Motley Fool readers, a word of caution: inflation is about to rear its ugly head. I mean really. We’ve already seen rising inflation, but what I’m talking about is big. Inflation eats away at our wealth and buying power. With inflation, gold prices rise and gold stocks like Barrick Gold (TSX:ABX)(NYSE:GOLD) and Agnico Eagle Mines (TSX:AEM)(NYSE:AEM) protect us from this destruction of wealth.

Please read on for two gold stocks to buy now to combat the coming storm.

Inflation is rising: Buy gold stocks for protection

Energy prices are skyrocketing. It’s increasingly expensive to source materials. Supply chains have become problematic. These factors are all pushing inflation higher on top of an already inflationary situation. I mean, the record amount of stimulus that has been pumped into economies due to the pandemic has been huge. Inflation is inevitable. So I‘m looking for an inflation hedge to protect my portfolio. Gold stocks will do the trick.

The correlation between inflation and gold stocks is quite clear; when inflation rises, gold prices rise. And when gold prices rise, gold stocks rise. This has been a tried and tested relationship that we could always count on. Simply put, gold is the ultimate store of value. Therefore, it protects against inflation’s wealth destruction. It also protects against fear — a safe haven that investors flock to in uncertain times.

In September, the inflation rate was clocked in at 4.4%, the highest in nearly 20 years. With this, we can expect rising interest rates and falling stock prices. Gold stocks can help shelter you from this. In fact, the price of gold is up more than 50% in the last three years.

Kirkland Lake acquisition will drive value

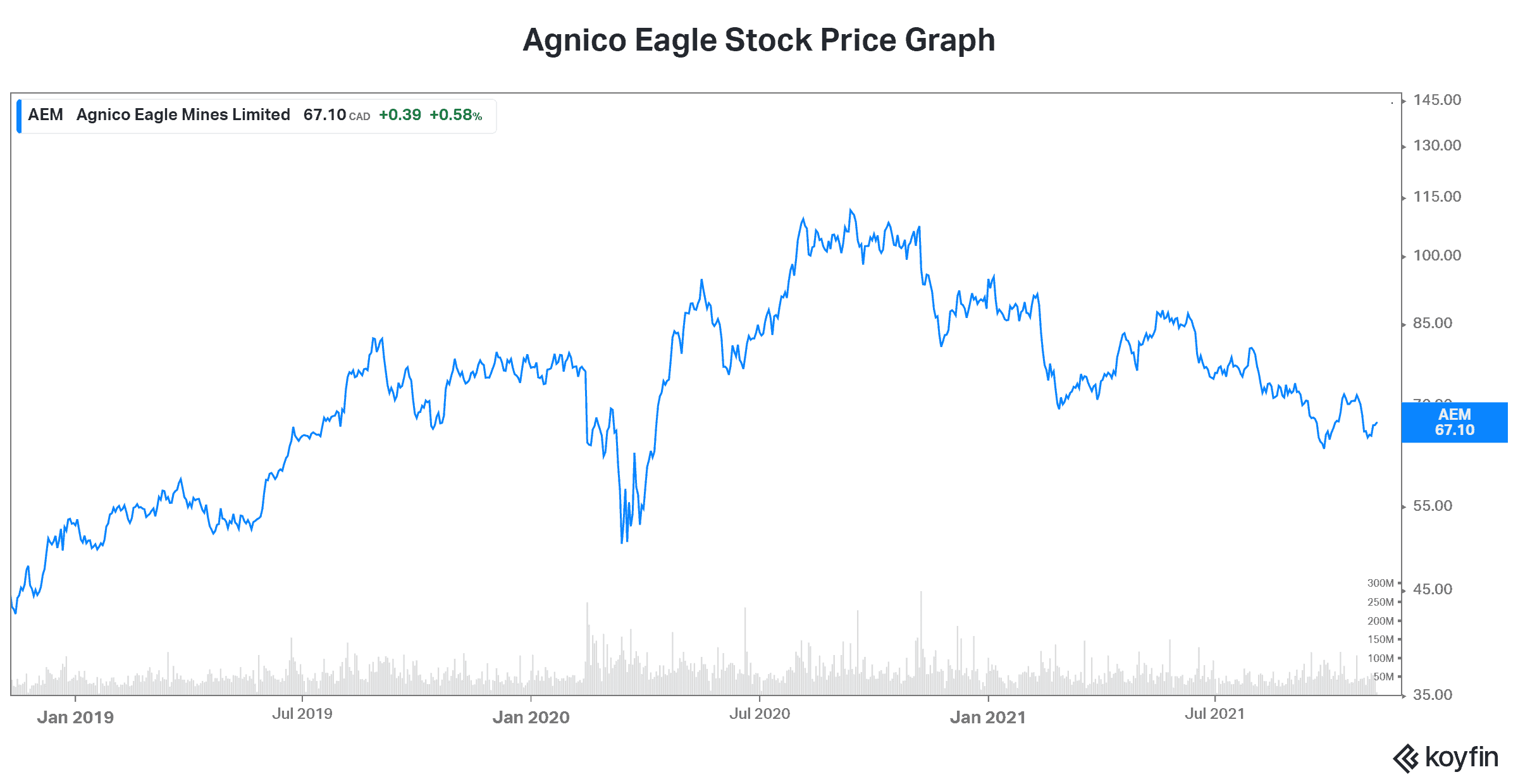

Agnico Eagle is a top-tier Canadian gold stock. The company has established a competitive advantage in low political risk, pro-mining jurisdictions, such as Canada and Europe. Operationally, Agnico has been a leader for many years now. Low costs, soaring cash flows, and strong production has kept it ahead of the game. But Agnico’s stock price is a different story. It hasn’t looked as good. I mean, the economy has been great and inflation hasn’t been an issue. Therefore, investors have been buying growth stocks.

