Financial contagion — it’s a phrase that gives most of us feelings of anxiety. And for good reason, as it’s a concept that can wreak havoc. Even the most developed and stable markets are not immune. This is exactly what happened in 2008. This week, China is front and centre. Could this be the beginning of another global meltdown? What would this mean for natural gas stocks, such as Peyto Exploration and Development (TSX:PEY) and Cenovus Energy (TSX:CVE)(NYSE:CVE)?

China’s Evergrande faces risk of default

Evergrande is a real estate company in China. It has expanded in recent years. Today, the company is much more than just a real estate company. Its businesses range from wealth management to electric cars and so much more in between. The problem is that it’s extremely heavily indebted. The company owes $300 billion, with no clear vision of how interest payments will be made. In short, Evergrande is drowning in debt.

On Monday, global markets got a whiff of this. The reaction was swift and steep. Markets around the world tumbled. The global financial crisis of 2008 was not far from our minds. Could this be the trigger for another global meltdown? Troubles in China will inevitably make their way to us. This country is one of the world’s fastest-growing economies. North America has benefitted dramatically.

Can China’s troubles be overcome?

The fears are legitimate. What would happen if China’s overheated property market triggers a collapse elsewhere in the world? It would create a domino effect reminiscent of the 2008 financial crisis. Investors lost big, and markets were destabilized.

Evergrande has already been discounting its properties significantly in order to ensure that cash was coming in. Now, interest payments are coming due soon. This has triggered talk of insolvency, as the real estate developer’s debt has been downgraded by global credit agencies. A bailout might be coming, but this story highlights the risks that are out there. They’re risks that have been there for a while, but this brings it closer to home. Will investor sentiment shift accordingly?

Natural gas stocks can shake this off

Part of the bullish thesis on natural gas stocks has been Asian demand. North America is building out its export capability, and China is part of the reason why. The huge growth in demand that’s expected from China and other Asian countries is a long-term driver. If China gets into trouble, what does it mean for this?

Natural gas companies have been booming as of late. Recovering demand along with dwindling supply have propped up prices. Natural gas is increasingly viewed as the transition fuel of choice as we shift to clean energy. It allows us to make the shift to clean energy while ensuring we have enough energy to meet demand.

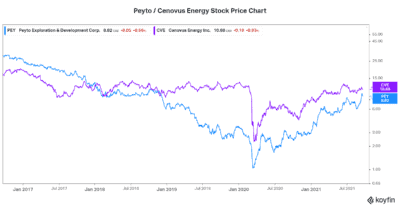

Companies like Peyto and Cenovus Energy are leaders in the industry. Low costs and operational savvy have made it this way. In short, Canada has many shipping and production advantages that make Canadian natural gas companies essential. Peyto stock has rallied significantly, as the value of its natural gas assets are finally coming to light. Cenovus stock has also been strong lately, as this company has become a global giant after its Husky Energy acquisition.

The Asia/China demand is a longer-term story that has been in the making for years. A short-term setback in China will not derail this long-term trend that simply has to happen.

Motley Fool: The bottom line

The financial difficulties of Evergrande in China have the potential to trigger a crisis. It’s a reflection of the bigger picture — huge debts and overvalued property markets in general. One might say that a day of reckoning is bound to happen. After the fall, however, we are still left with the fact that natural gas is essential. And Canadian natural gas companies, such as Peyto and Cenovus, are well positioned.