In just a matter of weeks, two of the largest recently listed tech companies on the TSX, Lightspeed (TSX:LSPD)(NYSE:LSPD) and Nuvei (TSX:NVEI)(NASDAQ:NVEI), saw their stock market values plummet by billions following the release of short-seller Spruce Point Capital reports.

Things were going well before Spruce Point’s attack

Lightspeed and Nuvei are two companies active in the field of electronic payment solutions. Lightspeed develops point-of-sale and e-commerce software, while Nuvei offers electronic payment-processing systems.

The two companies are established in Montreal. Before their IPOs, they both had been attributed a value of more than $1 billion by investors, so much they were recognized promising potential.

Lightspeed went public in September 2019 with an initial valuation of $1.7 billion while Nuvei went public in September 2020 at a starting value of $3 billion. Carried by the tech wave on the stock market, amplified by the new reality induced by the COVID-19 pandemic, Lightspeed and Nuvei quickly crossed the mark of $20 billion in valuation each.

Things were going smoothly for the two tech companies until activist investment firm Spruce Point Capital Management took aim on Lightspeed last September.

This New York-based investment firm specializes in stock shorting. That is, it borrows stocks with the expectation that their value will decline so that it can buy them back later at a lower price. In short, it makes substantial profits when the value of the stocks it targets drops significantly.

Lightspeed and Nuvei stock crashed after the reports

In a 125-page report published on September 29, Spruce Point accused Lightspeed of lacking transparency in revealing key information while overstating its growth prospects. The financial and competitive reality is less rosy than the company says, whose stock price is significantly overvalued, claimed the activist investor.

Immediately after the publication of this report, Lightspeed’s stock value fell 21% in one day from $160 to $126. The stock has since fallen steadily and is now trading around $52.

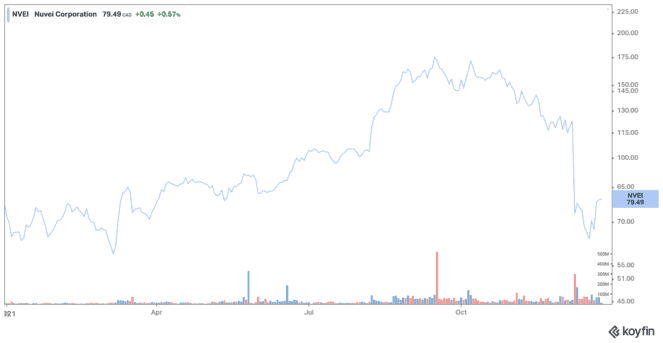

Two weeks ago, it was Nuvei’s turn to taste the medicine from the short-selling investment firm, which, on December 8, produced a new report just as devastating as Lightspeed’s, in which it questions the financial data of the Montreal company, its past, and the past of some of its leaders.

The crash was more devastating, as the value of Nuvei’s stock fell 40% in a single day. The stock, which had peaked at $180 in September, fell to $73. The stock has recovered some of its losses and is now trading above $78.

Which stock should you buy and hold in 2022?

You shouldn’t pay attention to short-seller reports. These reports have the sole purpose of generating a wave of panic and enriching the firm that wrote them. Lightspeed and Nuvei are still two great tech companies with strong potential.

The two companies are two good stocks to buy and hold in 2022, but if I had to choose one over the other, I would go with Lightspeed. Earnings are expected to grow faster in 2022 for Lightspeed than Nuvei, with an EPS growth rate of 51.2% versus 26.6%.