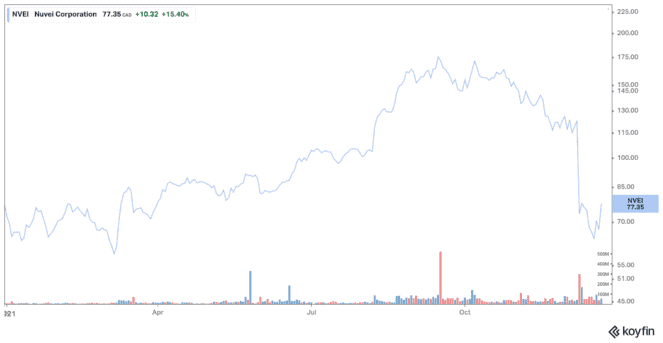

Shares of Nuvei (TSX:NVEI)(NASDAQ:NVEI) fell as much as 55% on December 8 after Spruce Point took aim at the Montreal-based payment processor. The stock has recovered some of its losses since then but is still far from the price it was at before the short-seller attack.

What the report said

After conducting a financial analysis, Spruce Point came to the conclusion that Nuvei has hidden failed business models, a lack of organic growth, and fraudulent activities.

The short-seller also questioned the recent acquisitions of the company and accused it of a lack of transparency in the disclosure of its financial results.

Spruce Point issued a “strong sell” notice on the stock and said it believed Nuvei stock could fall as much as 60%.

The New York firm had to clarify that it held a short position in Nuvei and held derivative securities that could benefit from the drop in its share price.

Nuvei has dismissed the short-seller accusations

Meanwhile, in a statement released the night after the report, Nuvei dismissed Spruce Point accusations and reiterated its financial forecast.

“The personal attacks on Nuvei executives made by the short-seller appear to have been made to distract from the company’s achievements and progress,” it stated in a news release. “The short-seller admits that it stands to profit significantly from Nuvei’s stock price decline, at the expense of Nuvei’s shareholders, customers and employees.”

In the third quarter, Nuvei made a profit, with revenue increasing 96% year over year to $183.9 million, while payments volume increased 88% to $21.6 billion.

Management refutes Spruce Point’s financial claims

Two weeks after the publication of a report by short-selling firm Spruce Point Capital that halved Nuvei’s share price, the management of this Montreal electronic payment processor replied by refuting 20 of the 21 financial allegations in the report.

This management response is very detailed and compelling, according to James Fotheringham, analyst at BMO Capital Markets. After a thorough review of Spruce Point’s allegations and management’s responses, the analyst recommended that investors looking for reasonably priced growth stocks buy Nuvei stock, for which it maintains a target price of $114.

Management does not rule out the possibility of suing the authors of the report. Such an announcement would likely be a catalyst for the stock.

Management is also reviewing the share-buyback program by the company as well as by its officers. As well as being a very attractive transaction, this would send a strong signal from management.

Nuvei is also considering holding an Investor Day in the short term, during which it will provide an update on its financial performance.

Nuvei stock is oversold

Investors might wonder what they should do with Nuvei stock today. Despite its recent sharp decline, Nuvei is a buy. Analysts remain largely bullish on the stock.

Based on the third-quarter and year-to-date results, the company is growing at a decent pace, and the international payments segment has significant growth potential in the coming years.

If the market decides the pullback is overdone, Nuvei stock could deliver big gains for new investors in the days and weeks to come. It’s one of the best Canadian tech stocks to buy today.