Merry Christmas from the Canadian Revenue Agency (CRA): the Tax-Free Savings Account (TFSA) contribution limit has been raised another $6,000 for 2022! That means that if you were 18 years or older in 2009, you can now contribute a grand total of $81,500 to your TFSA!

The TFSA is an ideal opportunity to compound wealth

Why is this a reason to celebrate? Well, in general, the TFSA is a great wealth-building gift supplied by the Canadian government. It is the only registered account in Canada where any dividend, interest income, or capital gain is completely safe from tax liability. Consequently, when you invest through the TFSA, you keep all your returns.

That means you can maximize the power of compounding. Albert Einstein once called compounding interest “the eighth wonder of the world.” It is, in essence, the downhill snowball effect. The more returns you accumulate and re-invest, the larger and faster your fortune grows.

Forget “high-interest” tax-free accounts

Some Canadian banks encourage people to put their money into a “high-interest” TFSA. By high interest, they generally mean 1-1.5% interest rates. Those interest rates normally only apply for a promotional period of a few months to a year. Frankly, it is a little bit deceptive. With inflation rising above 4% in 2021, those accounts are actually losing buying power.

The best way to unleash the power of tax-free compounding, is to invest through your TFSA. You can buy bonds, mutual funds, exchange-traded funds, indexes, and individual stocks in your TFSA. There are a few nuances and rules regarding investing through your TFSA, so be sure to talk to your bank or financial advisor.

Since the account is tax-free, you are not required to report your earnings to the CRA. However, that does mean you cannot claim losses against taxable gains in other non-registered accounts. As a result, I like to use my TFSA to invest in stocks with relatively limited risk but attractive upside.

Brookfield Asset Management: A great TFSA stock

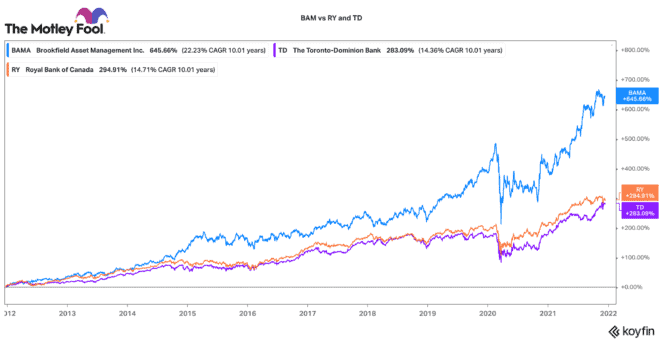

One great TFSA stock is Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM). With $650 billion of assets under management, Brookfield is one of the largest alternative asset managers on the planet. While Canadian banks get a lot of talk in the media, this financial stock has been delivering far superior returns for years.

In fact, over the past 10 years, it has offered a very nice 645% return. That return is more than double the two top Canadian banks.

Brookfield manages and invests in assets (real estate, infrastructure, renewables, insurance, and private equity) for institutional-grade shareholders. With interest rates so low, bonds are delivering negative returns. Consequently, many institutions are flocking to BAM to capture low-risk sustainable income streams.

This trend has been supporting very strong growth in BAM’s business. In fact, the larger it scales, the more opportunities it has to manage money for others. That then translates into more fee-related earnings and long-term gains from monetizing mature assets.

Brookfield is a great stock for a TFSA, because it provides a broadly diversified platform of quality assets. The company has a great balance sheet and some of the best asset managers in the world. For the past five years, BAM has been compounding earnings by about 30% a year. Given its ever expanding optionality, this TFSA stock has strong potential to compound wealth for many years ahead.