Cryptocurrencies have taken the market by storm over the last year. After years of different rallies, all that resulted in a significant selloff, many believed there was no real potential with crypto, and the rallies were a result of a bubble.

However, after the sustained rally that started last year and continues to gain steam, many are changing their opinion on the sector.

With all the recent innovation going on in the space, these have been some of the top assets and crypto stocks have become some of the top growth stocks to own over the past year. And going forward, they continue to offer some of the best potential for long-term growth.

The industry’s popularity is growing as fast as ever. With so many investors buying cryptos now, should all Canadians have exposure?

Cryptocurrencies: A new revolution

Over the last year, we have seen a significant change in the acceptance of Bitcoin and other cryptocurrencies as more than just a speculative investment.

Many prominent billionaires and investors have gained exposure. Major companies have gained exposure. And on top of the fact that the industry’s popularity has grown, so too has the innovation among developers.

The potential for growth and new ideas from decentralized finance (DeFi), for example, is just one of many promising areas of the cryptocurrency industry.

Furthermore, we have seen how much NFTs have grown in popularity, and so far, the industry has only just scratched the surface.

With all the opportunities for growth in the space, there are plenty of investments that you can buy and hold for years. But does that necessarily mean that all Canadians have exposure?

In my opinion, most investors should have at least little exposure to crypto. Even as little as 1% of your portfolio can’t hurt.

If you are a younger investor with a longer timeline and you aren’t as risk averse, you should certainly consider gaining some exposure. As you get closer to retirement, it may not make sense. But most Canadians should consider at least a small portion of their portfolio in cryptocurrencies.

And lucky for investors, by now, there are several different stocks you can buy with varying levels of risk.

A high- and low-risk crypto stock to buy today

Gaining exposure to cryptocurrencies by buying crypto stocks is a massive advantage that investors have. Buying cryptocurrencies yourself can be highly complicated, time-consuming, and quite expensive.

So, it’s crucial to take advantage of the tools at your disposal. One of the most popular investments you may want to consider is CI Galaxy Bitcoin ETF (TSX:BTCX.B).

CI Galaxy Bitcoin ETF is one of the best and easiest ways to gain exposure to the most popular cryptocurrency: Bitcoin. The fund buys and holds and stores the Bitcoin for you, in what’s called “cold” storage. This means that your Bitcoin is secure in an offline wallet away from any potential hackers.

Having a fund do this for you is a significant advantage. Like I said before, not only can the steps be complicated when buying and transferring Bitcoin, with the potential for you to lose all your money if you make one mistake. But it’s also quite costly, too.

By investing in the CI Galaxy Bitcoin Fund, though, you don’t have to worry about any of that, plus it has the lowest management fee of any Bitcoin ETF in the world.

If you’re an investor with even more appetite for growth, though, you may want to consider a cryptocurrency miner like Hut 8 Mining (TSX:HUT)(NASDAQ:HUT).

Hut 8 is one of the most exciting crypto miners there is. The stock has some of the most competitive mining operations of any publicly traded stock and is the largest holder of self-mined Bitcoin.

One of the reasons it’s so attractive for growth investors is because it’s leveraged to the price of Bitcoin.

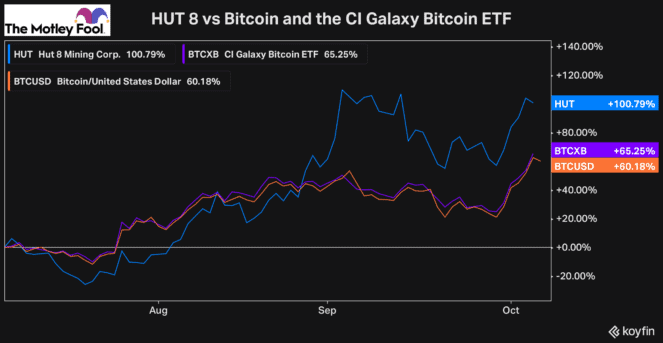

This chart perfectly demonstrates how much faster it can rally than Bitcoin or a Bitcoin ETF, which have almost identical performances.

If you’re bullish on Bitcoin long term and can stomach the volatility, you might want to consider a crypto mining stock.

No matter what, though, if you have a long enough investment horizon, I’d strongly recommend cryptocurrencies as a long-term investment.