It’s not often that analysts have a unanimous buy rating on a stock and a consensus target price that’s more than 80% above its current market value. So, when you find opportunities like this, there’s a strong possibility the stock could be a no-brainer buy.

Analysts aren’t always right. Sometimes they overestimate a stock’s ability to grow. Other times, they underestimate companies’ potential. So, while watching analysts’ estimates is a great way to identify high-potential opportunities, it’s crucial we do the research ourselves to confirm if the stock is worth an investment.

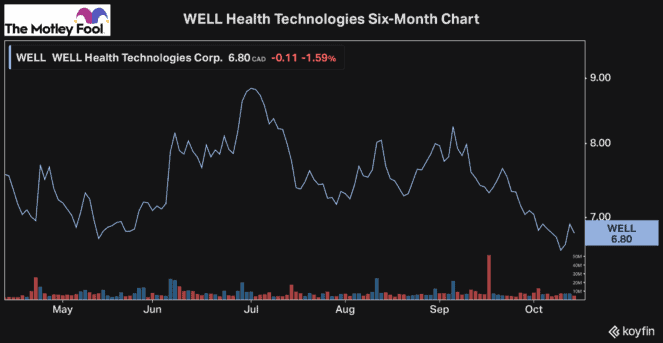

In the case of WELL Health Technologies (TSX:WELL), though, I think analysts are spot on with a unanimous buy rating and an average target price of roughly $12.50. One analyst even thinks the stock could be worth as much as $14.85 — a 118% premium to Friday’s closing price of $6.80.

Seizing a growing opportunity

WELL Health Technologies has been a rapidly growing healthcare tech stock since even before the pandemic hit. However, there is no doubt that the pandemic has been a major tailwind for the company. Going forward, though, WELL is showing that its business has the potential to continue growing even after the pandemic is well in the rearview.

The company sensed a significant revolution was coming in the healthcare sector and has been seizing the opportunity. In a world where consumers are increasingly demanding convenience, WELL has been taking advantage, buying up a tonne of high-quality healthcare stocks to create a diverse portfolio of rapidly growing companies.

From digital health apps that are disrupting the sector to telehealth businesses that are safer in the pandemic and more convenient in general, WELL has built an incredible portfolio of companies with numerous attractive synergies.

The financials show the stock is a no-brainer buy

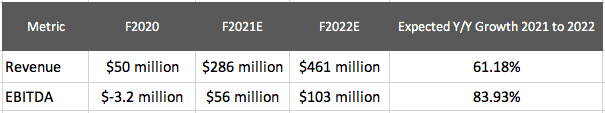

What’s most attractive about WELL Health is that each business it acquires has a tonne of potential in its own right. So, the company is experiencing rapid growth from all segments of its business. This not only shows that WELL’s strategy is paying off, but it also shows all the significant potential for growth, as the healthcare industry continues to go through this major revolution.

EBITDA = Earnings before interest, taxes, depreciation, and amortization.

The company isn’t just rapidly growing its revenue, though. Its EBITDA has been increasing rapidly, too, as WELL has seen its margins expand quickly. The company already expects that, exiting F2021 this year, it will have an EBITDA margin of roughly 25%.

And while its revenue for 2021 is expected to be $286 million, WELL has already announced it expects its run rate will be at least $400 million by the end of the year and could even be as high as $500 million if it makes another acquisition in the fourth quarter.

So, these revenue estimates could soon rise again should WELL make more attractive acquisitions in the short term.

WELL Health stock offers tonnes of value

One of the best ways to calculate a company’s value is by considering its enterprise value (EV). WELL currently has an EV of roughly $1.6 billion, giving it a forward EV/revenue ratio of just 3.5 times.

And while companies in its industry trade for various valuations, all based on what the market thinks their growth potential is, there is no doubting that 3.5 times next year’s sales is one of the cheapest valuations in the industry and well below the average.

So, when you consider how much potential WELL stock has and how cheap it’s priced today, the stock sure looks like a no-brainer buy. Should the stock rally to what analysts expect it should be worth to roughly $12.50, the company would then have an EV/revenue ratio of approximately 5.9 times, which is still slightly undervalued, in my opinion, but much more in line with its potential.

And as its revenues continue to increase over time, and the company realizes more synergies, its margins will only continue to improve, leading to more rapid growth in its profitability. So, if you’re looking for a high-quality stock to buy today, WELL Health seems like a no-brainer.