You can make money in your sleep, literally. This is called passive income, which allows you to have the freedom to live and work anywhere and not depend on staying in one place for a salary. Investing in the stock market is likely the easiest way to earn passive income. As the value of your stocks increases and you continue to reinvest the dividends you earn, you can see your investments grow through the power of compound interest. The key to earning passive income in the stock market is to use the buy-and-hold strategy. You will gain money from stock price appreciation over time. And if you buy dividend stocks, you will earn regular income altogether.

Royal Bank of Canada (TSX:RY)(NYSE:RY), BCE (TSX:BCE)(NYSE:BCE), and Magna International (TSX:MG)(NYSE:MGA) are three top Canadian dividend stocks to buy and hold to earn money in your sleep.

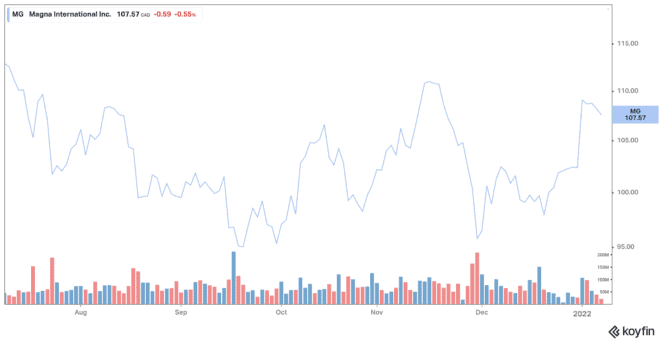

Royal Bank of Canada

Bank stocks are generally considered relatively safe to invest in if you are looking for long-term investments. Banks are tightly regulated, which helps keep stock prices relatively stable, mitigating the risks associated with falling interest rates and defaults. RBC is some of the best Canadian stocks to buy and hold because the bank is doing well.

RBC is not only Canada’s largest financial institution but also the second-largest company in terms of market capitalization. In 2020, RBC had sales of $37.36 million and net income of $9.03 million. In business since 1864, RBC got its current name in 1901. It has a reputation as one of the companies providing excellent customer service in Canada. In December, the bank raised its quarterly dividend to $1.20 per share, up 11% from $1.08 per share. The forward dividend yield is 3.4%. RBC stock has risen by more than 10% over the last six months.

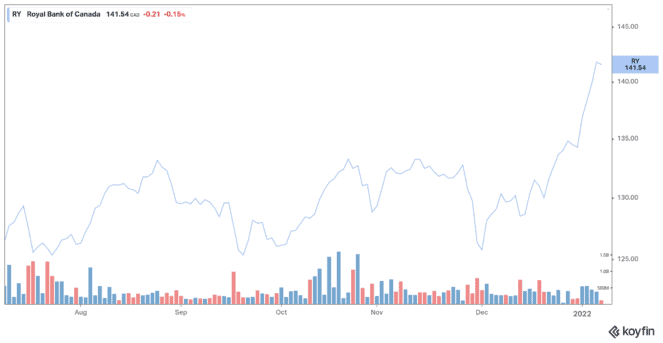

BCE

It’s always a good idea to invest in companies that provide essential services: their stocks tend to grow in value steadily over the long term. One essential service that no one can live without, especially now that so many of us are working at home, are telecommunications, including mobile and internet services.

BCE is the holding company that owns Bell Canada, the country’s largest telecommunications provider. It is among the 20 largest companies in the country by market capitalization. It achieved sales of $18.97 billion and net income of $2.52 billion in 2020. BCE shares are unlikely to experience a sudden and huge drop in value. On the contrary, their value has increased due to the growth potential of 5G. BCE stock has gained more than 5% in the past six months.

BCE pays a quarterly dividend of $0.875 per share for a forward dividend yield of 5.3%.

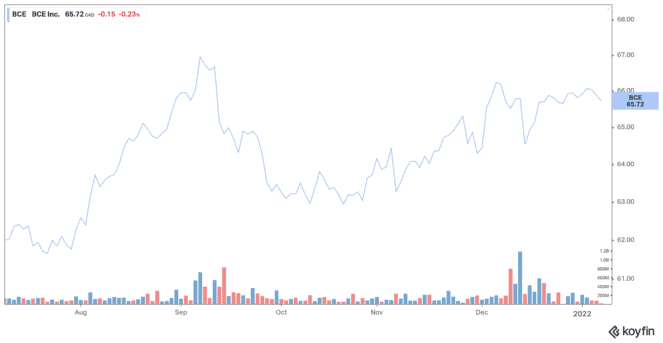

Magna International

COVID-19 has changed a lot of things in the way we live and work. For example, many people have decided to forgo public transit and instead invest in their first car so that they can maintain social distancing. This resulted in increased car sales as long as there was inventory.

The supply shortage in the auto industry right now is due to the global supply chain crisis. As soon as this is resolved, car sales are expected to increase again. As long as people buy cars, there will be a need for spare parts.

Magna International is the largest auto parts maker in North America and one of Canada’s 30 largest companies by market capitalization. In 2020, Magna’s revenues were $39.43 billion and net income amounted to $1.76 billion.

Magna pays a quarterly dividend of US$0.43 per share and the forward dividend yield is 2%. The stock has fallen by nearly 5% in the past six months.