It has been a topsy-turvy week for TSX stocks. While the TSX Index is up 1.3% this week, many high-quality growth stocks have been on the decline. A lot of this appears to be related to market near-sightedness around third-quarter earnings. Sometimes, this short-term thinking can just be befuddling.

Why I don’t understand the stock market

For example, two weeks ago, Shopify came out with a massive earnings miss due to difficult year-over-year pandemic-related comps. Yet its stock rose more than 7% after the announcement.

On the flip side, a payments giant like Visa issued perfectly good results that beat the market’s expectations. After its conference call, the stock collapsed due to concerns of growth deceleration. Its stock is down nearly 8% since.

I don’t need to understand to profit long-term from short-term thinking

My point in these two examples is that the stock market in the short term can operate without reason. However, these types of seemingly random dips can be great opportunities for long-term, patient investors. Do you see a stock or long-term theme that you love? Why not take the market’s short-sightedness as a chance to buy a great company at an even better price?

If there is a business or a theme that you love, there are bound to be some blips along the way. Buying TSX stocks when the market loses focus can be a great way to supercharge longer-term returns.

Nuvei: A top TSX payments stock

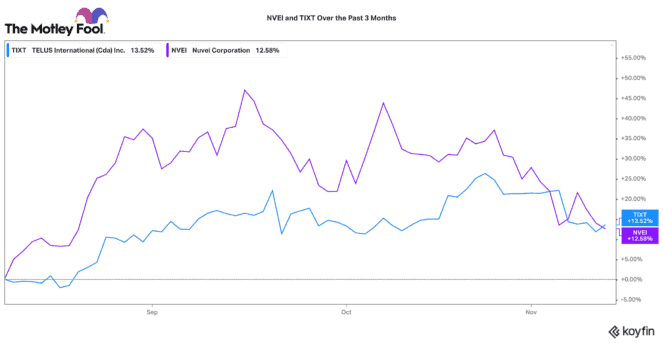

Personally, I am trying to take advantage in these situations. One TSX stock that hit some weakness after its third-quarter earnings is Nuvei (TSX:NVEI)(NASDAQ:NVEI). It had really exceptional results in the quarter. Payment volumes increased 88% to $21.6 billion. Revenues increased 96% to $183.9 million. Adjusted EBITDA increased 97% to $80.9 million. It has an adjusted EBITDA margin of 44%! That means it is very efficient at producing profits.

Frankly, there is nothing wrong with those numbers Likewise, it raised its fourth-quarter and year-end outlook by a good margin! Yet this TSX stock is down almost 17% since the end of October. The total payments sector has been on the decline. Perhaps, that is dragging the stock down. It could also be that its valuation just got stretched (it is not a cheap stock).

Yet for a growth stock that is actually profitable, it is one TSX stock to take a good, hard look at here.

Telus International: A top TSX AI stock

Another TSX growth stock I am looking at today is TELUS International (TSX:TIXT)(NYSE:TIXT). No, I am not talking about its income-yielding, telecom parent, TELUS. TIXT is a really interesting play on the digitization of business processes. It is helping some of the world’s largest corporations utilize artificial intelligence and machine learning to streamline their customer interactions.

Like Nuvei, TIXT produced very solid third-quarter results. Revenues, adjusted EBITDA, and free cash flow all were up over last year by 40%, 51%, and 28%, respectively. Of course, TIXT is facing some cost inflation that could affect margins temporarily.

However, it still affirmed 2021 guidance to grow revenues, adjusted EBITDA, and adjusted EPS by over 35% this year. I don’t see the adoption of its services slowing just because inflation is rising. In fact, I see quite the opposite over the longer term. This TSX stock is down around 6% since earnings, and it looks like a nice bargain to pick up now.