The pandemic has given a boost to e-commerce-related businesses and tech stocks around the world, including Lightspeed (TSX:LSPD)(NYSE:LSPD), which manages outlets for small- and medium-sized businesses in areas like retail and restaurants. The company’s platform is touted as an all-in-one solution for businesses making their digital transformations, which many businesses wanted to do with COVID-19 and its work-from-home environment.

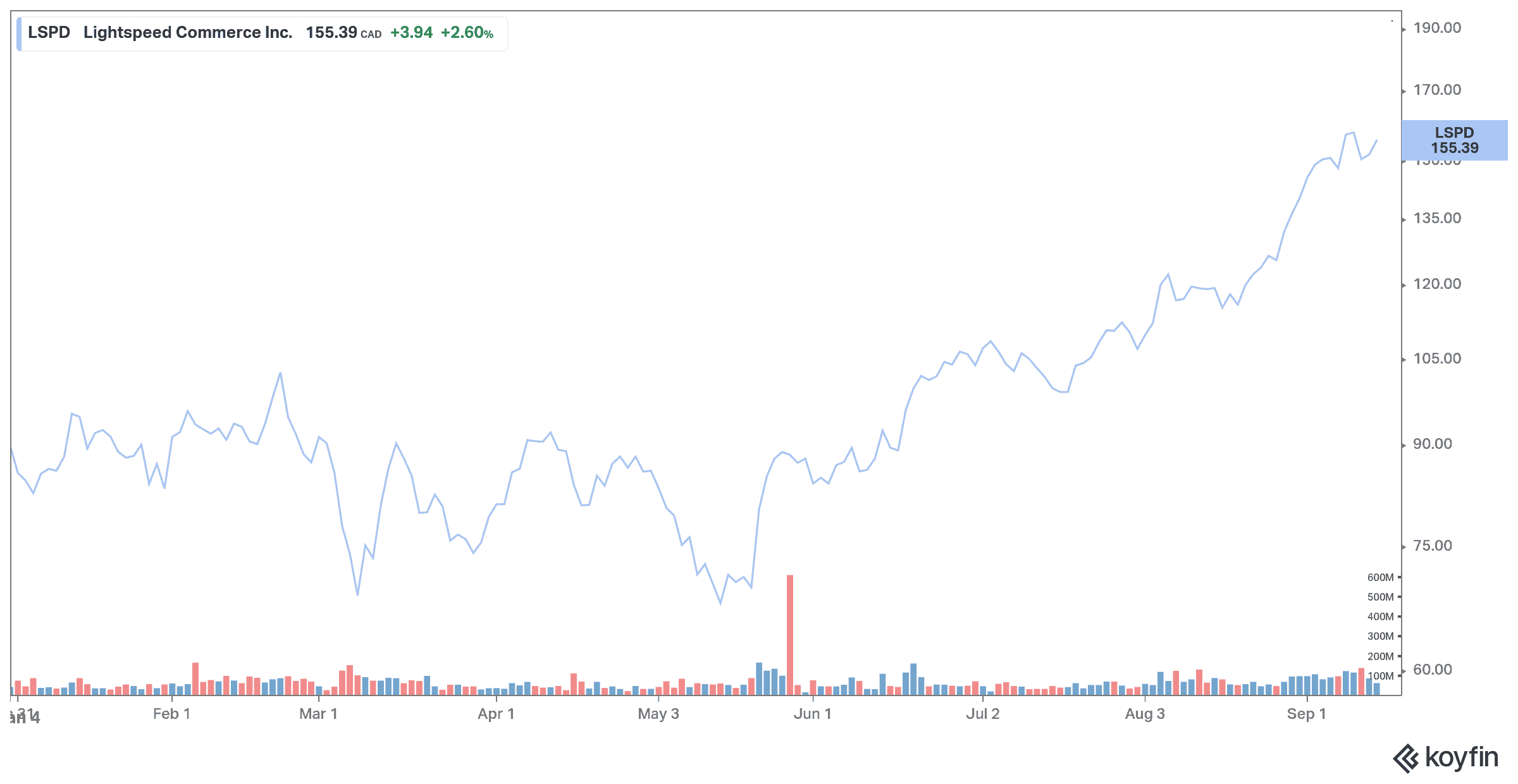

Lightspeed has been rallying recently, going from $85 at the start of the year and now trading around $155. Its year-to-date return of more than 80% is significantly higher than its fellow Canadian e-commerce company Shopify, whose shares are up more than 30% since the start of 2021.

The tech company is growing fast

What is behind the momentum? Very encouraging growth numbers are probably part of the equation, as Lightspeed continues to deliver on a quarterly basis while expanding its empire internationally through mergers and acquisitions.

Lightspeed has spent roughly $2.5 billion on five acquisitions since last fall and, in a single day in June, announced two takeovers with jaw-dropping prices.

The company paid $628 million for Ecwid Inc., an e-commerce platform in San Diego, Calif., which adds more than 130,000 paying customers to Lightspeed’s existing customer base.

At the same time, Lightspeed paid $535 million to purchase NuORDER Inc., a Los Angeles-based company whose approximately 100,000 retail customers use the company’s platform to automate their wholesale product orders.

Building on its “omnichannel” model of providing one of the broadest service lines in the e-commerce industry, Lightspeed purchased two U.S. restaurant management software companies last fall for a total of $1.1 billion. In addition, in March, it paid $440 million to acquire Vend Ltd., a cloud-based retail management software provider.

Last month, Lightspeed sourced for further acquisitions by issuing shares, offering about 8.86 million shares at US$93.00 per share for gross proceeds of $823.5 million. The company said it would use the money to strengthen its financial position and to help it with its growth strategies.

Montreal-based Lightspeed ended its 2021 fiscal year in March, posting revenue growth of 127% for the year, as the company’s recurring subscription and transaction revenue grew 137% to $75.3 million. Total revenue was $82.4 million

However, Lightspeed’s first quarter of 2022 showed even better results, with a whopping 220% year-over-year growth to $115.9 million, while recurring subscription revenue increased 115% to $49.9 million, and that transaction-based revenue grew a whopping 453 percent to $56.5 million.

But these good numbers have been associated with perhaps equally notable losses for Lightspeed. The first fiscal quarter of 2022 recorded a net loss of $49.3 million, more than double the loss of $ 20.1 million recorded a year earlier.

Those continued losses are a cause for concern. Investors who were lucky enough to buy Lightspeed earlier might consider taking a profit.

Lightspeed is overvalued

Lightspeed’s stock valuation has gotten very lofty, with a price-to-sales ratio over 70. This valuation isn’t supported by the company’s numbers, which increases the risk of a pullback.

Indeed, Lightspeed’s growth in revenue has been sensational, but the profits are nowhere in sight. The company is not expected to make a profit in the next two years, so that’s a concern. It might be wiser to take some profits now and wait for a better price before buying more shares.