Constellation Software (TSX:CSU) and Thomson Reuters (TSX:TRI)(NYSE:TRI) are two top Canadian stocks to buy in September. Here’s why.

Constellation Software

Constellation Software has been a leader in the technology industry for 25 years. The diversified software company focuses on acquiring a wide range of profitable assets and their long-term retention. Constellation has acquired more than 100 companies over the years. Through these companies, Constellation has a network of 125,000 customers. This stock is one of the best tech stocks to buy and hold for the long term.

Chris Blumas, portfolio manager of Raymond James Investment Counsel, said about Constellation, “What they do is they buy other smaller software companies that aren’t growing, and then they integrate them within their platform, and they’ve done a tremendous job compounding capital over the very long term. They’re one of the best compounders in Canada, and it’s a name that I know and I really, really like.”

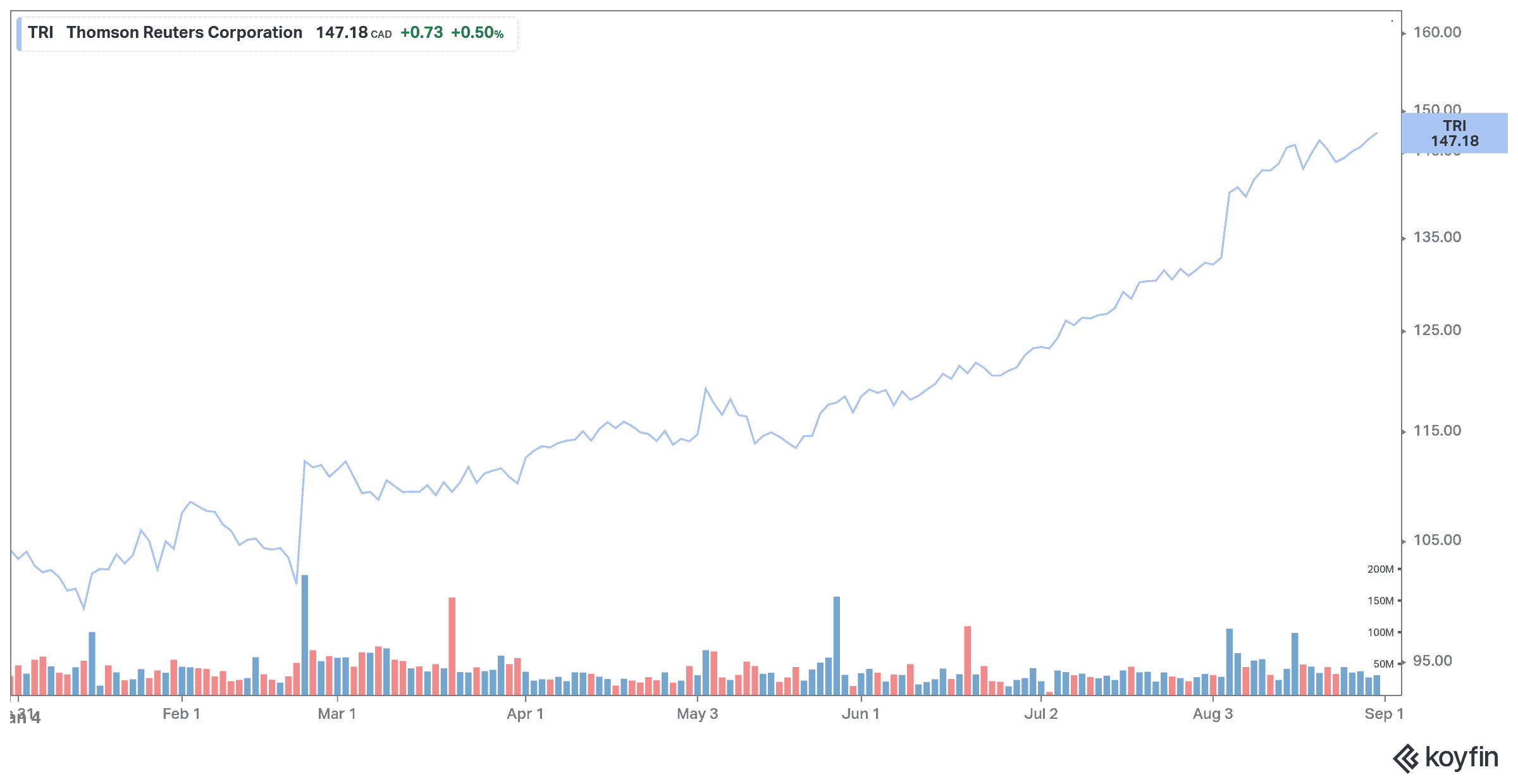

In the second quarter of 2021, Constellation’s overall revenue came in at $1,249 million — an increase of 35% year over year. Net income attributable to shareholders increased 7% to $88 million, or $4.16 per diluted share. Meanwhile, cash flow from operations fell 28% for the quarter.

On the M&A side, Constellation closed deals worth $292 million in the second quarter, with the company reporting $122 million in cumulative acquisitions since quarter-end.

The company’s balance sheet is strong, as it does not focus on a particular sub-sector of the software market. Its future growth looks promising. For fiscal 2021, Constellation is expected to report revenue growth of 28.2% and earnings-per-share growth of 25.3%.

