Well, well, well.

It looks like BlackBerry (TSX:BB)(NYSE:BB) is rallying again.

Just one short week after I chronicled the stock’s decline, it’s climbing once more.

On Thursday, BB stock rallied a whopping 14% in a single trading day. It was the stock’s biggest one-day gain in months but wasn’t enough to take it back to its highs for the year. Earlier this year, BB went on an epic 280% rally, climbing from $8.50 to $32 in under a month. The gains were widely thought to have come from Reddit’s WallStreetBets (WSB) community, which was pumping the stock at the time.

Yesterday’s rally was BB’s biggest since the January pump and–surprise, surprise–BlackBerry was WSB’s most mentioned stock when it happened.

Another meme stock rally

It seems clear what’s going on here:

BB is rallying because WSB is pumping it again.

Since the initial meme stock rally of January and February, we have seen WSB cycle through various different stocks. Generally, they move together as a group, but sometimes one of the less-known meme stocks will grab attention and break out. Over the last few months, BB hasn’t been as correlated with the bigger meme stocks AMC Entertainment Holdings and Gamestop as it was before. In fact, Yesterday, when BB was rallying, AMC saw a steep selloff and GME barely budged.

Correlation evaporates

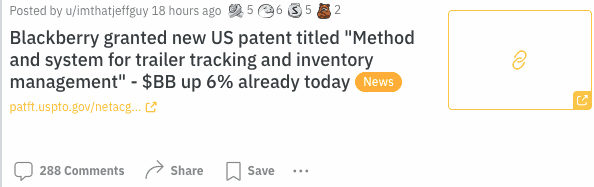

It’s not entirely clear why this lack of correlation has emerged. It is known that the rally in BB shares yesterday had at least some connection to fundamentals. Currently, the most viewed BB post on WSB touts the company’s new patent, perhaps this story helped kick off the rally. The post was made when BB was up just 6%, and it has accumulated 2,600 net upvotes, so this theory is plausible.

Poor fundamentals

I wouldn’t want to suggest that BB’s recent price moves have much to do with fundamentals, though. BlackBerry’s fundamentals are pretty bad. For the trailing 12-month period, it has delivered:

- -23% growth in revenue.

- -42% growth in EBITDA.

- Negative earnings.

On top of that, there was some genuinely bad news when the company lost its longstanding contract with Ford. Broadly, the news from BlackBerry over the last 12 months has been bad, but it does look like one isolated piece of good news may have gotten WSB interested in it again.

An interesting aspect of this is what it means for AMC and GME shareholders.

Yesterday’s BB rally coincided with AMC plunging and GME going basically nowhere. Is it possible that BB took those stocks’ thunder, as it were? That could be the case. WallStreetBets has a massive number of users (approximately 11 million), but its funds are unlimited. If any WSB user is fully invested in any random meme stock and wants to get in on BB, they’ll have to sell some of the former to buy the latter.

This underscores the importance of solidarity in these meme stock communities. Short squeeze notwithstanding, meme stock influencers are going to have to convince their followers to stick to one or two stocks to keep them rising. Otherwise, there’s always the possibility of a little-known stock like BB coming out of nowhere and stealing the show.