Christmas is coming fast, and with it comes a lot of shopping. Besides buying gifts for the one you love, have you thought about buying a gift for yourself? Why not buy some stocks to get richer? Manulife Financial (TSX:MFC)(NYSE:MFC), Bank of Montreal (TSX:BMO)(NYSE:BMO), and Suncor Energy (TSX:SU)(NYSE:SU) are three cheap stocks to put on your shopping list this holiday season.

Manulife

This company is a leader in the Canadian wealth management, insurance and asset management industries. Based in Toronto, Manulife has a multinational presence, with operations in Canada, the United States, Europe, and Asia.

Manulife Financial is an underrated financial giant. It is one of the cheapest Canadian stocks, with a forward P/E ratio of 6.79.

Manulife announced on November 4 that it will increase its quarterly dividends to shareholders by 18% to $0.33 per share. The dividend yield is currently 4.7%. The company also announced its intention to repurchase up to 39 million shares of Manulife, or approximately 2% of all its shares.

Manulife can expect a major tailwind as interest rates start to rise, which is expected to occur in 2022, as the economy continues to recover.

Manulife is a great long-term financial stock that, in addition to paying an attractive dividend, has years of growth potential as it expands its operations in Asia.

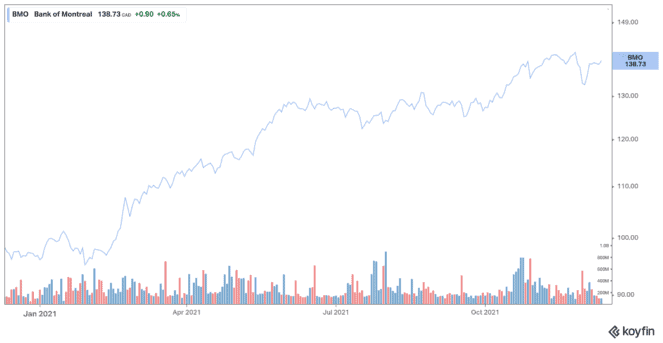

BMO

Shares of this bank stock currently have a favourable forward P/E ratio of 10.75. This puts BMO in very solid value territory relative to its industry peers. BMO announced a 25% quarterly dividend increase to $1.33 per common share. This represents a yield of 3.8%.

BMO has significantly advanced its strategy to build a digital bank ready for the future. BMO has chosen Amazon Web Services (AWS) as its fintech partner as part of its banking platform modernization plan.

The U.S. cloud provider will streamline the BMO’s internal business processes to help the Canadian bank meet its goal of being a cloud-centric organization.

The bank expects strong growth for 2022. Canada is poised to raise interest rates, which could contribute to market volatility, but will also improve profit margins for BMO and its peers. The Canadian economy was largely able to rebound to pre-pandemic growth and employment levels by the end of 2021.

Suncor

Suncor has said it will meet its 2025 net debt target by the end of 2021. This means more cash should be available for share buybacks and dividend increases over the coming year.

The company has raised its share-buyback target to 7% of the outstanding shares as part of the ongoing share-buyback program. Suncor also increased the dividend by 100% for a new quarterly payment of $0.42 per share. The forward dividend yield is 5.4%.

Another rise in dividends in the first half of 2022 would not come as a surprise. The price of WTI oil has fallen from a 2021 high to around US$85 per barrel to the current price of around US$72, but it is still very profitable for Suncor.

Despite some near-term uncertainty, Suncor looks cheap with a forward P/E ratio of 7.76.

With fuel demand on the rise, this stock looks undervalued today and deserves to be on your radar.