Thomson Reuters

Thomson Reuters is a global leader in problem-solving and data collection. Its parent companies, Thomson and Reuters, were founded in 1934 and 1851, respectively. Thomson acquired Reuters in 2008, and the two companies merged into one.

Thomson Reuters is a media company, but the scope of its operations is much broader. With data becoming the most important commodity, Thomson Reuters is well positioned to capitalize on a digital future.

The company has increased its dividends for 26 consecutive years and its 10-year CAGR is 14.5%.

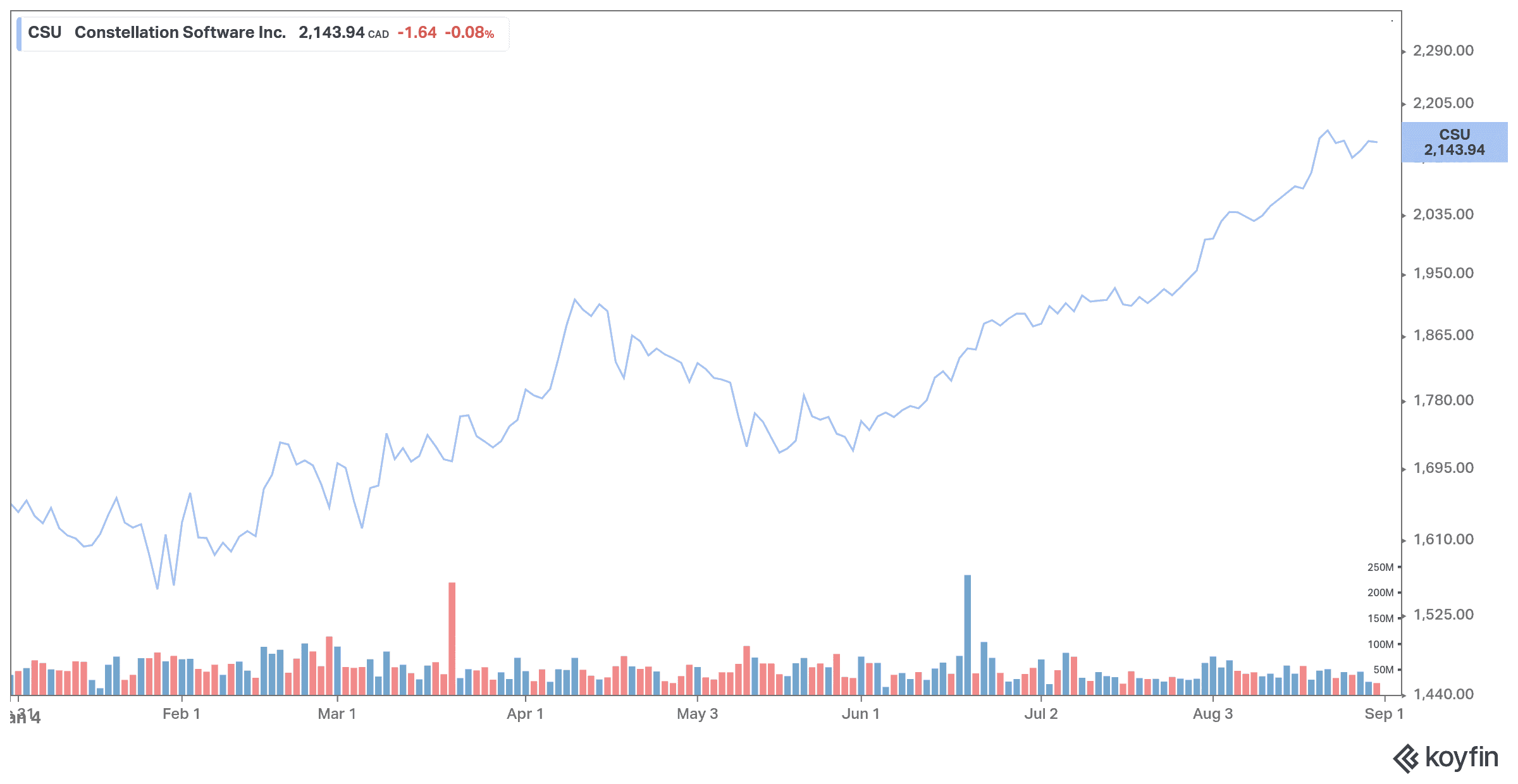

The company posted sharply higher net income for its second quarter and revised up its outlook for the year, thanks in part to the increase in the value of its investment in the London Stock Exchange.

Thomson Reuters reported earnings of US$1.07 billion, or US$2.15 per share, for its most recent quarter, compared to a profit of US$126 million, or US$0.25 per share, for the same period last year.

Excluding certain items, including the investment in the group that owns the London Stock Exchange, Thomson Reuters achieved adjusted earnings of US$240 million, or US$0.48 per share, compared to US$221 million, or US$0.44 per share, from the second quarter of 2020.

Revenue for the quarter ended June 30 increased 9% to US$1.53 billion from US$1.41 billion last year.

For fiscal 2021, Thomson Reuters is expected to report revenue growth of 4.9% and earnings-per-share growth of 3.2%.

Thomson Reuters announced in February a two-year transition that will see the content provider become more of a content technology company, requiring an investment of between US$500 million and US$600 million.