If you want a stress-free way to invest in Canadian stocks, you may want to consider the coffee-can approach. The idea comes from years ago, when you would buy shares in a business and actually receive a paper share certificate. You’d put your share certificates in a coffee can, forget about them, and just hold those stocks for years and years. Often, these shares were worth many multiples of what they were when initially bought.

Try the coffee-can portfolio

While the market is obsessed with trading and the day-to-day news, coffee-can investors don’t need to worry about short-term events. They just pick stocks in great businesses and hold them through the ups and downs of the markets. For many great investors, like Chuck Akre or Warren Buffett, this type of long-term strategy has resulted in long-term market-leading gains.

Warren Buffett has often remarked that his favourite holding period of a great business is a forever. Well, here are three Canadian stocks I plan to hold for forever. You might like them, too.

Brookfield Asset Management: A top Canadian financial stock

Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) is just an all-around great portfolio staple. Investors that own this stock get exposure to a broad array of alternative assets that you just can’t find anywhere else. I am talking about high-grade real estate, diverse infrastructure, green energy, cash-yielding private equity, distressed debt, and now insurance and impact investing.

Brookfield is an expert contrarian investor. It buys assets when the market is down, and profits when the markets are high. It has a global investment platform, so it can invest anywhere there is distress or capital dislocation. This company has the best and brightest managing these assets.

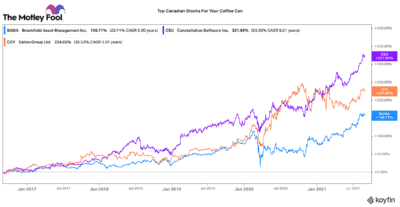

It has been growing assets under management by a five-year CAGR of 25%. It has grown distributable earnings per share even faster at 33%. While this Canadian stock does not pay a large dividend, it regularly spins off entities. For a solid portfolio anchor, this one stock to tuck away forever.

Constellation Software: A top capital allocator

Another Canadian buy-and-hold-forever stock is Constellation Software (TSX:CSU). For over 13 years, this stock has delivered an average annual return of 38%! Had you invested and held $10,000 into Constellation stock when it was first listed, it would be worth over $888,000 today!

The key to its success is its strategy to compound capital. It acquires small niche software businesses with solid competitive fundamentals. It lets those businesses operate autonomously, except it collects their cash flows and reinvests them into new business acquisitions.

The company is getting creative about unlocking shareholder value. It recently spun off its European operations through Topicus.com. To date, that has been a huge success. Likewise, it is looking for larger acquisition targets that could more substantially “move the needle.” All-in, you can’t go wrong buying this stock and tucking it away in the coffee can.

Calian Group: A top Canadian conglomerate stock

Another Canadian conglomerate-type stock that I have quickly started to admire is Calian Group (TSX:CGY). It operates four unique divisions in healthcare, education, IT/cybersecurity, and advanced technologies. These are largely catered to institutional clients like the Canadian military, NATO, the European Space Agency, and regional health authorities.

While these are separate divisions, the company is now at the scale where it is able to cross-sell services or package a variety of services for its clients. Consequently, its margin profile should continue to rise over the years to come. Likewise, the company has a cash-rich balance sheet that it can continue to deploy into accretive acquisitions.

Right now, Calian targets over 10% organic growth in each of its segments. This year it has massively exceeded that. I believe its growth is only accelerating at this point. For a Canadian stock with diverse exposure to crucial services and technological trends, this is one I plan to buy and hold for forever.