Inflation is rising globally, and that is a concern for investors, as it can impact investments.

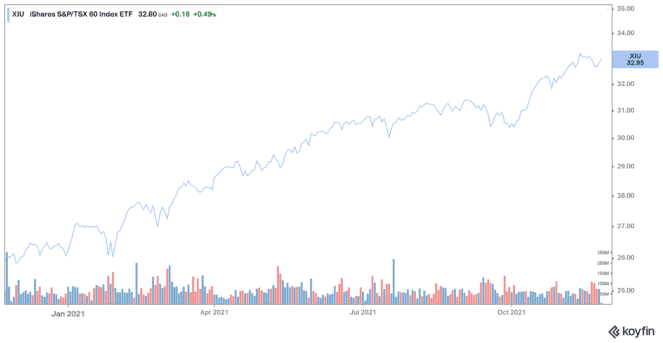

Let’s look at what inflation is and what the impact could be on the TSX.

What is inflation?

At its core, inflation drives up prices. From a business perspective, rising prices can be a good thing. Sales, after all, are prices multiplied by the number of items sold. If the number of articles sold stays the same, higher prices mean higher sales. In fact, many companies increase their profits this way, slowly increasing prices over time. Income management is a dance between rising prices and sustaining demand, and inflation can actually facilitate rising prices. Companies can increase prices and sales without hurting demand if demand is strong, as is the case now.

Even though inflation means sales are increasing, it also means businesses are facing increasing costs.

But, generally, expenses do not increase at the same rate as sales. Some expenses do, of course, but costs, such as rent, supply contracts, salaries, and equipment, are typically contracted over periods of one to several years. Because a significant portion of a business’s costs is usually sticky, expenses will grow more slowly than revenues. Costs will eventually catch up, but, for a while, business income will grow faster than expenses.

Over time, however, the story is not that simple. Rising earnings are good for stocks, but earnings are only one part of the story. The other part is the amount investors will pay for those profits, expressed as a price-to-earnings multiple (P/E). P/E multiples reflect how bullish or pessimistic investors are, but they are also tied to interest rates. The higher the interest rates available, the less attractive stocks are compared to other options such as bonds, and the lower the multiple of earnings investors will pay. If inflation pushes interest rates up, as it usually does, stock multiples may go down. So, the market can go down even if the profits go up.

Effects of higher interest rates could be significant

Interest rates are rising somewhat now but still within the range seen in recent years, and stock valuations are holding up. Investors respond to better earnings but not to higher interest rates. So far, so good. But this fact highlights the need to pay attention to the effect of inflation on the TSX. It will not be inflation itself that drives the market, but rather its effect on interest rates and therefore P/E multiples.

This does not mean that there is nothing to worry about. The effects of rising interest rates could be significant, especially in the short term. This potential deserves our attention. Over time, however, companies are well positioned to respond and take advantage of moderate levels of inflation.

Which stocks should you buy to beat inflation?

Investors should buy value stocks in order to beat rising inflation, as value stocks perform better in high-inflation periods than growth stocks.

Sherifa Issifu, associate, index investment strategy at S&P Dow Jones Indices, said in an email, “During higher inflation environments, investors tend to rotate away from growth into value as present income and strong cash flows become more important.”

Canadian Tire, Parkland, and Canaccord Genuity are three Canadian value stocks that should perform better in the context of rising inflation. Their forward P/E ratios are 10.1, 11.6, and 6.7, respectively, so they’re quite cheap.