After soaring at the end of August and beginning of September, uranium stocks started crashing on September 17. What are the causes of this selloff in uranium stocks? Although the International Atomic Energy Agency has significantly increased its long-term estimate of nuclear power, a general market downturn, a mixed outlook from Morgan Stanley, and news from China all weighed on uranium stocks. Cameco (TSX:CCO)(NYSE:CCJ), the world’s largest publicly traded uranium company, wasn’t spared. Should you buy this stock now? Let’s look at Cameco stock more closely to determine if it’s a good buy on the dip.

Cameco recently hit a 52-week high

Cameco produces and sells uranium. The company operates in two segments: uranium and fuel-related services. It also produces fuel bundles or reactor components for reactors. Cameco sells uranium and fuel services in the Americas, Europe, and Asia.

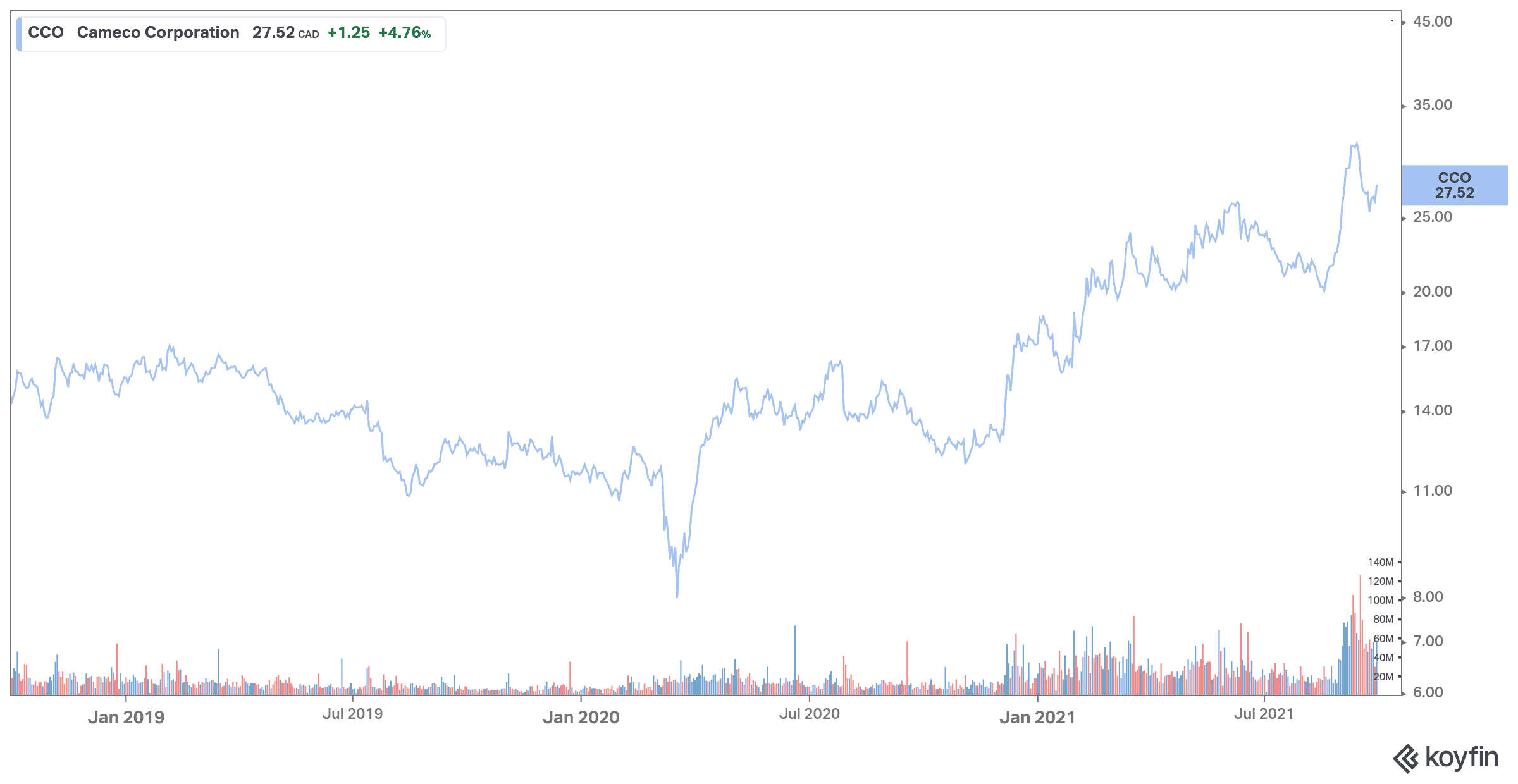

As the chart shows, Cameco shares hit bottom in March 2020 at $9.07 per share. The stock has hit higher lows and highs, with the most recent high on September 15 at $31.22. Shares are now trading around $26.

The price development since August 19 shows the high level of volatility of Cameco shares, which reflects the evolution of uranium prices since mid-August.

The chart shows the drop from a low of $20.04 on August 19 to a high of $31.22 less than a month later on September 15. Cameco shares exploded by 55.8%.

At the $27.52 level on September 30, the stock corrected 11.85%. But Cameco is still in an uptrend, supported by rising uranium prices.

What has caused the rally in uranium stocks?

Cameco stock and uranium price action have been drawing attention since mid-August, as uranium has joined many other commodities with substantial rallies in recent months.

Uranium stocks have exploded this year due to two factors. First, there was President Joe Biden’s announcement in January that billions would be invested in clean energy initiatives. This included the use of current clean energy assets, such as nuclear reactors. This pushed uranium prices up after a decade of virtually no growth, as it was linked to the Fukushima disaster in 2011, which caused uranium prices to plummet.

The recent rally in uranium stocks can also be due to WallStreetBets, a subreddit on the Reddit social media aggregate. Retail traders have bought out companies under a “pump-and-dump” scheme, trying to increase stocks before dumping stocks for the best price.

Cameco is one of the best uranium stocks

The demand for nuclear power is likely to increase, as the world moves away from fossil fuels. As the world leader in uranium production. Cameco stock is likely the top name among uranium stocks. Cameco has more upside potential as it has a strong asset base.

The company currently has the capacity to produce over 53 million pounds of uranium concentrates. In addition, with 455 million pounds of proven and probable mineral reserves, the company has long-term growth and cash flow visibility.

For the second quarter, the company reported revenue of $359 million and gross profit of $12 million. As operations ramp up, key margins are likely to improve. In the uranium segment, the company expects annual sales of $995 million. Cameco reported cash and cash equivalents of $1.2 billion in the second quarter. The company also has an unused credit facility of $1 billion. Therefore, there is great financial flexibility to pursue aggressive growth in exploration and production.

Production for the year from owned and operated properties is expected to reach six million pounds. Given the company’s licensed production capacity, there are many opportunities for scaling up operations if uranium continues to trend upward.