It has been a red fall, both figuratively and literally. Since the start of September, Canadian stocks on the S&P/TSX Composite Index have declined by nearly 4%. While this may be a concern, it is also a natural part of markets. They go up and down. Fortunately for the past hundred years, they go up far more often than they decline.

One area that looks particularly attractive is in smaller-cap stocks. Often these stocks are forgotten because they are smaller and lesser-known and are at times less liquid. Similarly, major institutions avoid small caps because they can’t amass positions of scale without taking on controlling ownership stakes in the business.

This is where retail investors actually have a significant advantage. They can snap up little-known growth stocks before the major players. Consequently, retail investors have an early advantage over the broader market.

Sangoma Technologies: An up-and-coming Canadian tech stock

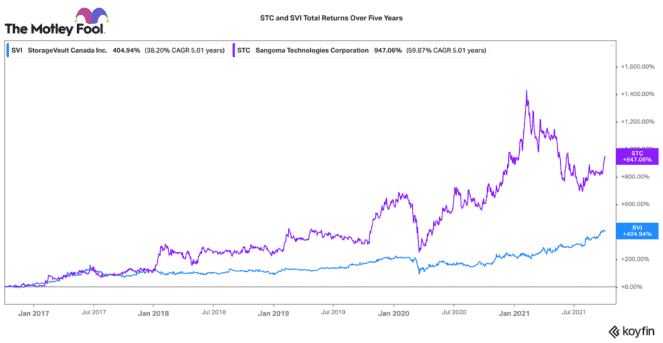

Sangoma Technologies (TSXV:STC) is a perfect example of this. After a choppy year, this Canadian stock is starting to recover. Today, it trades for $3.60 per share with a market cap of only $476 million. Sangoma just released very solid fourth quarter and year-end 2021 results. Revenues and adjusted EBITDA improved over 2020 by 27% and 50%, respectively.

The company has been integrating its large acquisition of American peer, Star2Star. So far things are looking very good. Gross profit margins in the quarter improved to +70% and recurring revenues increased over the 70% range. The company is now equipped to be a complete one-stop shop for the organization’s unified and cloud-based communications needs.

A number of catalysts for this Canadian stock include a potential U.S. listing, rising profitability (due to large cloud-based recurring sales), and a broader global sales pipeline for the combined entity. The company issued guidance where it projects revenues and adjusted EBITDA could rise respectively by as much as 62% and 75% in 2022!

Despite soaring 15% over the past month, this Canadian stock only trades with an enterprise value-to-EBITDA ratio of 33 times. On a price-to-growth basis that is very attractive, especially considering that most U.S. peers (Twilio, RingCentral, etc.) trade at more than three times that price.

StorageVault: A high-growth Canadian real estate stock

When inflation is hot and prices are rising, real estate is traditionally a good asset to hold. One Canadian stock that looks very attractive in this environment is StorageVault (TSXV:SVI). With a market cap of $2.26 billion, it is quite a bit larger than Sangoma. However, the stock trades for just $6.15 per share today.

This is an interesting real estate stock because it does not have a traditional real estate investment trust (REIT) structure. Consequently, it is not required to distribute the majority of its earnings. Rather, it can keep the cash flow it yields and re-invest by building new storage properties or by acquiring smaller competitors.

Over the past 10 years, StorageVault has done a great job consolidating a traditionally mom-and-pop self-storage industry in Canada. It has resulted in an over 3,000% return in the past 10 years. Year to date, this Canadian stock is up 50%. Consequently, SVI stock is not cheap. It has a price-to-adjusted funds from operation (P/AFFO) ratio of 36 times. I might wait for some market volatility (like we have been seeing) to buy into this Canadian stock.

However, over the past five years, this company has been growing revenues and AFFO per share by a compound annual growth rate of 48% and 39%, respectively. Given that StorageVault has the scale, platform, and industry tailwinds to keep growing, this stock should continue to outperform the broader real estate market for years to come.