Canadian small-cap stocks have been volatile in 2021. Small-cap stocks, particularly in technology, have underperformed the greater TSX Index this year. For stock pickers and long-term investors, this may, in fact, be a gift. Canada has some wonderful technology businesses. However, they often fail to get the same recognition and valuation as American peers.

This can present a great arbitrage opportunity for investors willing to be patient. One Canadian stock that appears to be right in the sweet spot for outsized gains in 2022 and beyond is Sangoma Technologies (TSX:STC). While it only trades with a market capitalization of $440 million, it is at the threshold of accelerating into a solid Canadian technology stalwart.

A small-cap stock with a large-cap opportunity

Sangoma provides unified communications-as-a-service solutions for small- to medium-sized businesses across the world. Sangoma provides a one-stop shop of communication services and products. This is ideal for smaller businesses, as they don’t have to go shopping for different providers to meet their diverse communication needs.

Earlier in the year, Sangoma completed the transformational acquisition of a similar-sized peer, Star2Star. The acquisition expands Sangoma’s cloud-based offerings, increases its exposure to the large American market, increases its recurring revenues, and significantly raises its profit margins. The two companies are nearly integrated into one entity, and it has been translating into strong earnings results already.

A strong history of revenue and earnings growth

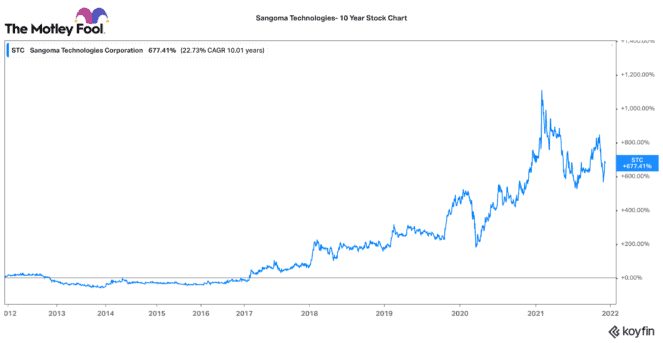

Last quarter, it grew revenues year over year by 77% to $61.55 million. It also grew adjusted EBITDA by 96% to $12.09 million. For its fiscal year 2021, it grew revenues and adjusted EBITDA by 27% and 50%, respectively. Sangoma has a great history of scaling its business through organic growth and acquisitions. Since 2011, it has grown revenues by a compounded annual growth rate (CAGR) of 33%. In that time frame, its stock has delivered a near 650% gain.

For fiscal 2022, Sangoma is projecting (on the high end of its range) about 27% growth in revenues and adjusted EBITDA. In 2021, it exceeded its guidance. Given its solid balance sheet, it has room to make some tuck-in acquisitions that could even bolster returns beyond its projections.

A volatile stock presents value-priced opportunities

It has been a rocky year for Sangoma stock. After the Star2Star acquisition was announced, it soared to $36 per share. However, shortly thereafter the stock declined to a 52-week low of $18.90 per share. The stock recently declined after Sangoma pulled out of an American NASDAQ initial public offering (IPO) due to weak market conditions.

Today, this TSX stock trades around $23.50 per share, and it looks pretty attractive. It only trades for two times forward sales and 11 times free cash flow. It has a forward enterprise value-to-EBITDA of only 10 times. Communication software peers in the U.S. trade for more than triple those multiples. That is despite some of these peers not even being profitable.

Buy and hold this stock as it rises to large-cap status

Sangoma is cheap and has lots of room to catch up. While the NASDAQ listing didn’t work out this year, it doesn’t mean it can’t attempt an IPO next year. That could be a major catalyst for the stock, as it would vastly expand its investor market.

Regardless, this small-cap stock is quickly growing to become a communications software leader in Canada, the U.S., and across the world. For an undervalued stock with years of compounding potential, Sangoma is one of my top picks for 2022.