There has been a tonne of opportunities to buy high-quality Canadian stocks this year, especially ones with the potential to recover as the economy reopens. But what about a stock like Alimentation Couche-Tard (TSX:ATD.B)?

Alimentation Couche-Tard is a massive Canadian stock with a market cap of more than $50 billion, making it one of the largest companies you can buy.

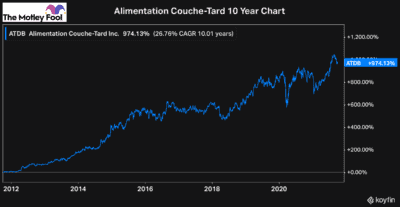

It’s also been one of the best and most consistent growth stocks in Canada over the past decade. In fact, Couche-Tard shareholders have seen a total return of 974% or a compounded annual growth rate upwards of 26.75% over the last 10 years.

This impressive and consistent growth shows why Alimentation Couche-Tard is such an excellent stock to own for the long term. So, with that in mind, you may be wondering if Couche-Tard offers potential today or if it’s one of the top reopening stocks to buy now.

Alimentation Couche-Tard stock

Alimentation Couche-Tard is a convenience store and gas station operator with locations worldwide. In fact, Couche-Tard owns over 14,000 stores in more than 26 different countries.

This not only gives the company excellent diversification, but it shows what a massive stock Alimentation Couche-Tard is and the deal flow that comes as a result.

So, it’s no surprise that much of the growth the company has seen in the past have been thanks to high-quality acquisitions. Although going forward, the company is a lot more focused on organic growth.

That doesn’t mean Alimentation Couche-Tard won’t pull the trigger and acquire attractive businesses if the price is right. However, the majority of its growth will come from organic growth, such as increasing customer loyalty, which is why Couche-Tard has been consolidating its brands around the world.

While the stock is still reporting sales that are lower than they were before the pandemic, it has recovered rapidly from the impacts its business faced last year.

In normal times, gas stations and convenience stores are highly defensive. Alimentation Couche-Tard stock was only impacted this badly because of the unprecedented nature of the pandemic and shutdowns that limited mobility for months at the start of last year.

Now that it’s recovered, though, it, unfortunately, doesn’t offer any real reopening potential. However, that doesn’t necessarily mean that Alimentation Couche-Tard is not worth an investment today.

Should you buy Couche-Tard today?

Looking at the chart of Alimentation Couche-Tard stock, it’s clear that the company has recovered all the value that it lost in the market pullback during the initial reaction to the pandemic. Furthermore, it’s even recovered from its selloff earlier this year.

However, just because it’s not necessarily a reopening stock doesn’t mean it’s not worth an investment for the long term. Couche-Tard has proven to be one of the best long-term growth stocks you can buy. And while it’s not necessarily super cheap today, it isn’t necessarily overly expensive either.

Currently, Couche-Tard has a forward price-to-earnings ratio of just 16 times. In addition, its enterprise value to EBITDA ratio is less than 10 times. That’s pretty fair, especially for a high-quality growth stock that has proven to grow rapidly and, more importantly, consistently.

So, if you like Alimentation Couche-Tard stock and you’re looking to own the company for the long term, you might want to buy it soon. There’s a strong possibility that going forward, this is as cheap as the stock will get.