Cineplex (TSX:CGX) stock has been a major headache and stressor for many in the last two years. As Canada’s leader in movie exhibition and entertainment venues, lockdowns certainly hit it hard. At one point in the heart of the pandemic, its very survival was even in question.

Today, the pandemic is nearing its end. And this is very obvious in the bullish Q3 results coming out of Cineplex. Here’s why you should buy this dirt-cheap stock today.

Cineplex stock is still grossly undervalued

While the landscape has changed, the fact remains that Cineplex is Canada’s leading entertainment company. It has an increasingly diversified business. And it benefits from one of the best management teams out there.

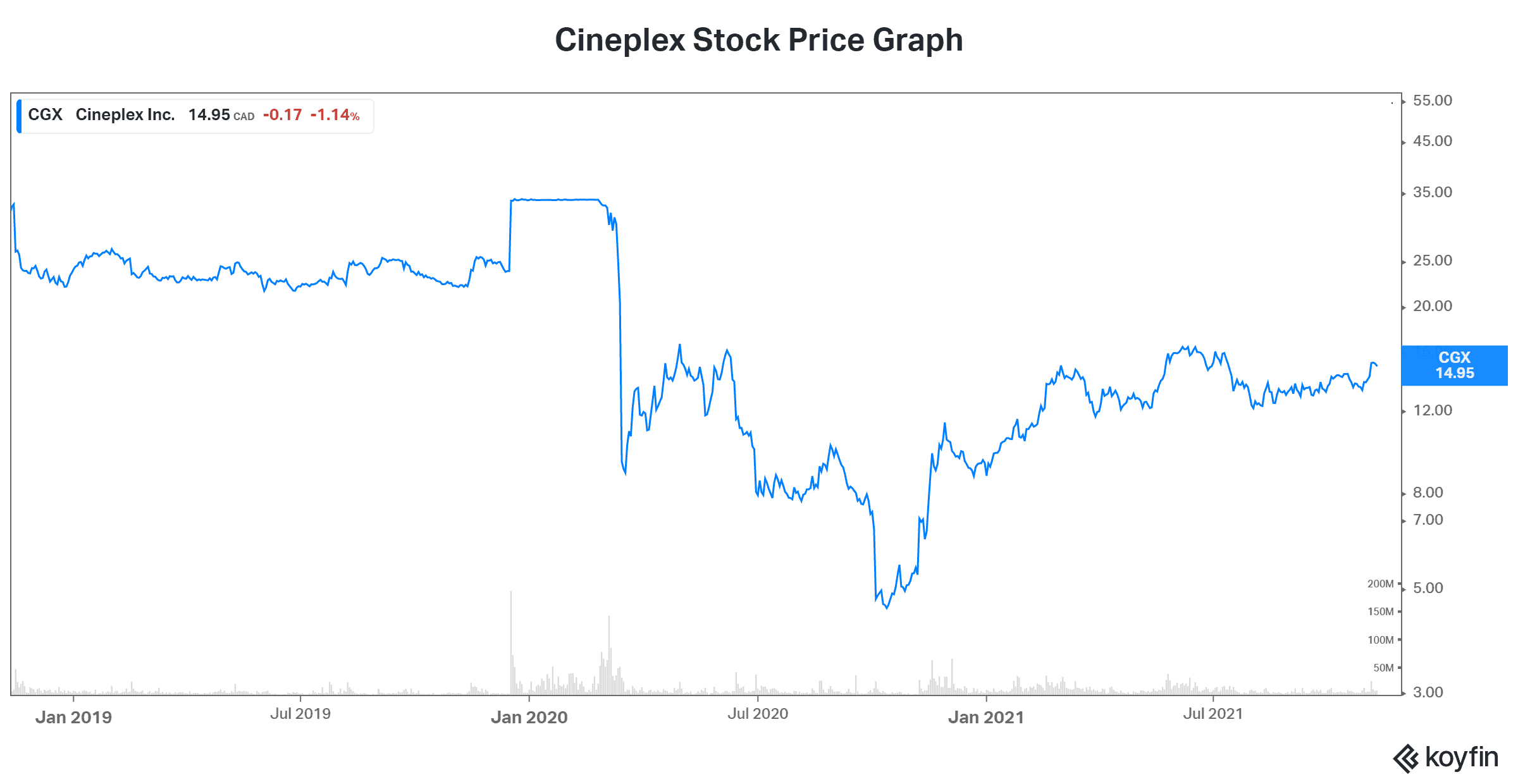

Today, Cineplex stock trades below 20 times 2019 earnings. Its stock price is a fraction of what it was before the pandemic when Cineplex’s stock price was trading above $33. In 2017 it was trading above $50. This does not guarantee that the stock will climb back up there. But it does illustrate the upside that exists if the company plays its cards right. Valuations for Cineplex stock are ultra-cheap. Remember, Cineplex was always a good business. Strong cash flows and its predictable, recurring business made it so.

Cineplex’s Q3 results are an inflection point

Looking at Cineplex’s third-quarter results, it’s clear that people are ready and willing to get back to the movie theatres. In fact, the company’s increasingly diversified business is showing strength on all fronts. For example, box office revenue (32% of revenue) rose 550%. In addition to this, theatre foodservice revenue (28% of total revenue) also rose more than 500%. Finally, amusement revenue (21% of total revenue) increased by over 300%. So in short, Cineplex is recovering strong.

With this, the company’s focus right now is on reopening and getting its debt levels back to pre-pandemic levels. With its cash burn dramatically improving, this finally appears possible. I mean, its monthly cash burn was a mere $2.9 million in the quarter. This compares to its $20 million cash burn previously. In fact, Q3 was the first quarter since the pandemic that Cineplex generated positive EBITDA. So all of these numbers should help drive home one simple point – Cineplex’s business has hit a turning point. This time, things are changing for the better, dramatically so.

This top stock is up 54% year to date

Yes, it’s true that Cineplex’s stock price has outperformed in 2021. But don’t be fooled into thinking this is the end. I mean, it was coming off of valuations that were pretty much pricing in bankruptcy for the company. Today, we can see that Cineplex’s situation is the exact opposite. Revenues and attendance are soaring back. And the financials are recovering rapidly. So this stock has a lot of ground to make up.

The bottom line

The bottom line here is simply that Cineplex stock is making a ground-breaking comeback. With the end of the pandemic, people are returning to movie theatres and game rooms. This business model is not dead – it may have actually gotten new life breathed into it after so many months of stay-at-home orders.