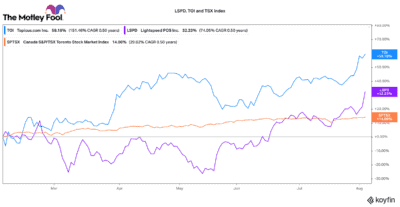

While 2021 may be the year of the value trade, TSX growth stocks have still fared pretty well. Over the summer, we have seen some of Canada’s leading technology stocks recover in a strong fashion. In fact, many of these stocks are hitting fresh all-time highs.

While valuations have certainly risen, many of these businesses are leaders in their sector and are producing very strong, consistent results. Similarly, their businesses are often supported by strong competitive moats and/or favourable economic and societal tailwinds.

Given this, here are two high-growth TSX stocks that could each double sooner than you expect.

Lightspeed POS: A top TSX growth stock

Lightspeed POS (TSX:LSPD)(NYSE:LSPD) is not a cheap stock by any metric. It trades at a price-to-sales multiple of 72 times! Similarly, this company is not yet profitable. Regardless, investors are willing to pay up to own this stock for a reason.

Just yesterday, it released first-quarter results and blew away the market’s expectations. This TSX stock jumped by more than 7% after earnings. Revenues increased year over year by 220% to more than US$115 million. Gross transaction volumes expanded by 203% to $16.3 billion. While the company took a larger-than-expected net loss in the quarter, the loss was mostly due to acquisition-related costs.

Lightspeed has been positioning itself to become an all-inclusive commerce platform for small- and medium-sized retailers and restauranteurs worldwide. While it provides point-of-sale solutions, its omnichannel platform and services span far beyond that. Indeed, its platform has become a crucial extension of many retailers’ businesses.

Over 90% of revenues are recurring and its customer retention has been very strong. The company still has $603 million in cash, so further acquisitions are not out of the question this year. There are still thousands of merchants on legacy systems, so Lightspeed continues to enjoy a large addressable market.

While I might wait for a cheaper entry point, this TSX stock could still more than double over the next few years.

Topicus.com: A technology play on Europe

Another intriguing growth stock is Topicus.com (TSXV:TOI). Since its initial public offering early this year, this TSX stock has returned nearly 58% to early buyers. While perhaps not as well known as Lightspeed, Topicus is the child of a TSX legend, Constellation Software.

Topicus was spun out as a means of concentrating and monetizing Constellation’s growing software platform in Europe. Topicus is actually the combination of two entities: one is growing organically, while the other is growing by means of aggressive consolidation (much like Constellation).

I like this stock because it offers crucial software services to clients, particularly in the banking, education, and government sectors. Once a customer is onboarded, revenues are very predictable and sticky.

This TSX stock just produced solid quarterly results. Revenues grew over last year by 54%. In addition, 8% of that growth was produced organically by its current operations. The earnings picture for this stock is a little hazy due to non-cash gains realized on some convertible preferred securities. Those will be converted by early next year, so that should largely clear up earnings results in the future.

Topicus announced a larger energy-focused software acquisition just last week. This TSX stock should see some decent cash flow growth as it integrates this (and other smaller acquisitions) into its empire.

This company has a great management team, leading software assets, and the experience and guidance of a board populated with Constellation’s top managers. You will need to be patient, but this stock could also double your money over the next few years.