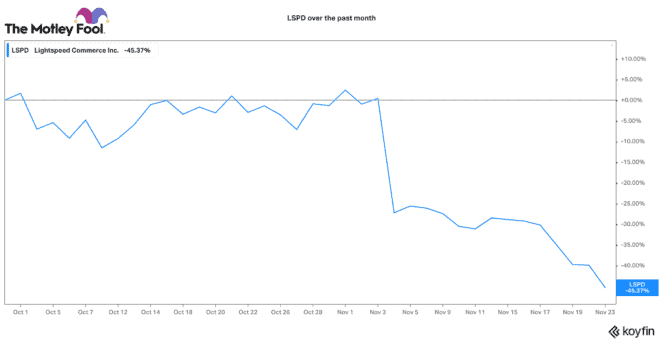

This November, it has been nothing but carnage for TSX growth stocks, especially for Lightspeed Commerce (TSX:LSPD)(NYSE:LSPD) stock. Over the past week, its stock is down over 25%. Over the past month, it has collapsed 43%! Since its all-time peak high in September, its stock is down almost 60%.

Lightspeed stock is down 60% since September

Clearly, Spruce Point Management, the group that authored a short report about Lightspeed, is feeling pretty smug right now. The combination of the alarmist short report and weaker-than-expected earnings have investors heading to the door. In fact, across the broader stock market, overvalued growth stocks have been taking a severe valuation de-rating.

The stock market has been fueled by a lot of excess capital over the year. Demand for growth stocks has pushed many stocks over what is reasonable. As inflation continues to be a headwind for many businesses, investors are starting to pull back on their 2022 growth expectations. That is why stocks like Lightspeed are getting absolutely punished.

Overvalued growth stocks are getting slaughtered

Recently, Motley Fool Canada advisor Jim Gillies encapsulated the high-growth, high-valuation market well in a tweet. He said, “[N]ow that it’s 25x sales, tell me why you think that’s safe and it can’t possible fall to 10x sales…go on, I’ll wait…be sure to show your work.”

The point he is making is that when the market turns, stocks that are overvalued and not backed by strong fundamentals are increasingly vulnerable to crash. This is largely the case for Lightspeed stock. The company has been growing revenues at a rapid triple-digit pace.

It has been able to fund this by consistently diluting shareholders and offering equity to the market. However, such precipitous growth has come at the cost of earnings power. As the short report noted, they are concerned Lightspeed might never be profitable going forward.

When will the carnage end for Lightspeed stock?

So, when does the carnage end for Lightspeed stock? Well, obviously, that is very difficult to predict. Despite the 60% decline, its stock still trades with price-to-sales ratio of 18 times. Like Jim noted, what’s to say it doesn’t go down to a price-to-sales ratio of 10 times?

That would value the stock at only $4 billion. That’s a further 63% decline from here. While I don’t think that scenario is likely, it does illustrate the risk of owning high-flying stocks that are not backed by earnings and cash flows (i.e., traditional fundamentals).

Lightspeed does have some great commerce solutions, and I don’t think its revenue-growth trajectory will overtly decline over the next few years. The prime question is whether it can produce growth that is sustainable and profitable. Despite a capital markets day on Tuesday, Lightspeed stock continues to decline. If management can somehow prove that it can modify its strategy to scale profitable growth, then perhaps the stock may turn around.

Some alternative growth stocks to consider owning today

Until then, it might just be a good idea to stay on the sidelines with Lightspeed stock. There are some interesting alternatives. In fact, the recent selloff in growth stocks might present some good long-term opportunities.

Some TSX stocks that are fast growing and profitable are Nuvei, Kinaxis, Telus International, and Descartes Systems. Like Lightspeed, they are not cheap stocks, but they are increasingly profitable as they grow. Some TSX stocks growing at a very reasonable price include Calian Group, BRP, and goeasy. These are all stocks I’d consider before buying Lightspeed today.