The Tax-Free Savings Account (TFSA), is here for us to reduce our taxes. Therefore, it’s well worth taking advantage of it to the fullest extent possible. The cumulative contribution limit is $75,500. This means that the tax savings to be had are pretty significant. For TFSA investors, cheap dividend growth stocks are a goldmine. These stocks set us up with tax-free income and capital gains. The tax savings add up over time. These savings alone are enough reason to carefully select the right TFSA stocks.

Without further ado, let’s take a look at Altagas (TSX:ALA) stock. It’s a cheap dividend growth stock that’s about to take investors by storm.

TFSA investors: Altagas stock is a dividend king and a growth stock all in one

Altagas stock is currently yielding just under 4%. That’s a healthy yield. This yield is underpinned by a strong utilities business and a growing midstream business. Let’s see why this is important by looking at the company’s history.

Sure, Altagas had trouble in the past after a debt-fuelled acquisition. In fact, so much trouble that the company had to reduce its dividend. This was a real strike against it. But I view this as necessary growing pains. It was this that catapulted Altagas to where it is today. It was this that transformed the company.

Consider its diversified business. Also, consider its growth profile. Altagas has two segments: the defensive utilities segment (accounting for 60% of EBITDA) and the midstream segment. The utility segment provides Altagas with steady and defensive utilities earnings. The midstream segment provides Altagas with huge growth. All of this has culminated into another exceptional quarter. Indeed, Q2 2021 EBITDA increased 12% and normalized EPS increased 33%. This ideal dividend stock for TFSA investor portfolios provides stability and growth at a cheap price.

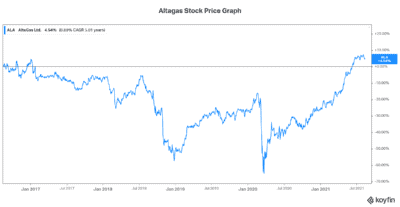

Altagas stock: Up 40% in 2021 with no signs of stopping

Altagas stock is cheap; it’s trading at under 15 times earnings. Also, the company continues to perform above expectations. Essentially, the market continues to underestimate Altagas. And here is the opportunity. Today, this is what is keeping its valuation at inexpensive levels.

In 2022, Altagas will continue to de-risk the company. For example, debt will continue to be paid down. Also, Altagas will continue to invest in its low-risk utilities operations. These operations will ensure strong and stable cash flows. This will support the dividend.

The Ridley Island Propane Export Facility (RIPET) is a very bright spot. This facility is part of Altagas’s midstream business. It’s connecting Canadian producers to global markets. This is a strategic advantage for Altagas at a time when this access is lacking. Simply put, the propane business is booming. The Ridley facility is seeing strong interest from producers. Utilization is increasing and volumes are ramping up quickly.

Altagas’ dividend is secure and growing: An ideal TFSA stock

Energy infrastructure companies like Altagas are well-known for their stable earnings. They’re also known for their cash flow generating prowess. And they’re known for their slow and steady returns. So how is Altagas expecting a 20% + increase in EPS? Well, the answer lies in the company’s midstream segment, as previously discussed.

With a payout ratio of 75% and a growing earnings base, Altagas’s dividend is clearly secure. In December 2020, the company raised its dividend. Going forward, I would expect it to rise even more as Altagas’s business continues to grow and thrive. This becomes evident as we study the midstream segment which is thriving amidst increasing global demand.

The bottom line

TFSA investors have a chance here to buy into one of the best Canadian stocks for passive income. Altagas has a solid strategy that is underpinned by the stability of its utility business and the growth of its midstream business.