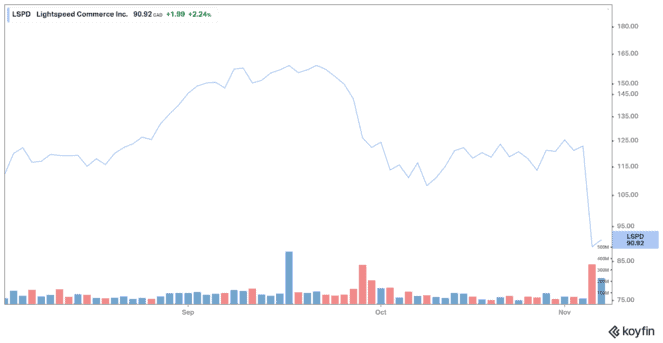

Shares of Lightspeed (TSX:LSPD)(NYSE:LSPD) plunged 25.6% last week. This drop comes on top of the nearly 20% drop the tech stock experienced since the release of a short-seller’s report in late September. The fall in price is not surprising, given the doubts raised by the publication of the Spruce Point Capital report.

The Montreal-based cloud-based retailer was severely punished by investors on Thursday after posting its most recent quarterly performance. Shares crashed 30% during that day. The decline in the stock price could be explained by the fact that results did not exceed expectations by a sufficiently large margin or by the fact that management did not raise its forecast by a sufficiently significant margin. In addition, Lightspeed reported a wider loss in the second quarter than a year ago, despite a strong increase in revenues. Lightspeed’s results are in part due to the pandemic and supply issues.

Revenue and earnings

Lightspeed’s total revenue almost tripled in the three months ended September 30, reaching US$133.2 million versus US$45.5 million in the prior-year quarter.

Strong organic growth and the recent acquisitions of NuORDER, Vend, Upserve, and ShopKeep, which added US$62.5 million in revenue, drove revenue growth. Subscription revenue came in at US$59.4 million, up 132%, while transaction-based revenue was US$65 million, up 320%. GTV (gross transaction volume) increased 123% year over year to US$18.8 billion.

Net loss was US$59.1 million in Q2 2022, wider than the net loss of US$19.5 million reported in Q2 2021. After adjusting for certain items such as acquisition costs and stock-based compensation, the adjusted loss amounted to US$11.1 million, or US$0.08 per share, in the quarter, up from an adjusted net loss of US$4.6 million, or US$0.05 per share, a year earlier.

Analysts were expecting revenue of US$123 million and a loss of US$0.09 per share.

Lightspeed raised FY2022 outlook

Commenting on the July, August, and September results released Thursday, Dax Dasilva noted that several key performance indicators have just reached historic levels at Lightspeed.

Lightspeed chief financial and operations officer Brandon Nussey said, “Lightspeed achieved solid results this quarter on the back of strong GTV growth, an increased Payments Penetration Rate and growing software adoption. While the rate of global economic recovery is expected to be uneven, overall our core business drivers remain strong.”

For the full year, Lightspeed’s revenue is expected to be in the range of US$520 million to US$535 million, rather than the US$510 million to US$530 million previously forecasted. Its losses are expected to be larger, between US$40 million and US$45 million, whereas they were previously estimated at US$35 million.

However, the company wanted to be reassuring by indicating that the pace and timing of the onboarding of new customers, the increase in its market share, and more normal supply and macroeconomic conditions should allow it to rebound in the first quarter of fiscal year 2023.

Overall, despite some challenges associated with the business transition that are expected to fade in the next quarter or two, the foundations on which Lightspeed is built appear still strong. Investors who are able to ignore the aftermath of the Spruce Point report could make significant gains.