What if I told you that there was a simple, dirt cheap, and easy to implement investing strategy that could set you on the path to being financially independent and retiring early within 25 years?

If this sounds too good to be true, allow me to introduce you to the S&P 500.

The S&P 500 is a stock market index that tracks the largest 500 companies listed on U.S. exchanges and is widely seen as a barometer for overall U.S. stock market performance. More than $5.4 trillion dollars are invested in funds tied to the performance of the index, a sign of its ever-increasing popularity.

Why is the S&P 500 so great?

The index is composed of stable U.S. blue-chip companies like Microsoft, Apple, Google, JPMorgan, and Amazon, and it is diversified across various sectors like technology, health care, financials, communications, consumer staples, consumer discretionary, industrial, and energy.

The S&P 500 has seen screaming highs during historic bull markets like the dot-com bubble and withering lows from prolonged bear markets like the 2008 financial crash. Yet over time, it has delivered a solid 8% annualized return since 1957. The S&P 500 is so difficult for investors to consistently beat over time that it is widely accepted as a benchmark for professional fund managers to compete against.

As recommended by Buffett himself

Still not convinced? Here’s what the “Oracle of Omaha” Warren Buffett had to say about the S&P 500 during the 2021 Berkshire Hathaway shareholder’s meeting:

“I recommend the S&P 500 Index Fund, and have for a long, long time to people.”

– Warren Buffett

True to his word, Buffett even instructed his trustee to invest 90% of his estate into a low-cost S&P 500 index fund after he passes away. What’s great is that you don’t have to be the trustee for one of the richest people on the planet to invest in this vehicle — you can invest like Buffett’s trustee for cheap. Better still, there is good evidence to suggest that sticking to this strategy consistently over 25 years could lead you to a million-dollar net worth at retirement.

Investing like a future millionaire

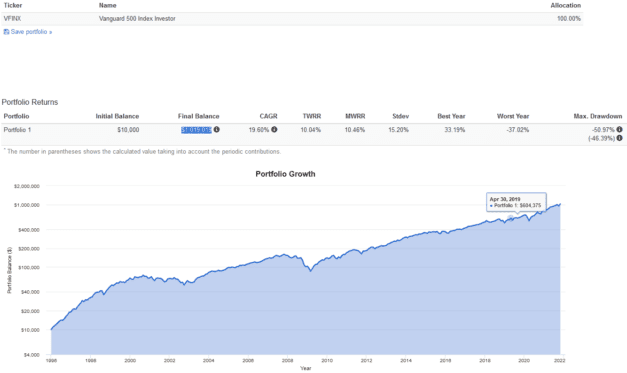

Let’s assume that it is 1996 and you are 25 years old. You’ve saved a nest egg of $10,000 in your Tax-Free Savings Account (TFSA) and are looking to park it somewhere to grow for retirement. You pick a low-cost, S&P 500 index fund and decide to contribute $500 every month to it for the next 25 years, regardless of how the market is doing at the time.

Twenty-five years later, after holding strong through ups and downs and continuing to make those consistent contributions, you are able to retire early at age 50 with a whopping $1,019,019.

The great news is that Canadian investors don’t have to look hard to find this amazing investment vehicle. Major fund providers like BMO, Vanguard, Invesco, Horizons, and BlackRock all provide low-cost, CAD-domiciled S&P 500 index exchange-traded funds (ETFs). You can buy and sell these S&P 500 ETFs from most brokerages, and hold them in various accounts, including taxable, RRSPs, and TFSAs.

Not bad at all for a low-cost, hands-off strategy.