As the oil rally subsides, investors should look to buy energy stocks before the next potential rise. A US$100 oil environment will be a tide that will lift all ships in the oil field.

Suncor Energy (TSX:SU)(NYSE:SU) and Cenovus Energy (TSX:CVE)(NYSE:CVE) are two buy-the-dip energy stocks to buy before the boom.

These energy stocks are due for a huge recovery when investors catch on to how cheap they are compared to their future outlook.

Going forward, expect these energy stocks to return to their 2020 highs, even with the occasional drop in near-term oil prices. Cenovus Energy and Suncor Energy both reported strong results in their latest quarter.

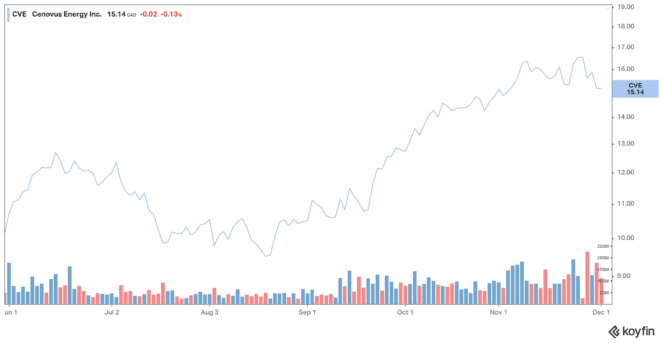

Cenovus Energy

Cenovus Energy, a Canadian producer of oil and natural gas, reported a profit in the third quarter of 2021 compared to a loss a year ago thanks to higher production and a recovery in demand for oil.

Cash flow from operating activities reached $2.14 billion in the third quarter, nearly three times higher than the previous year quarter. Adjusted cash flow increased from $407 million ($0.33 per share) to $2.34 billion ($1.16 per share) during the quarter ended September 30.

Net income was $551 million ($0.27 per share) in the third quarter of 2021, up from a loss of $194 million ($0.16 per share) in the third quarter of 2020.

Total upstream production reached 804,800 barrels of oil equivalent per day (boe/d) in the third quarter, up 70.6% from 471,799 boe/d a year earlier. Downstream flow nearly tripled to 554,100 barrels per day.

Cenovus president and CEO Alex Pourbaix said, “Our free funds flow capacity will support swiftly advancing toward our longer‐term net debt target of less than $8 billion, while balancing growth in shareholder returns.”

Cenovus doubled its dividend and announced a share-buyback plan of up to 10% of its shares.

With a forward P/E of only 7.2, Cenovus stock is among the cheapest energy stocks. For fiscal 2021, revenue is expected to increase by 242% to $45.24 billion and earnings per share are estimated to grow by 147.6% to $1.01 per share.

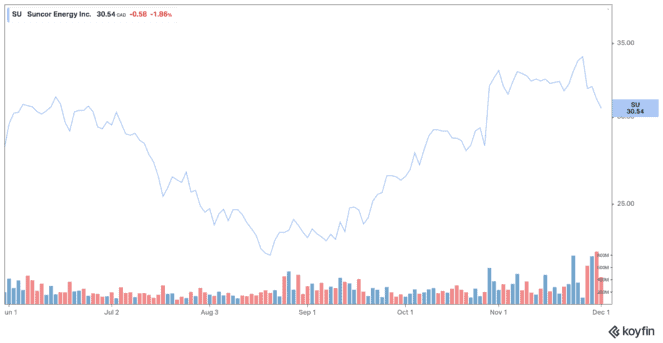

Suncor Energy

Suncor Energy is back on investor radars after its disgrace in 2020. You can forget about losses and the 55% cut in dividends last year, as crude prices rebounded from pandemic lows.

The large-cap oil producer reported a profit in the third quarter of 2021 compared to a loss a year ago.

Operating funds increased from $1.2 billion ($0.76 per share) to $2.6 billion ($1.79 per share) during the quarter ended September 30.

Net income amounted to $877 million ($0.59 per share) in the third quarter of 2021, up from a net loss of $12 million ($0.01 per share) in the third quarter of 2020.

Total upstream production reached 698,600 barrels of oil equivalent per day (boe/d) in the third quarter, up from 616,200 boe/d a year earlier.

Suncor president and CEO Mark Little said, “Since the start of 2021, we have returned $2.6 billion to our shareholders through share repurchases and dividends and have reduced net debt by $3.1 billion, demonstrating significant progress towards fortifying our balance sheet and meeting our capital allocation targets for the year.”

Suncor has restored its dividend to pre-pandemic 2019 levels of $0.42 per share — a 100% increase over the previous quarter’s dividend.

On September 30, 2021, Suncor became the operator of Syncrude, one of the largest Canadian operations in the oil sands industry. Management said this is a critical step that should lead to greater integration, efficiency, and competitiveness where Suncor does business.

With a forward P/E of only eight, Cenovus stock is very cheap. For fiscal 2021, revenue is expected to increase by 60.3% to $40.16 billion and earnings per share are estimated to grow by 299.3% to $2.93 per share.