Agnico recently acquired Kirkland Lake Gold, creating a best-in-class Canadian gold company. The synergies from this combination will total approximately $2 billion. Looking ahead, we can count on good things from Agnico. Record production momentum is matched only by record cost control. Agnico has paid out a dividend since 1983. Simply put, it’s a defensive gold stock with some real economic drivers.

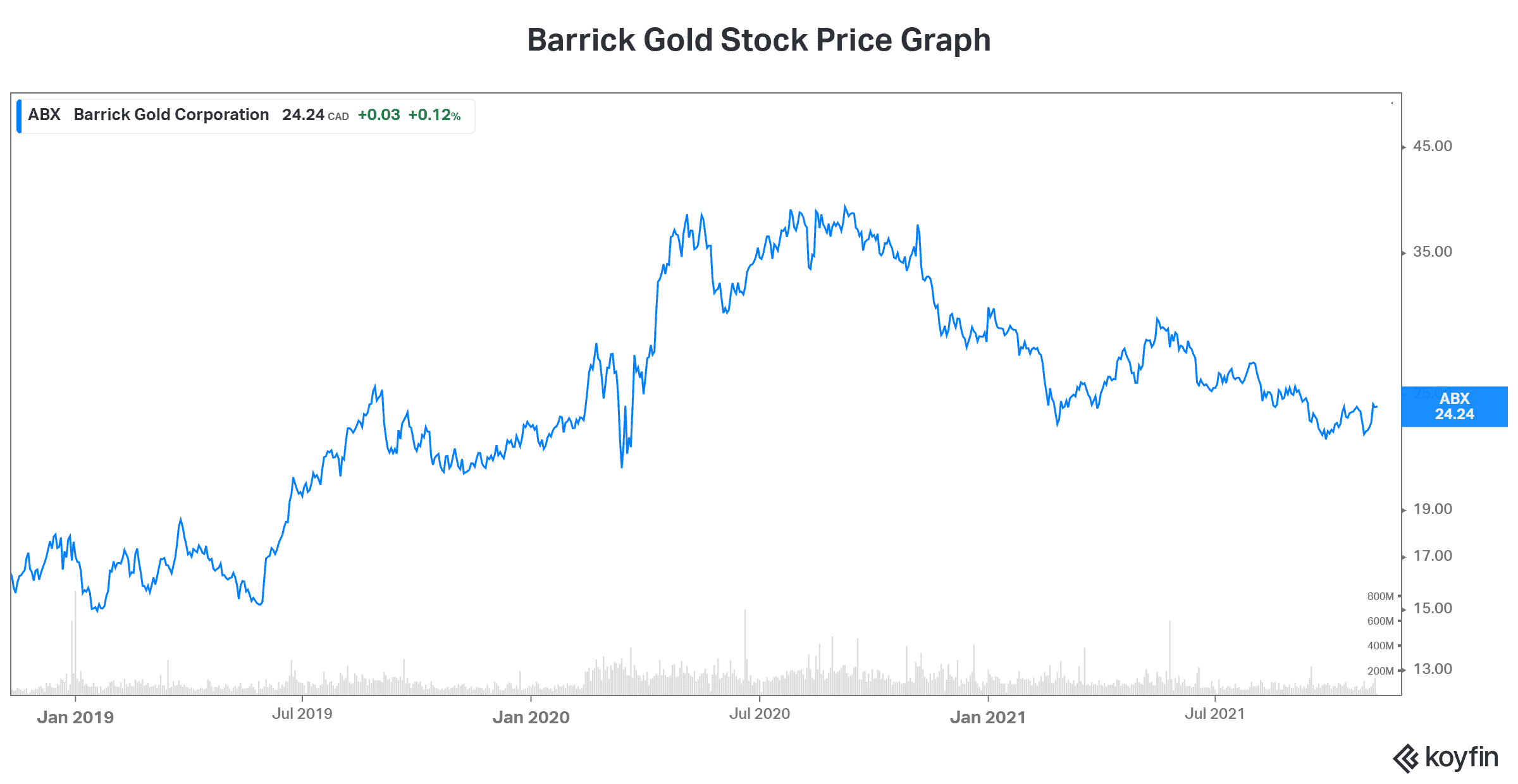

Barrick Gold: The ultimate gold stock

Barrick Gold is a little bit of a different beast than Agnico. First of all, it’s much bigger, at $43 billion. Also, its assets are spread across the world, including some politically risky and unsafe areas. Barrick Gold is really the gold stock that’s the most well-known amongst investors. Therefore, it’s the one investors flock to for gold exposure. This demand always drives Barrick Gold stock comparatively higher in times of rising gold prices.

The bottom line

In summary, gold stocks like Barrick Gold have certainly underperformed the market in the last many years. But I think that going forward, things will be different. Barrick, along with other gold stocks, is generating tons of cash flow. As gold prices strengthen, this will only accelerate.

I believe that gold stocks like Barrick Gold and Agnico Eagle will be the next to break out. Rising inflation, rising gold prices, and investors’ search for a safe haven will drive their outperformance.