Fortis (TSX:FTS)(NYSE:FTS) is in the energy delivery business. In fact, Fortis is a leader in the regulated gas and electric utility industry in North America. So what makes it one of the best Canadian stocks to buy now? Well, many things. But let’s focus on the top three.

Fortis stock: The top Canadian stock to buy for stability

The TSX continues to thrive as investor sentiment remains positive. And there are good reasons for this. For example, an endless amount of positive indicators amidst a sharp recovery from COVID-19 weakness has lifted people’s spirits. Also, after almost two years of restricted travelling and spending, investors have excess cash. A lot of money continues to pour into the market.

But even in this environment, a stable and predictable stock like Fortis is invaluable. Currently yielding 3.5%, Fortis offers investors a stable dividend underpinned by a stable business. It’s a highly regulated business (virtually 100% regulated) with $56 billion in assets and almost $10 billion in revenue. This kind of stability is priceless. In times when stock markets are trading near all-time highs and the risk of inflation is looming, it’s even more priceless.

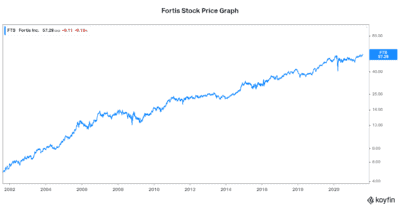

It is this stability that has provided Fortis with the ability to pay out a growing dividend for almost 50 years. And it’s this stability that makes Fortis the best stock to buy now. I mean, the market is arguably overvalued. Also, inflation may soon rear its ugly head. Fortis will be an anchor protecting us from all of this. Just take a look at the following 20-year graph of Fortis’s stock price; it shows great stability over time.

Fortis’s $19.5 billion capital investment plan will drive predictability and growth

The best companies always reinvest in their business to ensure longevity. They have a long-term plan, like Fortis. Let’s start with its five-year plan, which is to invest $19.5 billion back into the business. This plan aims to further position Fortis for energy delivery and clean energy infrastructure. It basically aims to fortify Fortis’s position in the future of energy: clean energy and natural gas.

It’s a low-risk plan that includes renewable generation such as wind, solar energy, and battery storage. It also includes liquefied natural gas and renewable gas infrastructure. The company expects that this will increase its rate base by 6% through 2025.

Plan for additional and sustainable growth for the long-term

Beyond the next five years, there are many more opportunities that Fortis is pursuing. Regional transmission planning is underway and Fortis has its eye on the prize. This planning has allowed many things to come to the forefront. For example, regulators are recognizing that big investments in transmission infrastructure are needed to ensure a low carbon future.

Fortis’s utilities will participate in this low-carbon future. For instance, renewable natural gas and hydrogen will certainly grow using Fortis’s infrastructure. And Fortis plans to invest what is needed to ensure that his happens. For its part, Fortis’s target is to reduce emissions by 75% by 2035. This will require a major overhaul of energy infrastructure. Fortis is claiming its spot.

The bottom line

Fortis is a dividend behemoth with 47 years of dividend growth under belt. It remains one of the best Canadian stocks to buy now. The company’s stability, predictability, and strong growth profile all contribute to its ”top Canadian stock” status. In fact, investors really can’t go wrong with Fortis. It’s a defensive stock that will provide dividends and steady growth for the long haul.