Nuvei (TSX:NVEI)(NASDAQ:NVEI) stockholders were left scrambling this week after the company was hit by a scathing short report. On Wednesday morning, Nuvei stock declined by nearly 60% in just a matter of minutes. In one hour, Nuvei lost nearly $9 billion of value. Fortunately, the stock has recovered about 20% of those losses.

Nuvei stock lost nearly 60% of its value on Wednesday

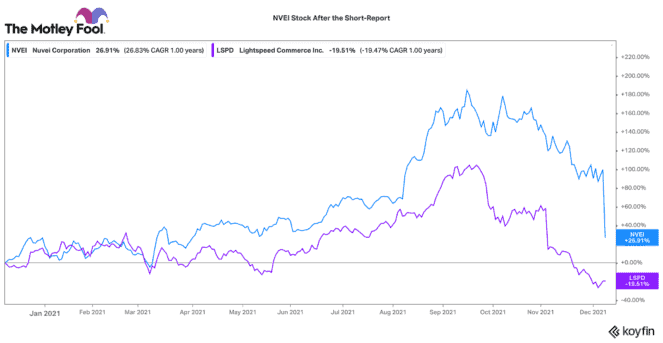

This is the second Canadian payments stocks to be targeted by activist short-seller Spruce Point Capital Management. Spruce Point recently went after Lightspeed Commerce (TSX:LSPD)(NYSE:LSPD) with a “short attack.” Lightspeed stock has subsequently declined almost 60% from all-time highs set this year.

Canada only has so many ultra-high growth stocks. Often, they can be an overcrowded trade. Both Lightspeed and Nuvei have traded at elevated valuations in 2021. Before the short attack, Nuvei was trading with a high price-to-sales ratio of 25.

First Lightspeed stock and now Nuvei

The big differentiator between Lightspeed and Nuvei is that Nuvei has been rapidly accelerating profit growth. Lightspeed does not foresee profitability for a number of years ahead. Whereas Nuvei has quickly scaled its platform in 2020 and 2021.

It has been churning out very attractive +40% EBITDA margins. Consequently, a number of Canadian investors cycled away from Lightspeed into Nuvei (which, by the way, traded at a lower valuation).

In hindsight, perhaps this was a perfect storm for a short-seller like Spruce Point. Canadian growth investors just experienced a large market correction through late November. Sensitivity to further investment losses is likely high. Targeting a stock like Nuvei was a perfect opportunity. With investors still reeling from the Lightspeed stock crash, fears of a similar scenario for Nuvei led to its stock collapsing after the short report release.

What is in the short report?

So, is there any merit to Spruce Point’s short report? As is always the case, it is important to review the allegations against Nuvei stock. As is the case with Lightspeed, the report is full of hyperbole, exaggeration, and fearmongering. However, there are points of concern that investors need to weigh.

A number of concerns surround Nuvei’s CEO and some failed past enterprises. Likewise, certain executives had or have connections to entities investigated for fraudulent activity. However, it issues no tangible proof of Nuvei involved in any sort of these activities.

The other major area of concern is how Nuvei has been integrating and reporting on new acquisitions. Spruce Point believes their financial disclosures are weak. It believes Nuvei’s current results are largely elevated due to higher-than-usual spending on e-commerce and gaming as a result of the pandemic. Consequently, it believes Nuvei’s stock price is largely overvalued. Frankly, it is up to Nuvei management to do better in its disclosure going forward.

What should Nuvei investors do?

Certainly, some of these issues are of concern. Chances are good that Nuvei stock will face some volatility for the next few months. Nuvei management has responded to the report stating that it is “intentionally misleading.” Likewise, Nuvei continue to uphold its 2021 outlook and long-term growth targets. It is important to note that insiders own about 35% of the business, so they are hurting on the decline as well.

I imagine Nuvei will have further opportunity to ease investor’s concerns over the next few weeks. If you believe in the long-term opportunity for Nuvei, today might be a great time to swipe up the stock at a bargain price. However, if you are fearful of further losses, this may be an opportunity for a tax-loss sale before year-end. Big declines are never fun, but that is why it is crucial to have a diversified portfolio and an iron-stomach through the market’s ups and downs.