Over the last year and a half, Canadian investors have seen just how much potential there is when you buy stocks that are severely undervalued. Since the bottom of the coronavirus market pullback last March, the TSX Composite Index has already gained an impressive 87% or a compound annual growth rate (CAGR) of 49%.

And that’s the broader market as a whole. Some of the top Canadian stocks have considerably outperformed the market, which is why these market pullbacks are such an excellent opportunity to buy stocks.

And while almost every stock on the market has recovered today, there are still some situations that offer exciting opportunities. One industry that provides the most potential to find a high-quality Canadian stock to buy that’s undervalued is the gold sector.

Gold stocks are cheap

Over the last year, gold stocks have been selling off as gold prices have fallen. However, many gold stocks have fallen quite substantially, while gold prices are only down slightly. This is creating a tonne of opportunities to buy these Canadian stocks while they are undervalued.

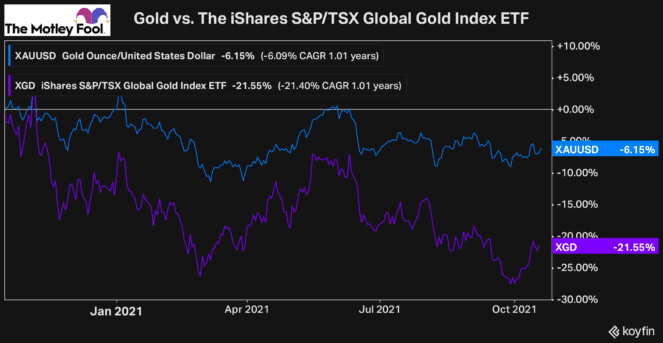

As you can see, the iShares S&P/TSX Global Gold Index ETF, which consists of a basket of high-quality gold stocks, is down by more than 20%, compared to gold prices, which are down just 6%.

This clearly shows that gold stocks have been out of favour and are trading undervalued. And to be fair, it’s understandable. The economy has been recovering rapidly, and there have been tonnes of high-quality opportunities for investors. So with stocks offering so much potential, it makes sense investors didn’t want cash tied up in gold.

However, just because it’s understandable that gold stocks have fallen out of favour doesn’t mean they will stay this cheap forever. And there is considerable potential for these stocks to rally again soon, especially with inflation increasing considerably. So many Canadian stocks in the gold sector are worth a buy today while they are still undervalued. But one stock offers far more value than all the others.

The top Canadian stock to buy undervalued today

While there are many opportunities to buy Canadian gold stocks while they are undervalued, I think the best opportunity is B2Gold (TSX:BTO)(NYSEMKT:BTG). B2Gold is a high-quality gold miner that earns excellent cash flow and has almost no debt.

Although gold prices have been falling over the last year, they are still significantly higher than they were a couple of years ago. And at these levels, B2Gold can earn impressive levels of cash flow. Over the last four quarters, the company has been highly profitable, earning a net margin of more than 30%, showing just how strong its operations are at these prices.

And yesterday, the company reported its production levels for the third quarter and updated its guidance. This included increasing its consolidated estimates for the full year. B2Gold now expects to produce between 965,000 and 995,000 ounces in 2021. That’s up quite significantly from its previous guidance of 920,000-970,000 this year.

The market understandably reacted positively to the news, as B2Gold continues to show its one of the top stocks in the sector. Plus, apart from the fact that it’s so cheap, it offers an incredible dividend that you wouldn’t normally expect from a gold miner.

Currently, its dividend yields 4%, and the stock trades at a forward price to earnings ratio of just 7.2 times. So if you’re looking for a high-quality Canadian stock to buy undervalued, B2Gold is one of the best opportunities investors have today.