

In 1996, Warren Buffett said, “The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines.” Given this, there are likely better opportunities than Air Canada stock for a long-term investor to put their money. Here are two Canadian transportation-type stocks you might want to consider instead.

Cargojet: A different kind of airline

There is one airline that I would not be opposed to owning. Cargojet (TSX:CJT) is like the freight tanker of the skies. It operates Canada’s largest domestic overnight freight network. It has a strong market advantage, reaching over 90% of Canada’s population.

Cargojet has been enjoying very strong tailwinds from the growth in e-commerce and same-day or next-day delivery. It has major contracts with Amazon, Canada Post, and DH (oh, and Drake as well). It is able recover almost all its variable expenses from its clients. Its earnings are not heavily affected by external factors.

Today, Cargojet is looking to expand into larger international markets, which could help fuel a new skyway of growth. For a solid, steady growth stock, this is a better one to buy over Air Canada.

Descartes Systems: A logistics software leader

Descartes Systems (TSX:DSG)(NASDAQ:DSGX) is another stock that is probably a superior long-term investment to Air Canada. It provides critical software and networking solutions for logistics and supply chain businesses. Regulations and compliance standards across borders has created a huge paper-trail. Descartes software streamlines and simplifies these processes.

Descartes garners very high margins and strong recurring revenues. Over the past five years, it has been growing revenues by about 13-15% a year, and EBITDA by about 14%-17% a year. Today, this stock is trading at 52-week highs based on a solid earnings outlook for 2021.

Consequently, I would perhaps wait for a pullback to get in. Yet, I would much rather own a stock with a strong and foreseeable outlook, than a stock like Air Canada, where its future success is anyone’s guess.