Every portfolio should contain some tech stocks. Indeed, tech stocks tend to beat the overall market over long periods of time. And the tech sector has continued to perform well during the pandemic.

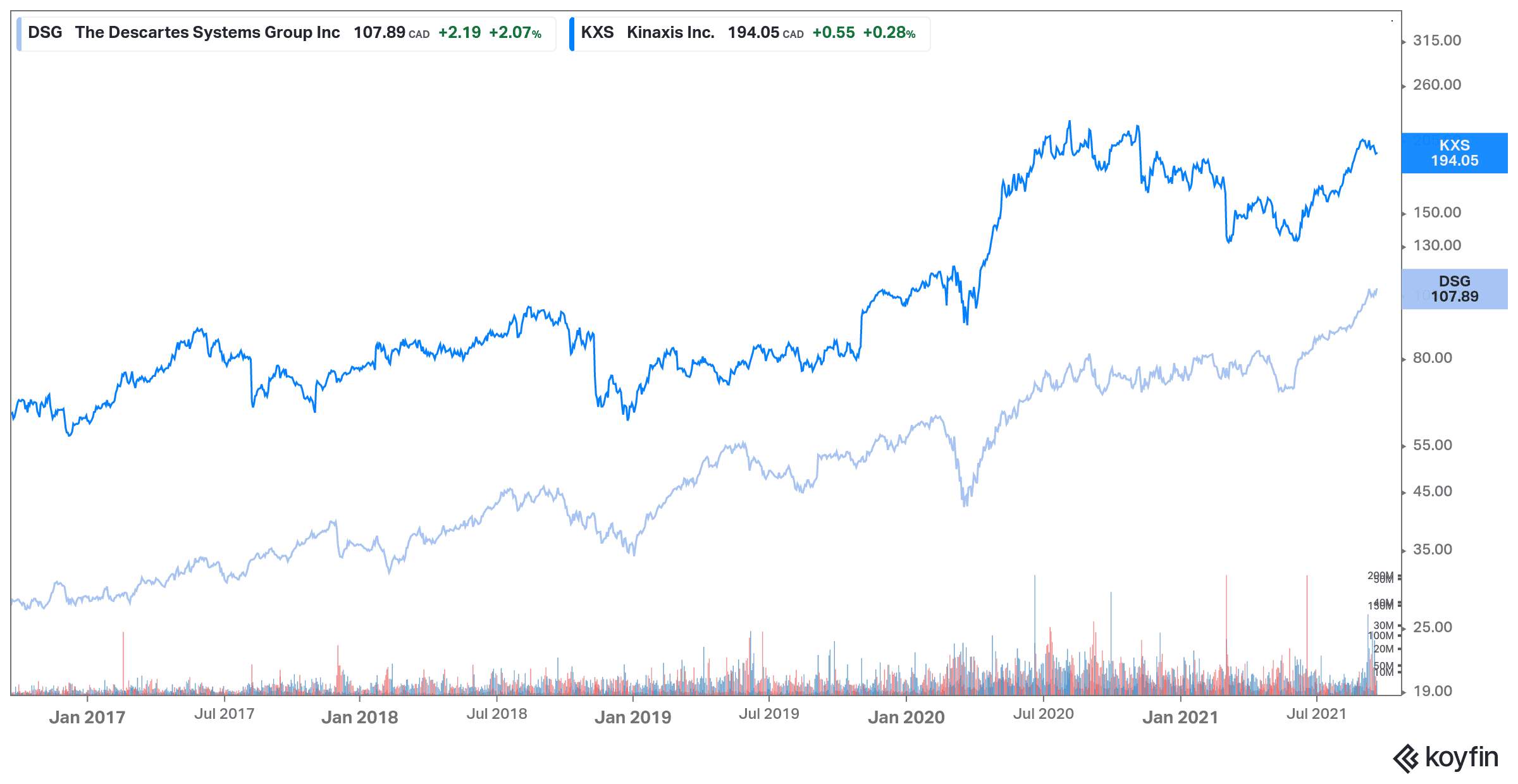

Among Canadian tech stocks, Descartes Systems (TSX:DSG)(NASDAQ:DSGX) and Kinaxis (TSX:KXS) are two of the best stocks you can buy now. Those stocks have gained more than 200% over the past five years and still have upside.

Descartes Systems

Descartes is a global supplier of federated networks and technological solutions for global logistics. It provides a full range of logistics and network solutions that connect business partners. Descartes has more than 20,000 customers in more than 160 countries.

The company operates the world’s largest multimodal and neutral logistics network with leading partners including Air Canada and UPS.

As governments around the world face the prospect of further shutdowns as the fourth wave persists, logistics are of the utmost importance. The company’s addressable market is estimated at over $4 trillion. It benefits from a complex and globalized supply chain.

Descartes is focused on revenue from higher-margin services and on transitioning existing customers from its legacy licence-based structure to its service-based structure.

In addition, the company is a serial acquirer. Since 2014, the company has completed 24 acquisitions for a total amount of approximately US$820 million.

In July, it acquired Green Mile, a cloud-based system for optimizing last-mile deliveries, particularly in the food and beverage industry. The deal, worth $30 million in cash, also includes a profit-sharing clause of up to $10 million if Green Mile meets specific revenue targets in the first two years following the acquisition. Green Mile mobile apps rely on machine learning to improve service and travel times.

Over the past five years, Descartes has grown profits at a double-digit annual rate. In the second quarter, revenues and adjusted EBITDA increased by 25% and 35% respectively. Adjusted EBITDA margins reached 44%. This tech stock has $128 million in net cash and is perfectly positioned for long-term compound growth.

Analysts expect the company to increase profits by about 19% per year over the next two years.

Kinaxis

Kinaxis’s gem is RapidResponse, a cloud-based subscription software for supply chain operations. Not surprisingly, the demand for reliable supply chain management software is at an all-time high.

Economic and border closures are causing problems, and platforms like RapidResponse are essential to minimize supply chain disruptions.

However, the pandemic has had a negative impact on historical customers. Some have been unable to renew contracts or postponed projects. The good news is that the company is gaining more business than it is losing, as the world continues to emerge from the pandemic.

One of the company’s previous drawbacks was the lack of diversification. But the company is currently working hard to reduce this.

In September, Kinaxis announced a partnership with Exelixis to advance its global supply chain capabilities for its cancer drug portfolio.

For the second quarter, total revenue was down 2% year over year to US$60 million. Meanwhile, adjusted EBITDA plunged 68% to US$7.14 million. However, it has seen strong customer growth, and its annual recurring revenue has jumped 24% compared to the same period in 2020.

Kinaxis said the long-term picture sees the company reach revenue of $242-$247 million for 2021, which would be up 10% from 2020, with an adjusted EBITDA margin between 11% and 14%.